Region:North America

Author(s):Rebecca

Product Code:KRAA3808

Pages:91

Published On:September 2025

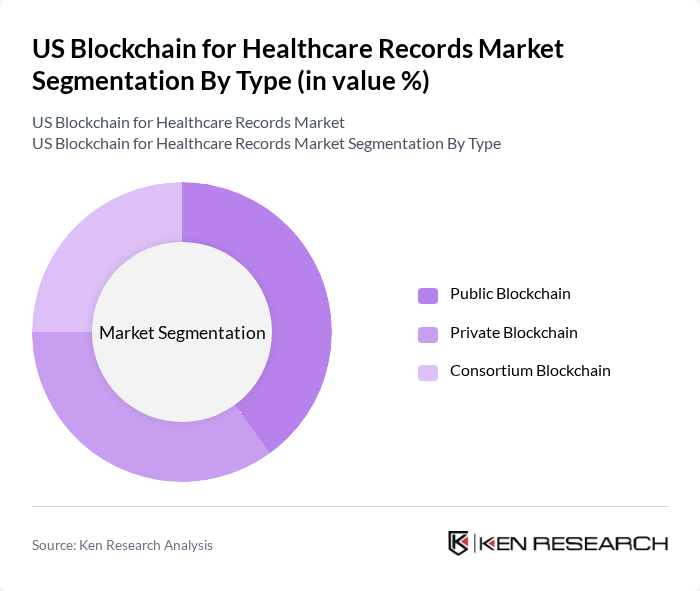

By Type:The market is segmented into three types: Public Blockchain, Private Blockchain, and Consortium Blockchain.Public Blockchainis gaining traction due to its decentralized structure, which enhances transparency and auditability, making it suitable for applications where trust and openness are critical.Private Blockchainis preferred by healthcare organizations requiring controlled access to sensitive patient data, supporting compliance with privacy regulations.Consortium Blockchainis favored for collaborative projects among multiple stakeholders, such as provider networks and insurance consortia, enabling shared governance and secure data sharing .

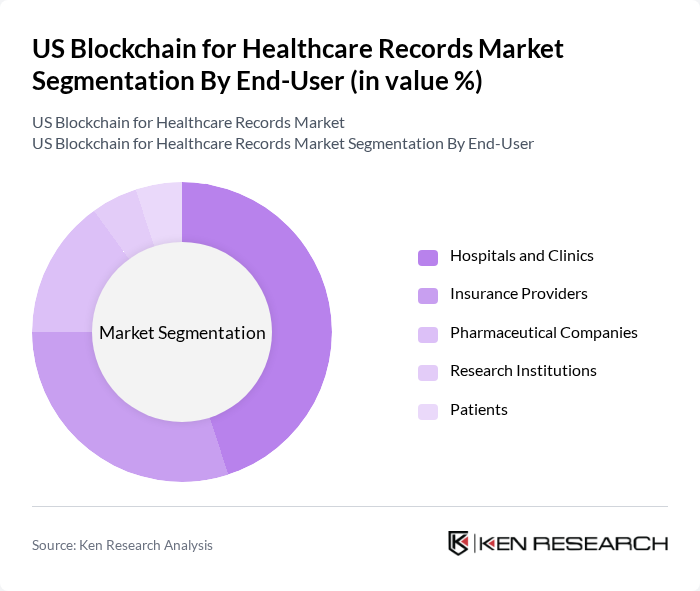

By End-User:The end-user segmentation includes Hospitals and Clinics, Insurance Providers, Pharmaceutical Companies, Research Institutions, and Patients.Hospitals and Clinicsare the leading end-users, driven by the need for secure patient data management, interoperability, and regulatory compliance.Insurance Providersleverage blockchain for efficient claims processing, fraud prevention, and real-time data verification. Pharmaceutical Companies utilize blockchain for supply chain transparency and clinical trial management. Research Institutions and Patients are emerging end-users, focusing on secure data sharing and patient-centric data ownership .

The US Blockchain for Healthcare Records Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, Guardtime, Chronicled, SimplyVital Health, Hashed Health, Solve.Care, Medicalchain, Factom, Rymedi, BurstIQ, Patientory, Embleema, ConsenSys Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US blockchain for healthcare records market appears promising, driven by technological advancements and increasing demand for secure data management. As healthcare organizations prioritize patient data ownership and interoperability, blockchain solutions are expected to gain traction. Additionally, the integration of artificial intelligence with blockchain could enhance data analytics capabilities, further driving adoption. The focus on decentralized applications and partnerships with technology firms will likely create a more robust ecosystem, fostering innovation and improving patient care outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Blockchain Private Blockchain Consortium Blockchain |

| By End-User | Hospitals and Clinics Insurance Providers Pharmaceutical Companies Research Institutions Patients |

| By Application | Patient Health Records (PHR) Electronic Health Records (EHR) Electronic Medical Records (EMR) Clinical Data Management Claims Management Consent Management Data Exchange & Interoperability |

| By Deployment Model | On-Premises Cloud-Based Hybrid Deployment |

| By Region | Northeast Midwest South West |

| By Compliance Standards | HIPAA HITECH GDPR |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Adoption | 100 | IT Directors, Chief Information Officers |

| Patient Data Management | 60 | Healthcare Administrators, Data Privacy Officers |

| Blockchain Technology Vendors | 40 | Product Managers, Business Development Executives |

| Regulatory Compliance Insights | 50 | Compliance Officers, Legal Advisors in Healthcare |

| Patient Perspectives on Blockchain | 70 | Patients, Healthcare Advocates |

The US Blockchain for Healthcare Records Market is valued at approximately USD 2.1 billion, driven by the increasing need for data security, interoperability, and the digitization of medical records, alongside regulatory pressures for data privacy.