Region:Europe

Author(s):Geetanshi

Product Code:KRAA3728

Pages:96

Published On:September 2025

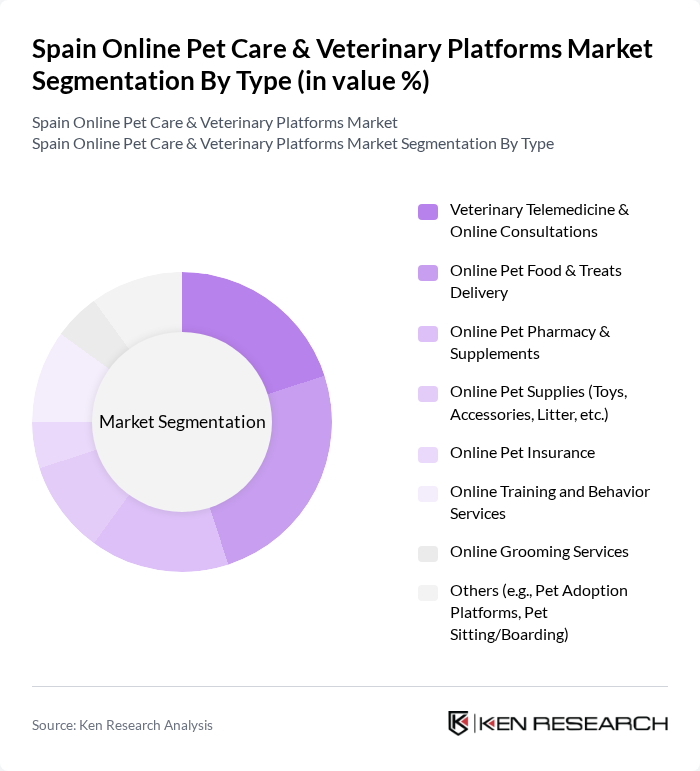

By Type:The market is segmented into various types, including Veterinary Services, Pet Supplies, Pet Food, Pet Insurance, Grooming Products, Litter Products, Medicines, Supplements, and Fashion, Toys & Accessories. Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics.Food & treatsis the largest segment, whilesupplementsis experiencing the fastest growth due to rising interest in pet health and wellness .

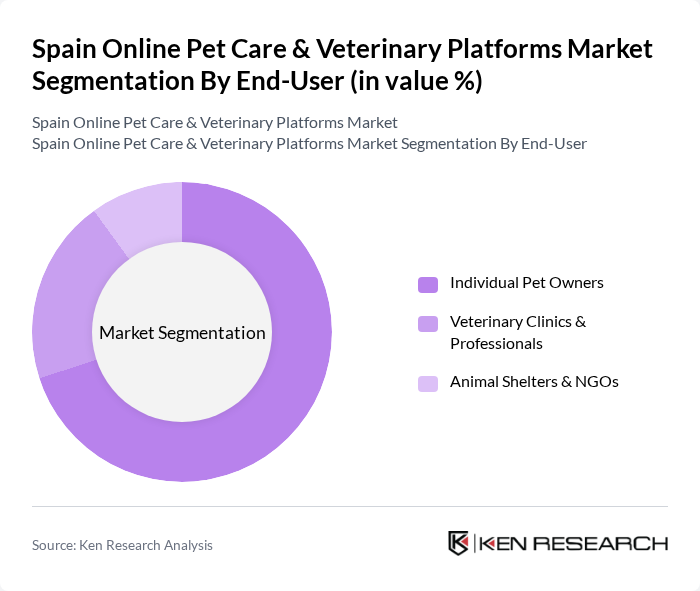

By End-User:The end-user segmentation includes Pet Owners, Veterinary Clinics, Pet Retailers, and Animal Shelters. Each segment plays a crucial role in the distribution and consumption of pet care products and services, reflecting the diverse needs of the market.Pet ownersrepresent the largest share, driven by higher pet adoption rates and increased spending on premium and health-focused products .

The Spain Online Pet Care & Veterinary Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiendanimal, Kiwoko, Zooplus SE, Mascoteros, Petplan España, Barkyn, Petclic, Amazon Spain (Pet Supplies), Miscota, VetFinder España, AniCura España, Barkibu, Sanitos Mascotas, Petco (International), Clínica Veterinaria Mediterráneo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online pet care and veterinary platforms market in Spain appears promising, driven by technological advancements and changing consumer preferences. As telemedicine for pets becomes more mainstream, platforms that integrate AI and machine learning will likely enhance service delivery. Additionally, the growing trend of subscription-based services will cater to pet owners seeking convenience and cost-effectiveness, positioning the market for sustained growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Veterinary Services Pet Supplies Pet Food Pet Insurance Grooming Products Litter Products Medicines Supplements Fashion, Toys & Accessories |

| By End-User | Pet Owners Veterinary Clinics Pet Retailers Animal Shelters |

| By Sales Channel | Direct Online Sales Third-Party Marketplaces Subscription Services Mobile Applications |

| By Service Type | Telehealth Services In-Person Consultations Emergency Services |

| By Customer Demographics | Age Groups Income Levels Geographic Locations |

| By Product Category | Organic Products Non-Organic Products Specialty Products |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Veterinary Consultation Usage | 100 | Pet Owners, Veterinary Professionals |

| Pet Care E-commerce Trends | 80 | Pet Retailers, E-commerce Managers |

| Telemedicine Adoption in Veterinary Services | 60 | Veterinarians, Telehealth Coordinators |

| Consumer Preferences for Pet Care Platforms | 90 | Pet Owners, Market Researchers |

| Impact of Digital Marketing on Pet Care Services | 70 | Marketing Managers, Digital Strategists |

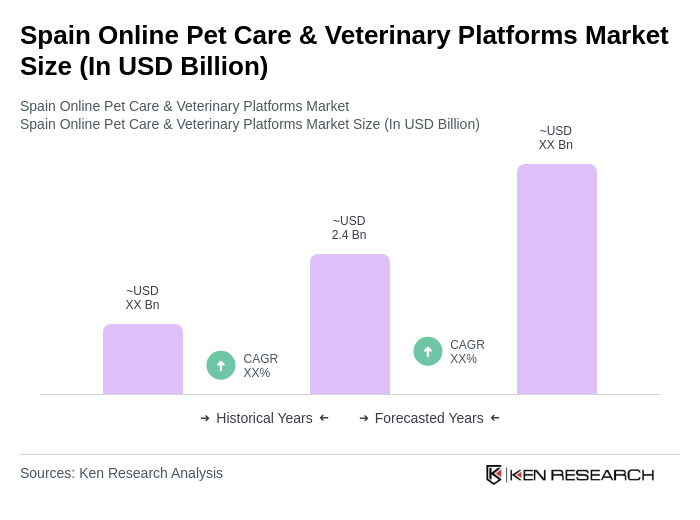

The Spain Online Pet Care & Veterinary Platforms Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and a shift towards online shopping for pet-related products and services.