Region:Europe

Author(s):Geetanshi

Product Code:KRAA3652

Pages:99

Published On:September 2025

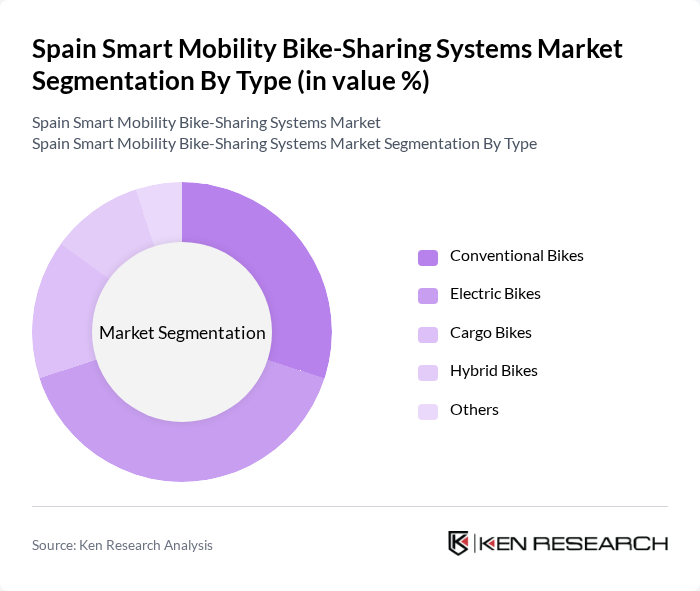

By Type:The market is segmented into various types of bikes, including Conventional Bikes, Electric Bikes, Cargo Bikes, Hybrid Bikes, and Others. Each type caters to different user preferences and needs, influencing the overall market dynamics. There is a growing trend towards electric bikes to cater to the increasing demand for eco-friendly transportation options, with companies expanding their fleets to include more electric bikes.

The Electric Bikes segment is currently dominating the market due to their convenience and efficiency, particularly in urban settings where users seek faster and less strenuous travel options. The increasing availability of electric bike-sharing services has attracted a diverse user base, including commuters and tourists. Additionally, the growing emphasis on eco-friendly transportation solutions has further propelled the demand for electric bikes, making them a preferred choice among consumers.

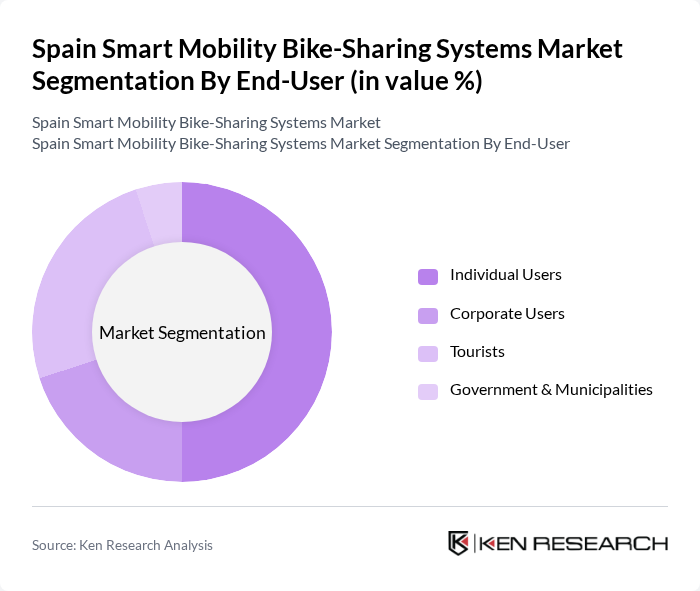

By End-User:The market is segmented based on end-users, including Individual Users, Corporate Users, Tourists, and Government & Municipalities. Each segment reflects different usage patterns and requirements, contributing to the overall market landscape.

The Individual Users segment leads the market, driven by the increasing number of urban residents opting for bike-sharing as a convenient and cost-effective mode of transport. This trend is further supported by the growing awareness of health benefits and environmental sustainability. Additionally, the rise in remote work has led to more individuals seeking flexible commuting options, solidifying the dominance of individual users in the bike-sharing market.

The Spain Smart Mobility Bike-Sharing Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bicing, Donkey Republic, PBSC Urban Solutions, Movus, Ofo, Mattia 46, Bike Tours Barcelona, Green Bikes, BICIMAD, Rutas Pangea, Eco Moving Sports, ByBike City, Lime, Jump Bikes, Reby contribute to innovation, geographic expansion, and service delivery in this space.

As Spain continues to prioritize sustainable urban mobility, the bike-sharing market is expected to evolve significantly. Innovations in electric bike technology and mobile payment systems will enhance user experience and convenience. Additionally, the integration of bike-sharing with public transport networks will likely improve accessibility. The focus on smart city initiatives will further drive the adoption of bike-sharing systems, as cities aim to create more interconnected and environmentally friendly urban environments, fostering a culture of cycling and sustainable transport.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Bikes Electric Bikes Cargo Bikes Hybrid Bikes Others |

| By End-User | Individual Users Corporate Users Tourists Government & Municipalities |

| By Subscription Model | Monthly Subscriptions Annual Subscriptions Pay-Per-Ride Corporate Packages |

| By Distribution Channel | Mobile Apps Kiosks Website Partnerships with Local Businesses |

| By Fleet Size | Small Fleet (1-50 Bikes) Medium Fleet (51-200 Bikes) Large Fleet (201+ Bikes) |

| By Geographic Coverage | Urban Areas Suburban Areas Tourist Areas |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Mobility Stakeholders | 100 | City Planners, Transportation Officials |

| Bike-Sharing Operators | 60 | Business Development Managers, Operations Directors |

| End-Users of Bike-Sharing Services | 120 | Commuters, Tourists, Local Residents |

| Policy Makers and Regulators | 50 | Government Officials, Environmental Advocates |

| Technology Providers for Smart Mobility | 40 | Product Managers, Technology Developers |

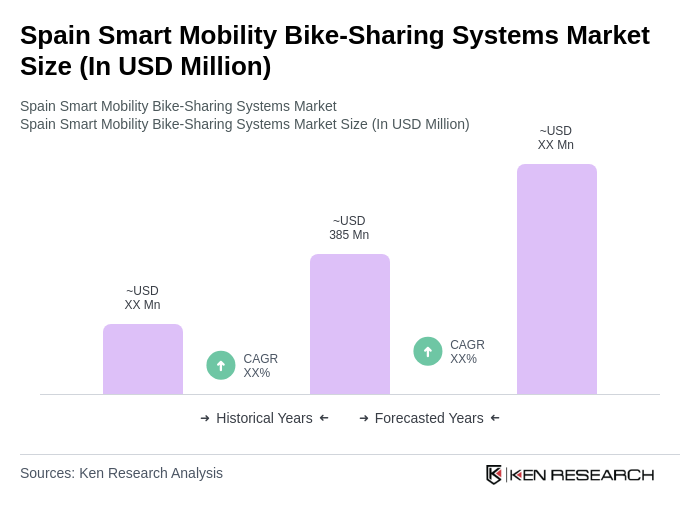

The Spain Smart Mobility Bike-Sharing Systems Market is valued at approximately USD 385 million, reflecting significant growth driven by urbanization, government initiatives for sustainable transport, and increased consumer awareness of environmental issues.