Region:North America

Author(s):Geetanshi

Product Code:KRAA3815

Pages:81

Published On:September 2025

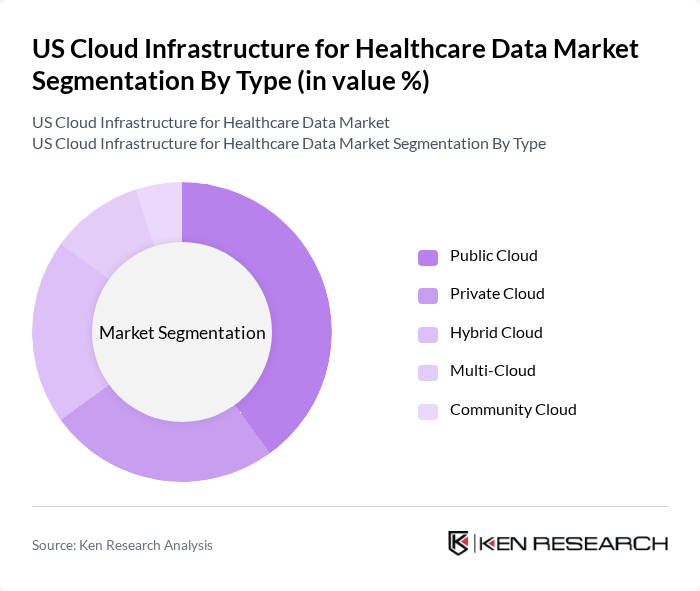

By Type:The market is segmented into Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, and Community Cloud. Each segment addresses distinct organizational needs and compliance requirements, shaping adoption patterns. Public cloud solutions are favored for scalability and cost-effectiveness, while hybrid and multi-cloud models are increasingly adopted to balance security, compliance, and operational flexibility. The hybrid cloud segment is experiencing notable growth as healthcare organizations seek to optimize sensitive data management and regulatory compliance while leveraging public cloud scalability .

ThePublic Cloudsegment leads the market due to its scalability, cost-efficiency, and accessibility. Healthcare organizations are increasingly adopting public cloud platforms to manage data efficiently and ensure regulatory compliance. The flexibility and rapid deployment capabilities of public cloud services enable healthcare providers to respond swiftly to evolving operational demands. Hybrid and multi-cloud models are also gaining traction as organizations seek to optimize data security and compliance while maintaining operational agility .

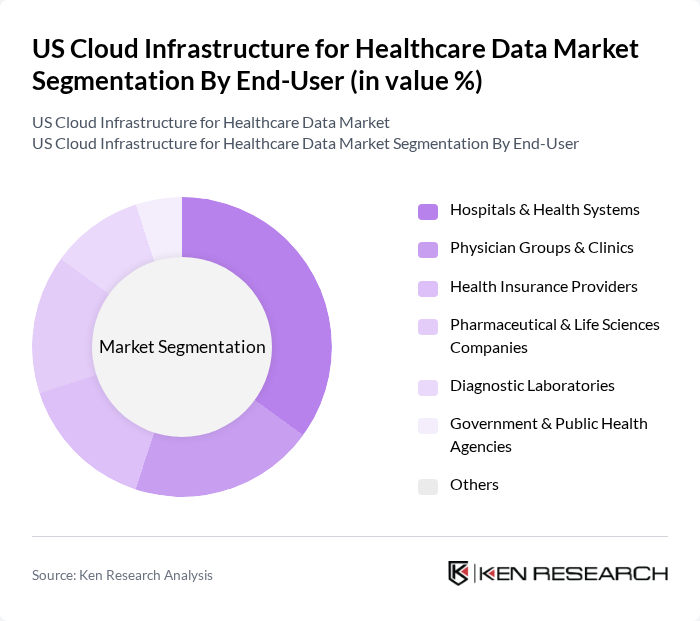

By End-User:This segmentation includes Hospitals & Health Systems, Physician Groups & Clinics, Health Insurance Providers, Pharmaceutical & Life Sciences Companies, Diagnostic Laboratories, Government & Public Health Agencies, and Others. Each end-user group has specific requirements influencing their cloud infrastructure strategies. Hospitals and health systems require extensive data management and integration capabilities, while insurers and life sciences firms prioritize secure, scalable, and interoperable solutions .

Hospitals & Health Systemsdominate the market, reflecting their substantial data management needs and the critical importance of patient care. The sector’s focus on digital transformation, interoperability, and regulatory compliance has driven significant investment in cloud infrastructure to enhance operational efficiency, support advanced analytics, and improve patient outcomes .

The US Cloud Infrastructure for Healthcare Data Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc. (AWS), Microsoft Corporation (Azure), Google Cloud Platform (GCP), IBM Corporation, Oracle Corporation, Salesforce, Inc., Dell Technologies Inc., Cisco Systems, Inc., VMware, Inc., Rackspace Technology, Inc., Cerner Corporation (now part of Oracle Health), Allscripts Healthcare Solutions, Inc. (now Veradigm Inc.), MEDITECH, Epic Systems Corporation, athenahealth, Inc., InterSystems Corporation, Change Healthcare (part of UnitedHealth Group), Optum (UnitedHealth Group), Philips Healthcare (Philips USA), GE HealthCare Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US cloud infrastructure for healthcare data market is poised for transformative growth, driven by technological advancements and evolving patient care models. As healthcare organizations increasingly adopt hybrid cloud solutions, the focus will shift towards enhancing data interoperability and patient-centric care. Additionally, the integration of AI and machine learning technologies will enable more efficient data management and analytics, ultimately improving patient outcomes and operational efficiencies across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Community Cloud |

| By End-User | Hospitals & Health Systems Physician Groups & Clinics Health Insurance Providers Pharmaceutical & Life Sciences Companies Diagnostic Laboratories Government & Public Health Agencies Others |

| By Application | Electronic Health Records (EHR) Telemedicine & Virtual Care Healthcare Data Analytics & Population Health Patient Management Systems Medical Imaging Storage & Sharing Genomics & Precision Medicine Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Edge Computing Others |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Disaster Recovery as a Service (DRaaS) Security as a Service Others |

| By Compliance Standards | HIPAA HITECH ISO/IEC 27001 SOC 2 Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Enterprise Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Adoption in Hospitals | 120 | IT Directors, Chief Information Officers |

| Telehealth Service Providers | 90 | Operations Managers, Telehealth Coordinators |

| Data Security in Healthcare | 60 | Compliance Officers, Data Protection Managers |

| Cloud Infrastructure for Clinics | 50 | Practice Managers, IT Support Staff |

| Healthcare Analytics Solutions | 70 | Data Analysts, Business Intelligence Managers |

The US Cloud Infrastructure for Healthcare Data Market is valued at approximately USD 76 billion, driven by the rapid adoption of digital health solutions, secure data storage needs, and the integration of advanced analytics and artificial intelligence in healthcare workflows.