Region:Asia

Author(s):Geetanshi

Product Code:KRAA3734

Pages:82

Published On:September 2025

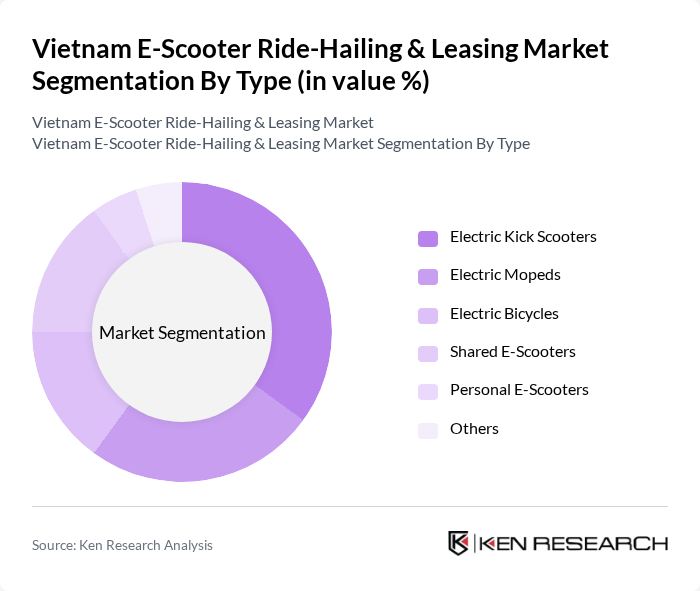

By Type:The market is segmented into various types of e-scooters, including Electric Kick Scooters, Electric Mopeds, Electric Bicycles, Shared E-Scooters, Personal E-Scooters, and Others. Among these, Electric Kick Scooters and Shared E-Scooters are gaining significant traction due to their convenience and affordability, particularly in urban areas where short-distance travel is common. The increasing preference for electric kick scooters is driven by their lightweight design, ease of use, and suitability for last-mile connectivity, while shared e-scooters benefit from app-based rental models and flexible usage options .

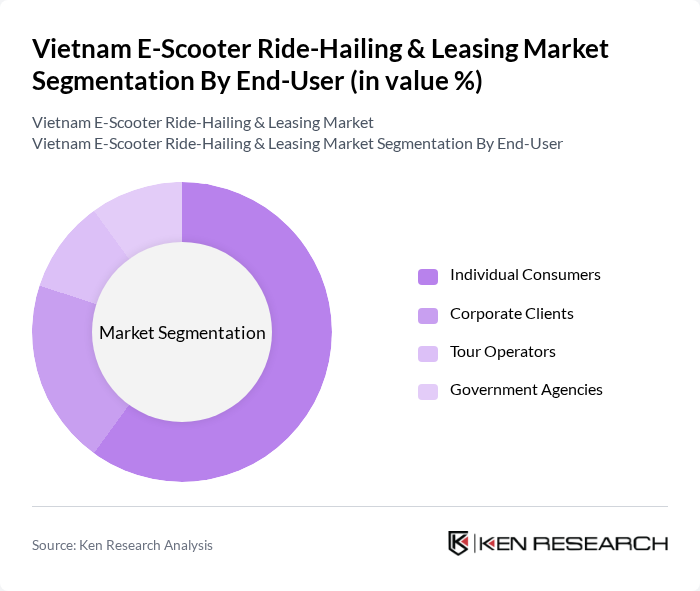

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Tour Operators, and Government Agencies. Individual Consumers dominate the market as they seek affordable and flexible transportation solutions for daily commuting, while Corporate Clients and Tour Operators are increasingly adopting e-scooters for business purposes and tourism, respectively. The rise in individual consumer adoption is supported by low operating costs, modern design preferences, and environmental consciousness, while corporate and tourism segments leverage e-scooters for fleet management and guided tours .

The Vietnam E-Scooter Ride-Hailing & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xanh SM (Green SM Bike), Grab Holdings Inc., Be Group JSC, VinFast, Selex Motors, Dat Bike, Yadea Vietnam, Niu Technologies, Ahamove, Mai Linh Group, Vinasun Corporation, Gojek Vietnam, E-Scooter Sharing Vietnam, Mobike (Vietnam Operations), Lime (Vietnam Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-scooter ride-hailing and leasing market in Vietnam appears promising, driven by increasing urbanization and a growing emphasis on sustainable transportation. As the government continues to invest in electric mobility infrastructure, including charging stations and regulatory frameworks, the market is expected to attract more players. Additionally, the integration of smart technologies and shared mobility solutions will likely enhance user experience, making e-scooters a preferred choice for urban commuters seeking efficient and eco-friendly transport options.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Kick Scooters Electric Mopeds Electric Bicycles Shared E-Scooters Personal E-Scooters Others |

| By End-User | Individual Consumers Corporate Clients Tour Operators Government Agencies |

| By Usage Type | Short-Term Rentals Long-Term Leasing Subscription Services |

| By Distribution Channel | Online Platforms Physical Retail Outlets Partnerships with Ride-Hailing Apps |

| By Pricing Model | Pay-Per-Ride Monthly Subscriptions Annual Leasing |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Customer Segment | Students Professionals Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 120 | Daily commuters, students, and professionals |

| E-Scooter Users | 60 | Current e-scooter riders and leaseholders |

| Potential Users | 80 | Individuals considering e-scooter usage |

| Industry Experts | 40 | Transport policy makers, urban planners, and industry analysts |

| Leasing Companies | 20 | Executives and managers from e-scooter leasing firms |

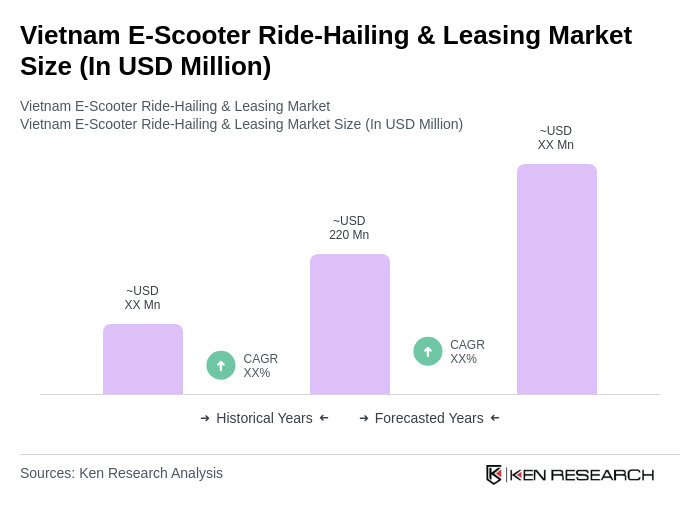

The Vietnam E-Scooter Ride-Hailing & Leasing Market is valued at approximately USD 220 million, driven by urbanization, environmental awareness, and government initiatives promoting electric mobility. This market is expected to grow as demand for eco-friendly transportation options increases.