Region:Europe

Author(s):Rebecca

Product Code:KRAA3344

Pages:86

Published On:September 2025

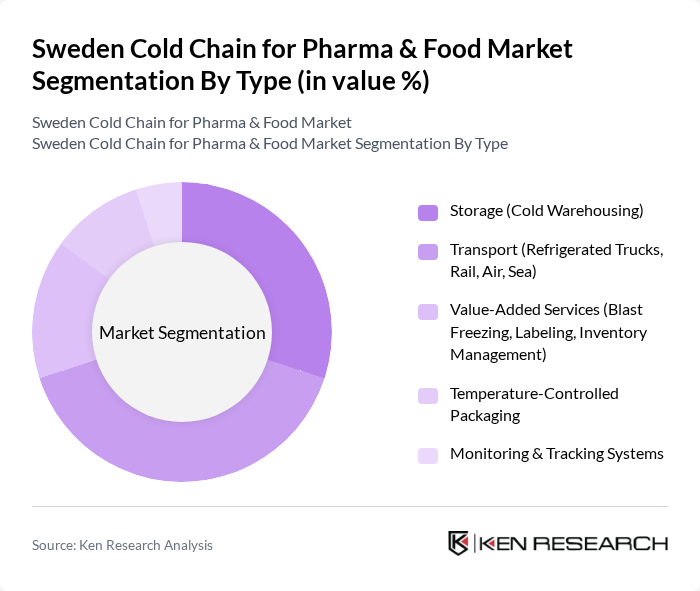

By Type:The cold chain market can be segmented into storage, transport, value-added services, temperature-controlled packaging, and monitoring & tracking systems. Each of these segments is essential for the safe and efficient handling of temperature-sensitive products. Storage and transport remain the largest segments, with value-added services and advanced monitoring solutions gaining importance due to regulatory and quality requirements .

Thetransport segment, particularly refrigerated trucks, dominates due to the increasing demand for efficient and reliable delivery of temperature-sensitive products. The rise of e-commerce and consumer expectations for rapid, safe delivery of perishables have further amplified this need. Advancements in logistics technology, such as real-time tracking and temperature monitoring, have enhanced the efficiency and reliability of transport services .

In end-user segmentation, thefood and beverages sectorleads, driven by consumer demand for fresh and safe products and reinforced by food safety regulations. The pharmaceutical sector is also significant, with the growing need for biopharmaceuticals and vaccines requiring stringent temperature controls during storage and transport .

Direct distributionis the leading mode of distribution, reflecting the need for immediate and reliable delivery of temperature-sensitive products. E-commerce platforms are expanding rapidly as consumers increasingly shop online for perishables, while third-party logistics providers are gaining traction for their specialized cold chain services .

Thevaccine and biologic distributionsegment is crucial, especially given the recent surge in demand for temperature-sensitive pharmaceuticals and the expansion of Sweden's pharmaceutical exports. Perishable food delivery remains significant, supported by the growth of online grocery shopping and consumer demand for fresh products .

Refrigerated trucks and containersdominate the packaging type segment due to their essential role in maintaining required temperatures during transport. The demand for insulated containers and active packaging solutions is also increasing, providing additional protection for sensitive products .

Transportation servicesare the backbone of the cold chain market, accounting for the largest share due to the need for timely and safe delivery of temperature-sensitive goods. Warehousing services are also significant, especially in urban areas where inventory management is critical .

Thechilled temperature rangesegment is the most significant, driven by the need to maintain the quality of perishable food and pharmaceuticals. The frozen segment is also substantial, particularly for products requiring long-term storage and transport, such as frozen foods and certain vaccines .

The Sweden Cold Chain for Pharma & Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Bring Frigo AB, PostNord TPL AB, Thermo-Transit AB, Freja Transport & Logistics AB, NTEX AB, Spedman Global Logistics AB, LBC Frakt AB, Ahola Transport AB, A.P. Moller - Maersk, Geodis, FedEx Express Sweden, UPS Supply Chain Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market in Sweden appears promising, driven by technological innovations and increasing consumer demand for temperature-sensitive products. As e-commerce continues to expand, companies are likely to invest in smart cold chain solutions that enhance efficiency and traceability. Additionally, the focus on sustainability will push for eco-friendly refrigeration technologies, aligning with global environmental goals. These trends will shape the market landscape, fostering growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Storage (Cold Warehousing) Transport (Refrigerated Trucks, Rail, Air, Sea) Value-Added Services (Blast Freezing, Labeling, Inventory Management) Temperature-Controlled Packaging Monitoring & Tracking Systems |

| By End-User | Pharmaceuticals (Including Biopharma & Vaccines) Food and Beverages Biotechnology Healthcare Providers Horticulture (Fresh Fruits & Vegetables) Dairy Products Fish, Meat, and Poultry Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Vaccine & Biologic Distribution Perishable Food Delivery Clinical Trials Logistics Processed Food Distribution Others |

| By Packaging Type | Insulated Containers Refrigerated Trucks & Containers Active and Passive Packaging Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services Monitoring Services Others |

| By Temperature Range | Chilled (2°C to 8°C) Frozen (Below -18°C) Ambient (15°C to 25°C) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Logistics | 100 | Logistics Managers, Quality Assurance Officers |

| Food Distribution Cold Chain | 80 | Supply Chain Directors, Operations Managers |

| Temperature-Controlled Storage Facilities | 70 | Facility Managers, Compliance Officers |

| Cold Chain Technology Providers | 60 | Product Development Managers, Sales Directors |

| Regulatory Compliance in Cold Chain | 40 | Regulatory Affairs Specialists, Legal Advisors |

The Sweden Cold Chain for Pharma & Food Market is valued at approximately USD 1.8 billion, driven by the increasing consumption of perishable items and the expansion of e-commerce in grocery and pharmaceuticals.