Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1187

Pages:93

Published On:August 2025

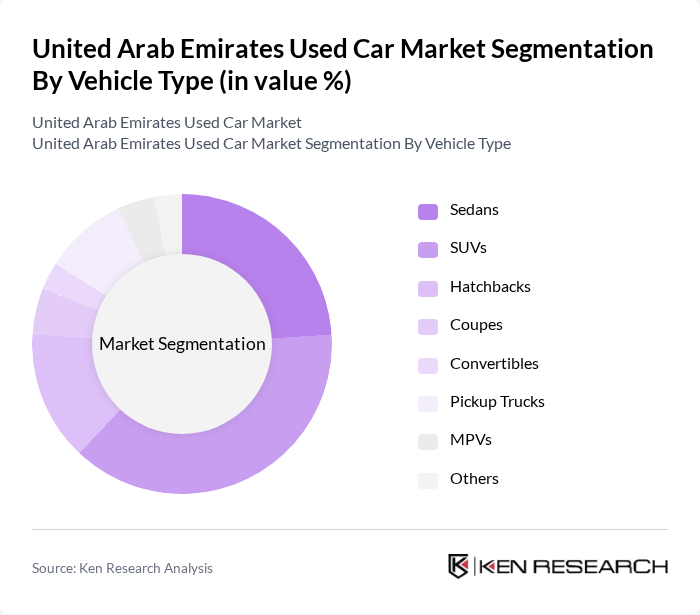

By Vehicle Type:The used car market in the UAE is segmented by vehicle type, which includes various categories such as sedans, SUVs, hatchbacks, coupes, convertibles, pickup trucks, MPVs, and others. Each category caters to different consumer preferences and needs, with SUVs and sedans being particularly popular due to their versatility and comfort. SUVs currently dominate the market, reflecting their appeal for both urban and off-road use .

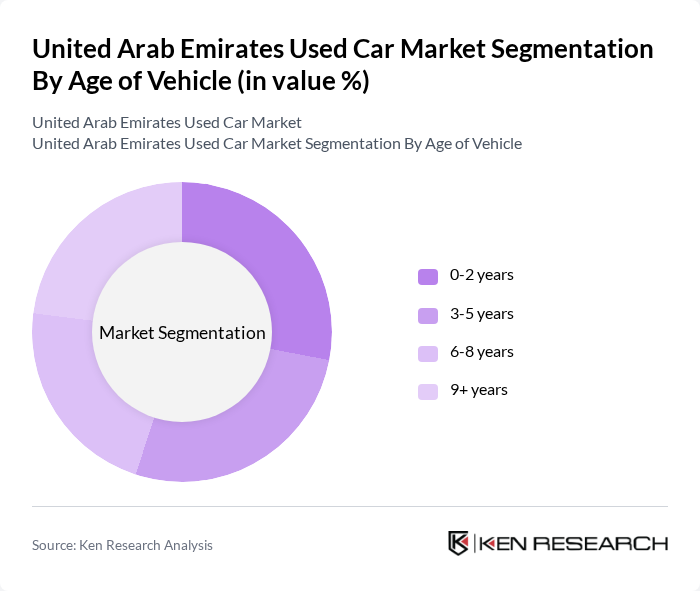

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-2 years, 3-5 years, 6-8 years, and 9+ years. This segmentation reflects consumer preferences for newer models, with younger vehicles generally commanding higher prices and demand due to their reliability and modern features. The market is witnessing increased demand for vehicles under five years old, driven by certified pre-owned programs and warranty-backed offerings .

The United Arab Emirates Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automall, Arabian Automobiles (AW Rostamani Group), Al Nabooda Automobiles, Emirates Motor Company, Al Tayer Motors, Al Ghandi Auto, Al Jaziri Motors, Al Yousuf Motors, Sun City Motors, Dubizzle Motors, CarSwitch, YallaMotor, Al Habtoor Motors, Elite Cars, Al Majid Motors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE used car market appears promising, driven by technological advancements and changing consumer preferences. As online platforms continue to evolve, they will likely enhance user experience and streamline transactions. Additionally, the growing awareness of sustainability will push consumers towards electric and hybrid used vehicles. With government support for eco-friendly initiatives, the market is poised for transformation, creating a more diverse and competitive landscape that caters to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Sedans SUVs Hatchbacks Coupes Convertibles Pickup Trucks MPVs Others |

| By Age of Vehicle | 2 years 5 years 8 years + years |

| By Condition | Certified Pre-Owned Non-Certified |

| By Sales Channel | Dealerships (Franchised & Independent) Online Platforms Private Sales |

| By Fuel Type | Petrol Diesel Electric Hybrid |

| By Financing Options | Cash Purchases Bank Loans Dealer Financing |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Brand Origin | Japanese American German Korean Chinese Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 60 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 120 | Consumers aged 25-45, First-time Buyers |

| Automotive Industry Experts | 40 | Market Analysts, Automotive Consultants |

| Online Automotive Marketplace Operators | 50 | Platform Managers, Marketing Directors |

| Financial Institutions Offering Auto Loans | 45 | Loan Officers, Risk Assessment Managers |

The United Arab Emirates used car market is valued at approximately USD 18.4 billion. This valuation reflects a five-year historical analysis, indicating significant growth driven by consumer demand, an increasing expatriate population, and the rise of online car sales platforms.