Region:Europe

Author(s):Rebecca

Product Code:KRAA1398

Pages:87

Published On:August 2025

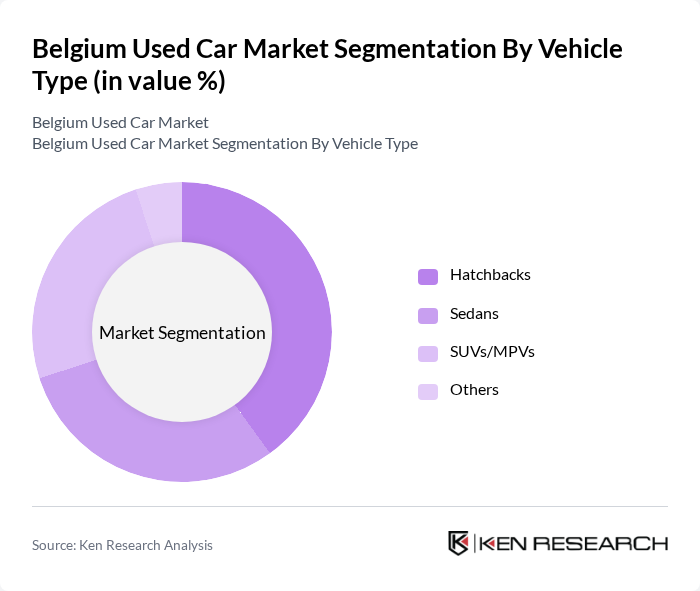

By Vehicle Type:The used car market in Belgium is segmented into various vehicle types, including hatchbacks, sedans, SUVs/MPVs, and others. Among these, hatchbacks are particularly popular due to their compact size and fuel efficiency, making them ideal for urban driving. Sedans also hold a significant share, appealing to families and professionals seeking comfort and space. SUVs/MPVs are gaining traction as consumers increasingly prefer larger vehicles for their versatility, comfort, and safety features. The "Others" category includes niche vehicles that cater to specific consumer preferences, such as convertibles and sports cars.

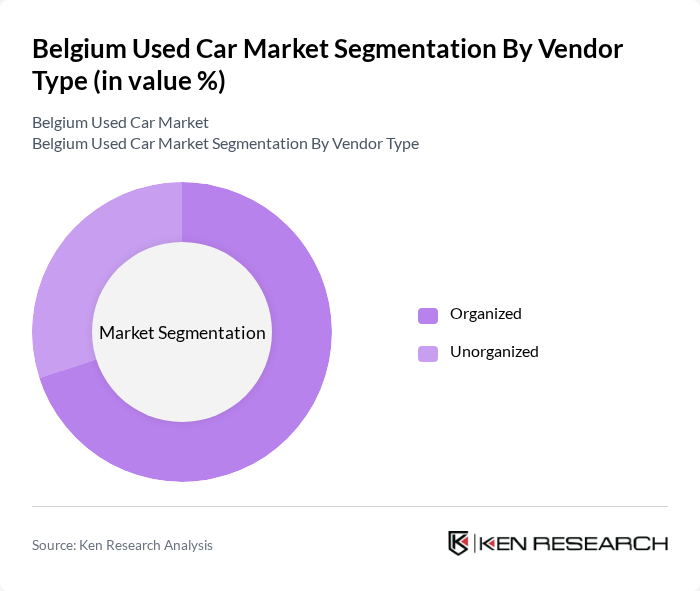

By Vendor Type:The market is also segmented by vendor type, which includes organized and unorganized vendors. Organized vendors, such as established dealerships and online platforms, dominate the market due to their ability to provide warranties, financing options, and a wide selection of vehicles. Unorganized vendors, including private sellers and small dealerships, cater to a niche market but face challenges in terms of consumer trust and service quality. The organized segment is growing as consumers increasingly prefer the reliability and transparency offered by these vendors, supported by regulatory measures and digital transformation in the sector.

The Belgium Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as D'Ieteren Group, AutoScout24, CarNext, Vroom.be, BCA Belgium, Gocar.be, Cardoen, Arval Belgium, LeasePlan Belgium, Car-Pass, Autosphere.be, MyWay (by D'Ieteren), Autohero Belgium, Beherman Group, Autovlan.be contribute to innovation, geographic expansion, and service delivery in this space.

The Belgium used car market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing shift towards online sales platforms will likely enhance accessibility and convenience for buyers. Additionally, the growing interest in electric and hybrid vehicles will create new segments within the used car market. As economic conditions stabilize, consumer confidence is expected to rise, further supporting demand for used cars in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Hatchbacks Sedans SUVs/MPVs Others |

| By Vendor Type | Organized Unorganized |

| By Fuel Type | Petrol Diesel Electric Other Fuel Types (LPG, CNG, etc.) |

| By Sales Channel | Online Offline |

| By Geography | Belgium (regional breakdown as applicable) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 100 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 120 | Consumers aged 25-55, First-time Buyers |

| Automotive Financing Institutions | 60 | Loan Officers, Risk Managers |

| Automotive Experts and Analysts | 40 | Market Analysts, Industry Consultants |

| Online Marketplace Operators | 50 | Product Managers, Marketing Directors |

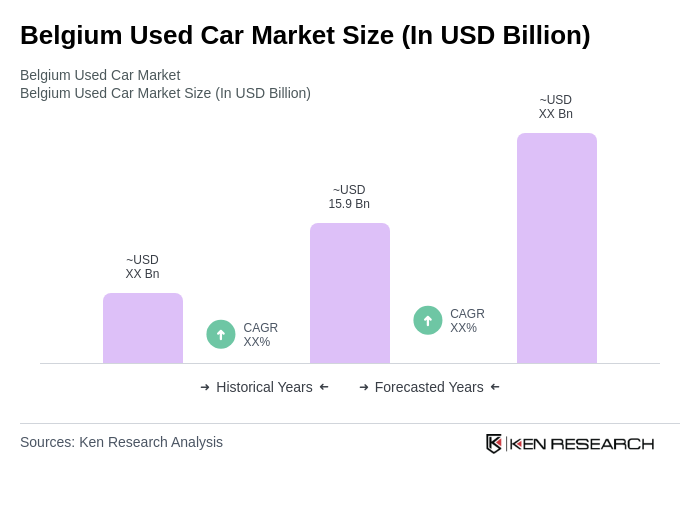

The Belgium used car market is valued at approximately USD 15.9 billion, reflecting a significant growth trend driven by increasing consumer demand for affordable vehicles and the rise of online car sales platforms.