Region:Europe

Author(s):Dev

Product Code:KRAA3534

Pages:89

Published On:September 2025

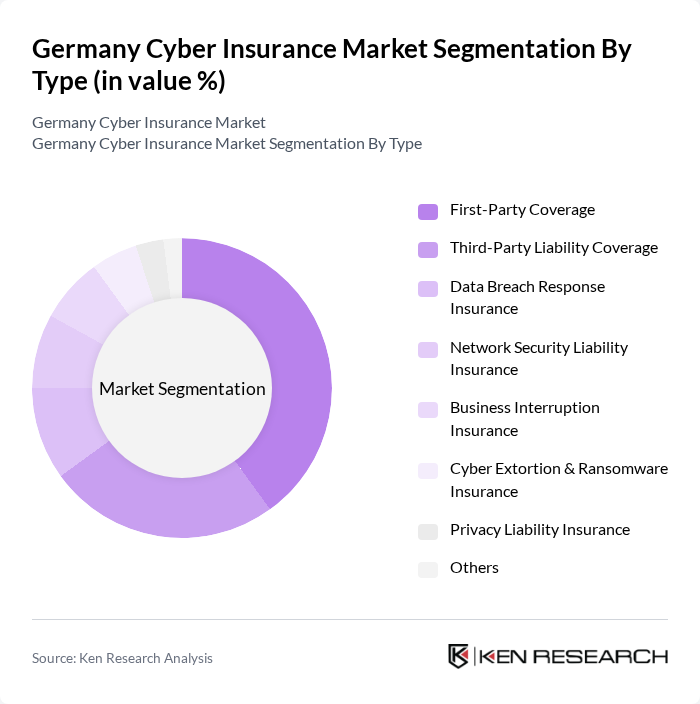

By Type:

The segmentation by type includes various subsegments such as First-Party Coverage, Third-Party Liability Coverage, Data Breach Response Insurance, Network Security Liability Insurance, Business Interruption Insurance, Cyber Extortion & Ransomware Insurance, Privacy Liability Insurance, and Others. Among these,First-Party Coverageis currently dominating the market due to the increasing need for businesses to protect their own assets and data from cyber threats. This type of coverage allows organizations to recover losses directly incurred from cyber incidents, making it a preferred choice for many companies. The growing awareness of the financial repercussions of cyberattacks has led to a surge in demand for this coverage type .

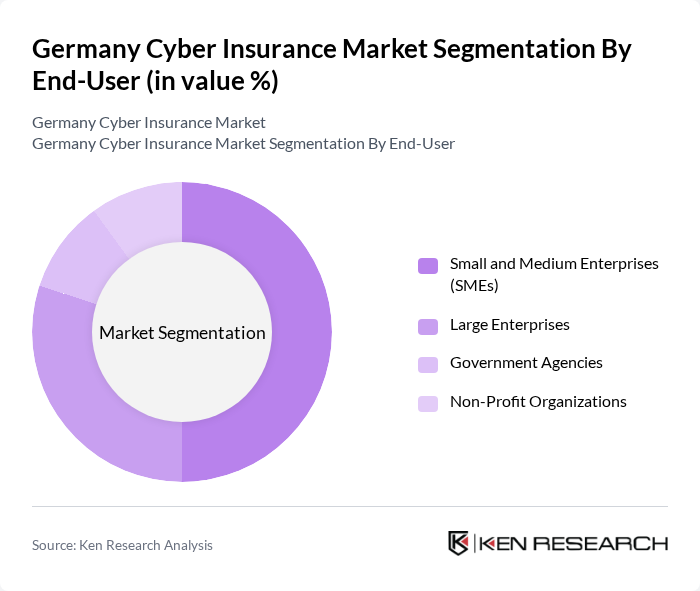

By End-User:

This segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Non-Profit Organizations. TheSmall and Medium Enterprises (SMEs)segment is leading the market, driven by the increasing digitization of operations and the growing recognition of cyber risks among smaller businesses. SMEs are increasingly adopting cyber insurance as a means to protect themselves from potential financial losses due to cyber incidents. The rise in cyber threats, especially ransomware and data breaches, has prompted these organizations to seek affordable insurance solutions tailored to their specific needs .

The Germany Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, Munich Re, AXA Versicherung AG, Zurich Insurance Group, HDI Global SE, Chubb Limited, AIG Europe S.A., Hiscox Ltd., Generali Deutschland AG, ERGO Group AG, QBE Insurance Group, Tokio Marine HCC, Beazley Group, CNA Hardy, Berkshire Hathaway Specialty Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cyber insurance market in Germany appears promising, driven by increasing awareness of cyber risks and the need for comprehensive coverage. As businesses continue to digitize operations, the integration of advanced technologies like AI and machine learning will enhance risk assessment and policy customization. Furthermore, collaboration between insurers and cybersecurity firms is expected to create innovative solutions, ensuring that companies are better equipped to handle evolving cyber threats and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Liability Coverage Data Breach Response Insurance Network Security Liability Insurance Business Interruption Insurance Cyber Extortion & Ransomware Insurance Privacy Liability Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Industry | Financial Services (BFSI) Healthcare Retail & E-commerce Manufacturing Technology & IT Services Telecommunications Energy & Utilities Others |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Standalone (Single-Risk) Coverage Add-on Coverage |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Risk Assessment Methodology | Qualitative Assessment Quantitative Assessment Hybrid Assessment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 60 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Coverage | 50 | IT Security Directors, Insurance Brokers |

| Manufacturing Industry Cyber Risk | 40 | Operations Managers, Cybersecurity Analysts |

| Retail Sector Cyber Insurance Needs | 45 | IT Managers, Business Continuity Planners |

| SME Cyber Insurance Adoption | 40 | Small Business Owners, Financial Advisors |

The Germany Cyber Insurance Market is valued at approximately USD 840 million, reflecting a significant increase driven by the rising frequency of cyberattacks and the growing need for businesses to protect their digital assets.