Region:Asia

Author(s):Rebecca

Product Code:KRAA3349

Pages:87

Published On:September 2025

By Type:The cold chain market is segmented into Refrigerated Transport, Cold Storage Facilities, Refrigerated Warehousing, Refrigerated Distribution, Transportation Management Systems, Temperature-Controlled Packaging, Monitoring Systems, Logistics Management Software, and Others.Refrigerated TransportandCold Storage Facilitiesare the largest segments, reflecting the critical role of maintaining product integrity during transit and storage. The rise of e-commerce and online grocery shopping has increased demand for temperature-controlled last-mile delivery and real-time monitoring systems. Logistics Management Software and IoT-enabled Monitoring Systems are emerging as vital segments due to the need for operational efficiency and regulatory compliance .

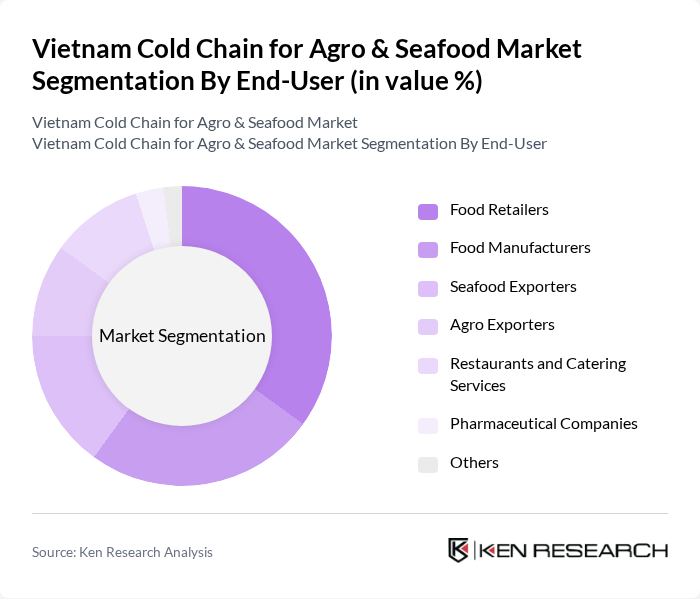

By End-User:The end-user segmentation includes Food Retailers, Food Manufacturers, Seafood Exporters, Agro Exporters, Restaurants and Catering Services, Pharmaceutical Companies, and Others.Food RetailersandFood Manufacturersaccount for the largest shares, driven by the need for reliable cold chain solutions to maintain product freshness and safety.Seafood ExportersandAgro Exportersrequire robust cold chain infrastructure to meet international standards and minimize spoilage. The pharmaceutical segment is expanding due to stricter requirements for temperature-sensitive drugs and vaccines .

The Vietnam Cold Chain for Agro & Seafood Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABA Cooltrans, Tan Bao An Logistics, Transimex Corporation, Gemadept Corporation, Vinafco Joint Stock Corporation, Minh Phu Seafood Corporation, T&M Forwarding, Thang Long Logistics, Hai Ha Logistics, An Phat Holdings, FPT Logistics, Binh Minh Import-Export, Phu Hoang Anh Logistics, Vietstar Express, Tuan Minh Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's cold chain market for agro and seafood products appears promising, driven by technological advancements and increasing consumer demand for quality. The integration of IoT technologies is expected to enhance monitoring and efficiency in cold chain operations. Additionally, as the government continues to invest in infrastructure improvements, the market is likely to see a rise in both domestic and international trade, particularly in seafood exports, which are projected to reach $10 billion in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Refrigerated Warehousing Refrigerated Distribution Transportation Management Systems Temperature-Controlled Packaging Monitoring Systems Logistics Management Software Others |

| By End-User | Food Retailers Food Manufacturers Seafood Exporters Agro Exporters Restaurants and Catering Services Pharmaceutical Companies Others |

| By Application | Fruits and Vegetables Seafood (Shrimp, Pangasius, Tuna, etc.) Dairy and Frozen Desserts Meat and Poultry Processed Foods Others |

| By Distribution Mode | Direct Sales Online Sales Wholesale Distribution Retail Distribution Export Distribution Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Sales Channel | B2B B2C E-commerce Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 60 | Facility Managers, Operations Directors |

| Seafood Processing Plants | 50 | Production Managers, Quality Control Supervisors |

| Agricultural Producers | 70 | Farm Owners, Supply Chain Coordinators |

| Logistics Service Providers | 40 | Logistics Managers, Business Development Executives |

| Retail Distribution Centers | 45 | Warehouse Managers, Inventory Control Specialists |

The Vietnam Cold Chain for Agro & Seafood Market is valued at approximately USD 1.2 billion, reflecting strong demand for temperature-controlled logistics in food, agriculture, and seafood sectors, driven by urbanization and increased consumer awareness regarding food safety and quality.