Region:Asia

Author(s):Rebecca

Product Code:KRAA3337

Pages:81

Published On:September 2025

By Program Type:The program types in the Vietnam Executive Education and L&D Market include Executive MBA Programs, Leadership Development Programs, Management Training Workshops, Technical Skills Enhancement, Digital Transformation Training, Soft Skills Development, and Professional Certification Programs. Among these, Leadership Development Programs are particularly dominant due to the increasing focus on nurturing future leaders within organizations. Companies are investing heavily in these programs to ensure they have a pipeline of skilled leaders ready to tackle future challenges. The adoption of immersive technologies, data-driven learning analytics, and blended formats is accelerating, reflecting broader Asia-Pacific trends in executive learning.

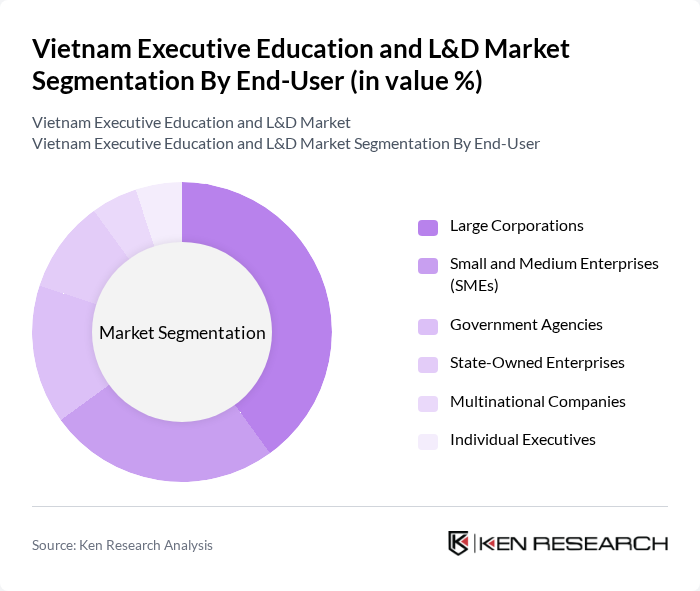

By End-User:The end-users in the Vietnam Executive Education and L&D Market include Large Corporations, Small and Medium Enterprises (SMEs), Government Agencies, State-Owned Enterprises, Multinational Companies, and Individual Executives. Large Corporations are the leading segment, as they have the resources and need to invest in comprehensive training programs for their workforce. This trend is driven by the necessity to maintain competitive advantage and adapt to rapid market changes. SMEs are also significant participants, leveraging cost-effective and tailored training solutions to upskill their employees.

The Vietnam Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam National University, FPT University, RMIT University Vietnam, Topica Edtech Group, University of Economics Ho Chi Minh City, British University Vietnam, Hanoi University of Science and Technology, National Economics University, Innotech Vietnam Corp, Tân T?o University, Hoa Sen University, University of Danang, Vietnam Australia International School, Asian International School, HCM City University of Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's executive education market appears promising, driven by ongoing government reforms and the increasing integration of technology in learning. As organizations recognize the importance of upskilling their workforce, there will be a greater emphasis on customized programs that address specific industry needs. Additionally, the collaboration between local institutions and international partners is expected to enhance program quality, making executive education more relevant and accessible to professionals across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Program Type | Executive MBA Programs Leadership Development Programs Management Training Workshops Technical Skills Enhancement Digital Transformation Training Soft Skills Development Professional Certification Programs |

| By End-User | Large Corporations Small and Medium Enterprises (SMEs) Government Agencies State-Owned Enterprises Multinational Companies Individual Executives |

| By Delivery Mode | Traditional Classroom Training E-Learning Platforms Blended Learning Virtual Reality Training Mobile Learning Applications |

| By Duration | Short-Term Programs (1-30 days) Medium-Term Programs (1-6 months) Long-Term Programs (6+ months) Continuous Learning Programs |

| By Industry Focus | Manufacturing and Industrial Banking and Financial Services Information Technology Healthcare and Pharmaceuticals Retail and Consumer Goods Energy and Utilities |

| By Training Content | Strategic Management Human Resource Management Financial Management Operations Management Innovation and Change Management |

| By Provider Type | Universities and Business Schools Corporate Training Companies International Training Providers Independent Consultants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | HR Directors, Training Managers |

| Leadership Development Initiatives | 90 | Senior Executives, Program Coordinators |

| Industry-Specific L&D Strategies | 80 | Sector Specialists, Learning Consultants |

| Online Learning Platforms for Executives | 70 | eLearning Managers, IT Directors |

| Assessment of Training Effectiveness | 90 | Training Evaluators, Performance Analysts |

The Vietnam Executive Education and L&D Market is valued at approximately USD 4.5 billion, driven by the increasing demand for skilled professionals and the government's emphasis on continuous learning and digital skills development.