Region:Asia

Author(s):Shubham

Product Code:KRAA3621

Pages:91

Published On:September 2025

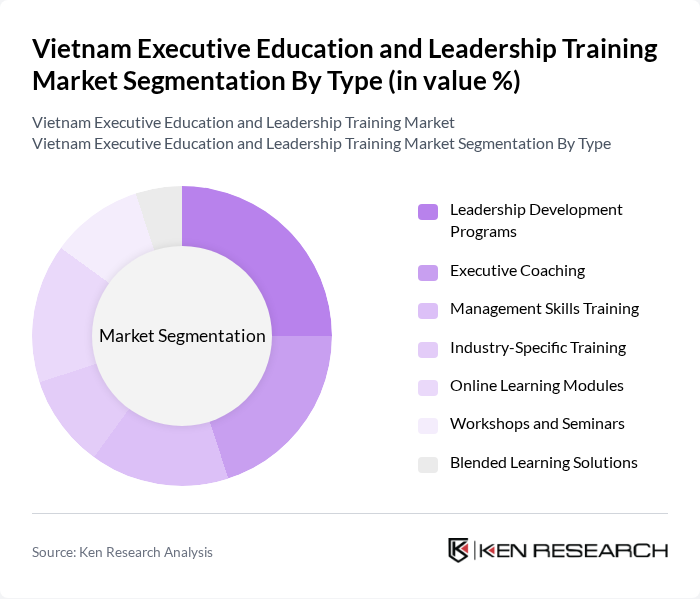

By Type:The market is segmented into various types of training programs, including Leadership Development Programs, Executive Coaching, Management Skills Training, Industry-Specific Training, Online Learning Modules, Workshops and Seminars, and Blended Learning Solutions. Each of these sub-segments caters to different needs and preferences of professionals seeking to enhance their skills. The adoption of blended and online learning modules is rising rapidly, reflecting the broader trend of digital transformation in Vietnam’s education sector .

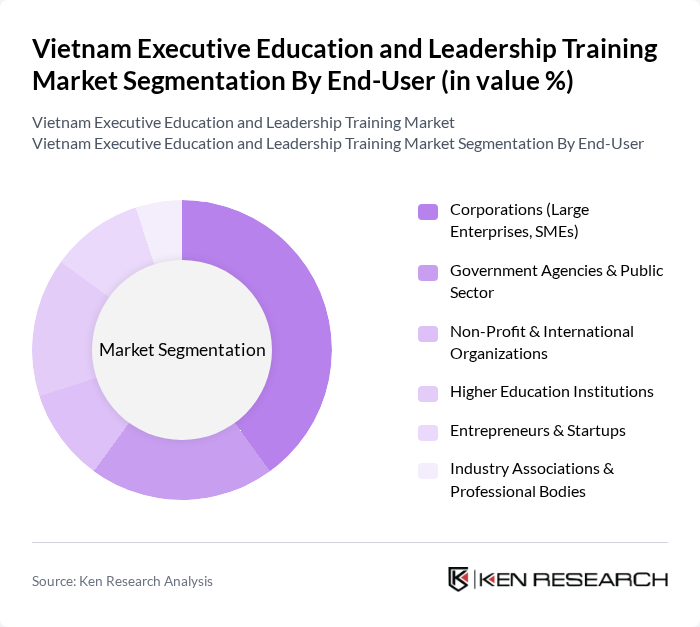

By End-User:The end-user segmentation includes Corporations (Large Enterprises, SMEs), Government Agencies & Public Sector, Non-Profit & International Organizations, Higher Education Institutions, Entrepreneurs & Startups, and Industry Associations & Professional Bodies. This segmentation reflects the diverse clientele that seeks executive education and leadership training. Corporations, especially SMEs, are the primary drivers of demand, while government agencies and higher education institutions are increasingly investing in leadership capacity building .

The Vietnam Executive Education and Leadership Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT University, RMIT University Vietnam, Vietnam National University, Hanoi, Hoa Sen University, University of Danang, British University Vietnam, INSEAD (Singapore Campus), Harvard Business School Online, Ho Chi Minh City University of Technology (HUTECH), University of Economics Ho Chi Minh City (UEH), National Economics University (NEU), University of Danang - University of Science and Technology, SaigonTech, Vietnam Executive Education Center (VEEC), Talentnet Corporation, Topica Edtech Group, Dale Carnegie Vietnam, FranklinCovey Vietnam, PACE Institute of Management, Navigos Group Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam executive education and leadership training market appears promising, driven by technological advancements and a growing emphasis on soft skills. As organizations increasingly recognize the importance of adaptive leadership in a globalized economy, the demand for innovative training solutions will likely rise. Furthermore, the integration of experiential learning and coaching methodologies is expected to enhance program effectiveness, fostering a new generation of leaders equipped to tackle emerging challenges in the business landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Executive Coaching Management Skills Training Industry-Specific Training Online Learning Modules Workshops and Seminars Blended Learning Solutions |

| By End-User | Corporations (Large Enterprises, SMEs) Government Agencies & Public Sector Non-Profit & International Organizations Higher Education Institutions Entrepreneurs & Startups Industry Associations & Professional Bodies |

| By Delivery Mode | In-Person (Classroom) Training Virtual Instructor-Led Training (VILT) Hybrid (Blended) Training Self-Paced Online Learning Immersive/Experiential Learning (Simulations, Case Studies) |

| By Duration | Short-Term Programs (1-3 days) Medium-Term Programs (1-3 months) Long-Term Programs (6 months and above) Modular/Stackable Programs |

| By Certification Type | Accredited Executive Education Programs Non-Accredited/Corporate Certificates Internationally Recognized Certificates Micro-Credentials & Digital Badges |

| By Pricing Model | Fixed (Per Course/Program) Pricing Subscription-Based Pricing Pay-Per-Session/Module Pricing Corporate Bulk Licensing |

| By Industry Focus | Technology & IT Finance & Banking Healthcare & Life Sciences Manufacturing & Engineering Retail & Consumer Goods Hospitality & Tourism Logistics & Supply Chain Public Sector & Education Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Needs Assessment | 100 | HR Managers, Training Coordinators |

| Executive Education Program Feedback | 80 | Program Participants, Alumni |

| Market Trends in Leadership Training | 60 | Industry Experts, Academic Leaders |

| Digital Learning Preferences | 50 | Corporate Executives, IT Managers |

| Impact of Training on Business Performance | 60 | Business Owners, Senior Executives |

The Vietnam Executive Education and Leadership Training Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by the demand for skilled leadership and the expansion of small and medium-sized enterprises in the country.