Region:North America

Author(s):Geetanshi

Product Code:KRAA3651

Pages:82

Published On:September 2025

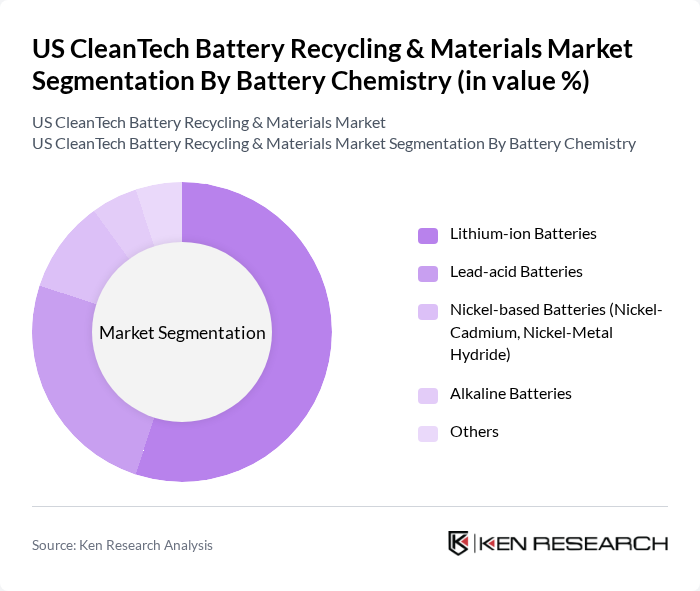

By Battery Chemistry:The battery chemistry segment includes lithium-ion, lead-acid, nickel-based, alkaline, and other batteries. Lithium-ion batteries hold the largest share, driven by their extensive use in electric vehicles and consumer electronics. The rapid expansion of the electric vehicle market has significantly increased the demand for lithium-ion battery recycling, as these batteries contain critical materials such as lithium, nickel, and cobalt that are valuable for reuse. Lead-acid batteries continue to represent a substantial portion due to their dominance in automotive and industrial applications .

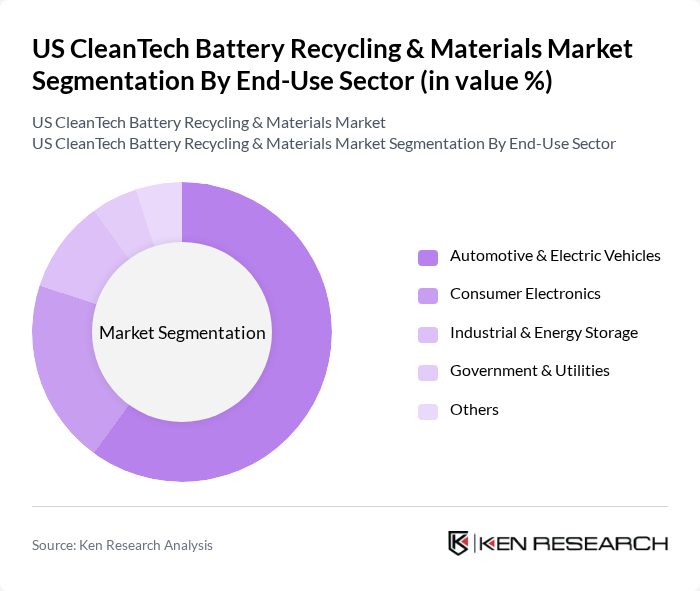

By End-Use Sector:The end-use sector covers automotive and electric vehicles, consumer electronics, industrial and energy storage, government and utilities, and other industries. The automotive and electric vehicles segment leads, propelled by the surge in electric vehicle adoption and the need for sustainable battery lifecycle management. Consumer electronics also account for a significant share, as the proliferation of portable devices increases the volume of batteries requiring recycling .

The US CleanTech Battery Recycling & Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Redwood Materials, Li-Cycle Holdings Corp., American Battery Technology Company, Umicore, Battery Solutions, Cirba Solutions, Glencore, Recycle Technologies, Retriev Technologies, Ascend Elements, Kinsbursky Brothers Inc., Accurec Recycling GmbH, Envirowaste, Ecobat, and Northvolt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US CleanTech battery recycling market appears promising, driven by technological advancements and increasing regulatory support. As the electric vehicle market expands, the demand for efficient recycling solutions will intensify. Innovations in recycling technologies are expected to enhance recovery rates of valuable materials, while government policies will likely continue to promote sustainable practices. This evolving landscape presents opportunities for companies to develop new business models focused on sustainability and resource efficiency, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium-ion Batteries Lead-acid Batteries Nickel-based Batteries (Nickel-Cadmium, Nickel-Metal Hydride) Alkaline Batteries Others |

| By End-Use Sector | Automotive & Electric Vehicles Consumer Electronics Industrial & Energy Storage Government & Utilities Others |

| By Application | Energy Storage Systems Electric Vehicles Portable Electronics Power Tools Others |

| By Collection Channel | Drop-off Centers Curbside Collection Retail Take-back Programs Manufacturer-led Collection Others |

| By Recycling Technology | Hydrometallurgical Pyrometallurgical Direct Recycling (Physical/Mechanical) Biotechnological Others |

| By Material Recovered | Cobalt Lithium Nickel Manganese Graphite Others |

| By Policy & Regulatory Support | Federal Subsidies State Incentives Tax Credits Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 65 | Production Managers, Sustainability Directors |

| Recycling Facilities | 55 | Operations Managers, Environmental Compliance Officers |

| Automotive Industry Stakeholders | 50 | Supply Chain Managers, Product Development Engineers |

| Consumer Electronics Companies | 60 | Product Managers, Corporate Sustainability Leaders |

| Government Regulatory Bodies | 45 | Policy Analysts, Environmental Program Managers |

The US CleanTech Battery Recycling & Materials Market is valued at approximately USD 420 million, reflecting significant growth driven by the increasing adoption of electric vehicles and advancements in recycling technologies.