Region:Asia

Author(s):Geetanshi

Product Code:KRAA3645

Pages:85

Published On:September 2025

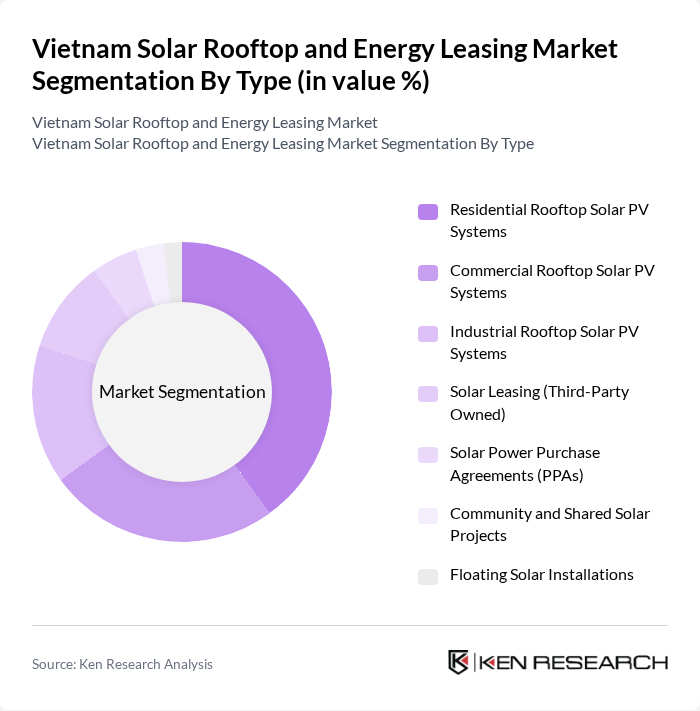

By Type:The market is segmented into residential, commercial, and industrial rooftop solar PV installations. Residential rooftop solar PV systems are gaining momentum due to increased consumer awareness, attractive government incentives, and the desire for energy independence. Commercial and industrial systems are significant contributors, driven by the need for reliable and cost-effective energy solutions. Solar leasing and power purchase agreements (PPAs) are emerging as popular financing models, enabling users to adopt solar technology with minimal upfront investment. Community and shared solar projects, as well as floating solar installations, are also expanding, reflecting Vietnam’s innovative approach to maximizing solar adoption .

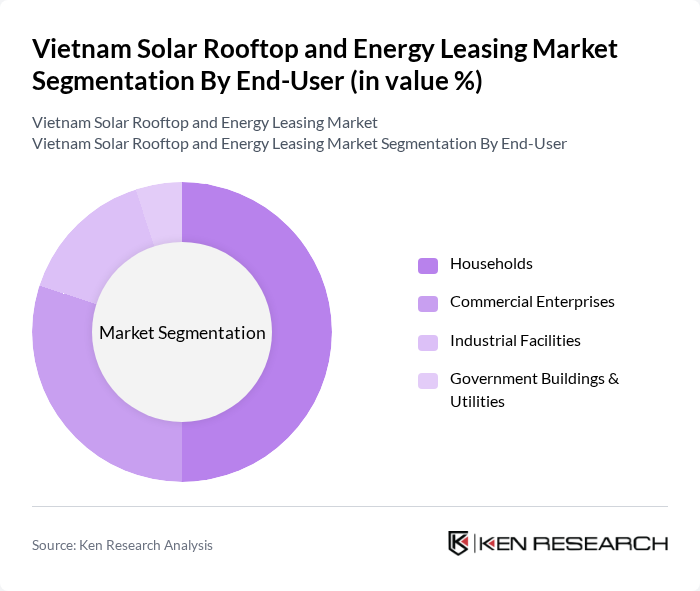

By End-User:The end-user segmentation comprises households, commercial enterprises, industrial facilities, and government buildings. Households represent the largest segment, driven by rising electricity costs and a growing preference for energy independence. Commercial enterprises are significant adopters, seeking to reduce operational expenses and enhance sustainability. Industrial facilities are increasingly implementing solar solutions to meet environmental targets, while government buildings are required to integrate renewable energy practices as part of national energy security and sustainability mandates .

The Vietnam Solar Rooftop and Energy Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SolarBK, Trung Nam Group, BCG Energy, TTP Energy, GreenYellow Vietnam, EVN (Electricity of Vietnam), Sunseap Group, Vietnam Sunergy Joint Stock Company (VSUN), Sharp Energy Solutions Corporation, JinkoSolar, Hanwha Q CELLS, Trina Solar, Canadian Solar, SMA Solar Technology, LONGi Solar, Risen Energy, Song Giang Solar Power Joint Stock Company, Berkeley Energy Commercial & Industrial Solutions, Tata Power Solar Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam solar rooftop and energy leasing market appears promising, driven by increasing energy demands and supportive government policies. As urban areas expand, the need for sustainable energy solutions will intensify, prompting further investments in solar technologies. Additionally, advancements in energy storage and smart grid technologies will enhance the efficiency and reliability of solar systems. With a focus on sustainability, businesses are likely to adopt solar solutions, contributing to a greener energy landscape in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Rooftop Solar PV Systems Commercial Rooftop Solar PV Systems Industrial Rooftop Solar PV Systems Solar Leasing (Third-Party Owned) Solar Power Purchase Agreements (PPAs) Community and Shared Solar Projects Floating Solar Installations |

| By End-User | Households Commercial Enterprises Industrial Facilities Government Buildings & Utilities |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Incentive Schemes |

| By Application | Grid-Connected Rooftop Systems Off-Grid Rooftop Systems Rooftop Installations (All Types) Utility-Scale Rooftop Projects |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors/Installers |

| By Price Range | Entry-Level Systems Mid-Range Systems Premium Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Users | 100 | Homeowners, Property Managers |

| Commercial Solar Leasing Clients | 70 | Facility Managers, Business Owners |

| Solar Installation Companies | 40 | Business Development Managers, Technical Directors |

| Energy Policy Makers | 40 | Government Officials, Regulatory Bodies |

| Financial Institutions Supporting Solar Projects | 50 | Investment Analysts, Loan Officers |

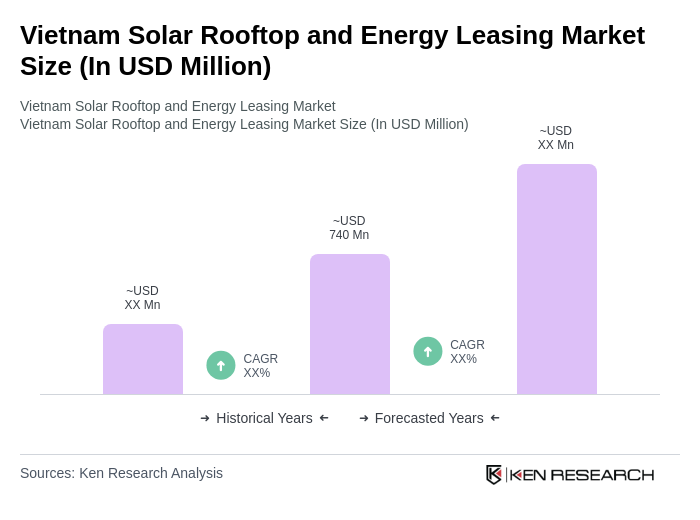

The Vietnam Solar Rooftop and Energy Leasing Market is valued at approximately USD 740 million, driven by increasing demand for renewable energy, supportive government policies, and rising electricity costs, particularly in urban areas.