Region:Central and South America

Author(s):Rebecca

Product Code:KRAA3348

Pages:97

Published On:September 2025

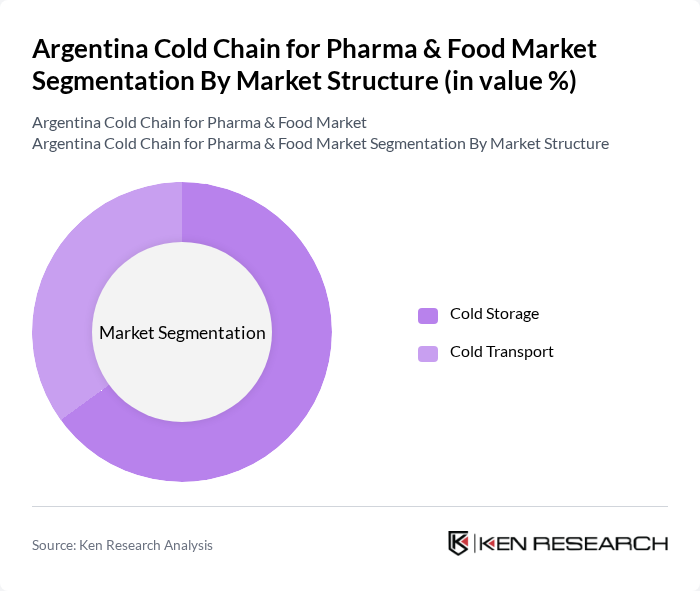

By Market Structure:The market is segmented into two primary structures: Cold Storage and Cold Transport. Cold Storage facilities are essential for maintaining the integrity of temperature-sensitive products, while Cold Transport ensures that these products are delivered under controlled conditions. The Cold Storage segment is currently dominating the market due to the increasing need for long-term storage solutions for pharmaceuticals and perishable food items, supported by Argentina’s export-oriented agri-food sector and the growth of modern retail channels.

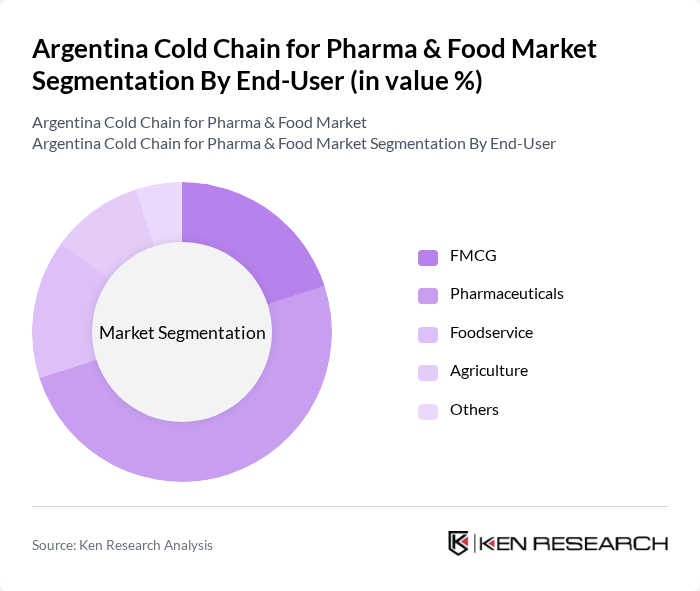

By End-User:The market is segmented into several end-users, including FMCG, Pharmaceuticals, Foodservice, Agriculture, and Others. The Pharmaceuticals segment is leading the market due to the stringent requirements for temperature control in drug storage and distribution. The increasing number of biopharmaceutical products requiring cold chain logistics is a significant factor contributing to this dominance. The FMCG and Foodservice segments are also growing, driven by urbanization, modernization of retail, and rising demand for chilled and frozen consumer goods.

The Argentina Cold Chain for Pharma & Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Andreani Logística, Ocasa, Frío Star, Logística La Serenísima, Frialsa Frigoríficos S.A., Comfrio Soluções Logísticas, Friozem Armazéns Frigoríficos, Superfrio Armazéns Gerais, Americold Logistics, DHL Supply Chain Argentina, Kuehne + Nagel Argentina, FedEx Argentina, Grupo Logístico Andreani, Cargill Argentina, Grupo Sancor Seguros contribute to innovation, geographic expansion, and service delivery in this space.

The future of Argentina's cold chain market is poised for transformation, driven by technological advancements and increasing consumer expectations for quality. The integration of IoT technologies is expected to enhance monitoring and efficiency, while sustainable practices will gain traction as environmental concerns rise. Additionally, the growth of biopharmaceuticals will necessitate more sophisticated cold chain solutions, ensuring that temperature-sensitive products are delivered safely and effectively across the country, thereby fostering market resilience and innovation.

| Segment | Sub-Segments |

|---|---|

| By Market Structure | Cold Storage Cold Transport |

| By End-User | FMCG Pharmaceuticals Foodservice Agriculture Others |

| By Temperature Type | Chilled Frozen |

| By Ownership | Third-Party Logistics (3PL) Owned |

| By Region | Buenos Aires Córdoba Santa Fe Others |

| By Service Type | Storage Transportation Value-Added Services |

| By Destination | Domestic International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Logistics | 60 | Logistics Managers, Quality Assurance Officers |

| Food Distribution Networks | 50 | Supply Chain Directors, Operations Managers |

| Cold Storage Facility Operations | 40 | Facility Managers, Compliance Officers |

| Technology Providers in Cold Chain | 40 | Product Managers, Business Development Executives |

| Regulatory Compliance in Cold Chain | 40 | Regulatory Affairs Specialists, Legal Advisors |

The Argentina Cold Chain for Pharma & Food Market is valued at approximately ARS 102.9 billion, driven by the increasing demand for temperature-sensitive products in the pharmaceutical and food sectors, along with advancements in logistics and e-commerce capabilities.