Region:Asia

Author(s):Dev

Product Code:KRAA3580

Pages:98

Published On:September 2025

By Product Category:The product category segmentation includes Dried Baby Food, Prepared Baby Food, Milk Formula, and Other Baby Food. Among these, Milk Formula is the leading sub-segment, driven by the increasing preference for formula feeding due to lifestyle changes and the convenience it offers to parents. The demand for high-quality, nutritious milk formulas has surged, particularly among urban families who prioritize health and nutrition for their infants. International brands from countries such as the United States enjoy strong consumer trust, with Abbott and Johnson & Johnson being well-recognized names in the market.

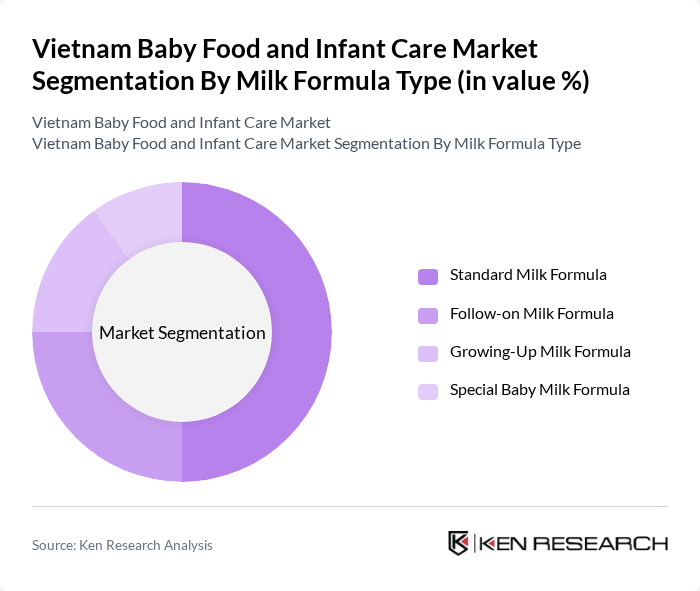

By Milk Formula Type:The milk formula type segmentation includes Standard Milk Formula, Follow-on Milk Formula, Growing-Up Milk Formula, and Special Baby Milk Formula. The Standard Milk Formula dominates this segment, as it is the most commonly used product for infants. Parents often choose this option for its balanced nutrition and affordability, making it a staple in many households across Vietnam. The market is experiencing growth driven by increasing consumer awareness, e-commerce expansion, and improved child nutrition initiatives.

The Vietnam Baby Food and Infant Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Vietnam Co Ltd, Nestlé Vietnam Co Ltd, Danone Dumex Vietnam Co Ltd, FrieslandCampina Vietnam Co Ltd, Mead Johnson Nutrition (Vietnam) Co Ltd, Meiji Holdings Co Ltd, Glico Dairy Products Co Ltd, Hipp GmbH & Co Vertrieb KG, Kraft Heinz Co, Nutifood Nutrition Food Joint Stock Company, TH True Milk, Vinamilk, Dutch Lady Vietnam, Gerber Products Company, Wakodo Co Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam baby food and infant care market is poised for significant growth, driven by urbanization, rising incomes, and heightened awareness of nutrition. As consumer preferences shift towards convenience and quality, brands that innovate with organic and plant-based options are likely to thrive. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of products, particularly in rural areas. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture emerging market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Dried Baby Food Prepared Baby Food Milk Formula Other Baby Food |

| By Milk Formula Type | Standard Milk Formula Follow-on Milk Formula Growing-Up Milk Formula Special Baby Milk Formula |

| By Distribution Channel | Retail Offline Retail E-commerce |

| By Age Group | 6 months 12 months 3 years |

| By Brand Origin | International Brands Domestic Brands |

| By Price Segment | Premium Mid-range Economy |

| By Geographic Region | Urban Centers (Hanoi, Ho Chi Minh City) Provincial Markets Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Parents of Infants (0-12 months) | 120 | Parents, Guardians |

| Pediatric Healthcare Professionals | 60 | Pediatricians, Nutritionists |

| Retailers of Baby Food Products | 50 | Store Managers, Category Buyers |

| Manufacturers of Baby Food | 40 | Product Development Managers, Marketing Directors |

| Caregivers and Childcare Providers | 40 | Childcare Workers, Nannies |

The Vietnam Baby Food and Infant Care Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and increased awareness of child nutrition among parents.