Region:Asia

Author(s):Dev

Product Code:KRAA3586

Pages:85

Published On:September 2025

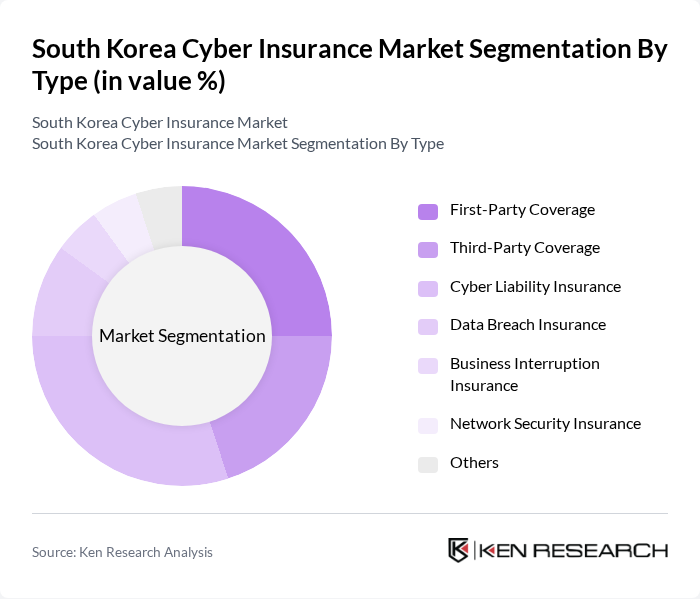

By Type:The market is segmented into various types of coverage, includingFirst-Party Coverage,Third-Party Coverage,Cyber Liability Insurance,Data Breach Insurance,Business Interruption Insurance,Network Security Insurance, andOthers. Each of these subsegments addresses specific needs and risks associated with cyber incidents, catering to different organizational requirements. Insurers are increasingly offering bundled solutions that combine these coverages to address the complex and evolving threat landscape, including ransomware, business email compromise, and regulatory fines.

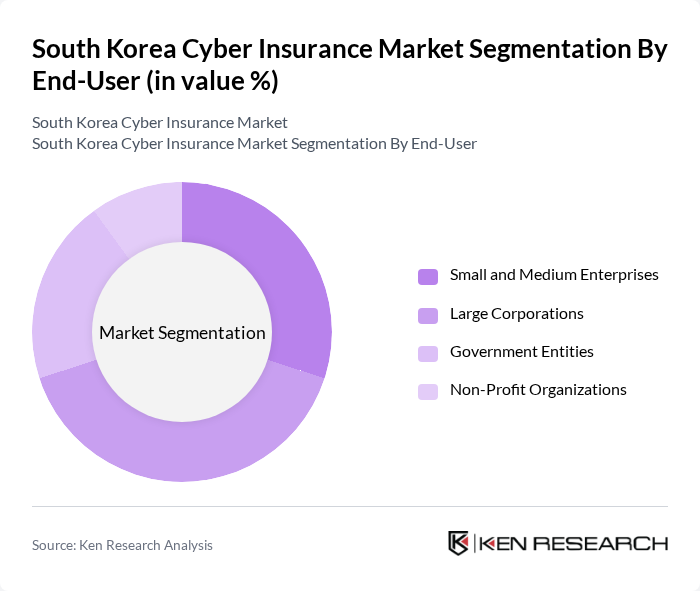

By End-User:The end-user segmentation includesSmall and Medium Enterprises,Large Corporations,Government Entities, andNon-Profit Organizations. Each category has distinct needs for cyber insurance based on their size, operational complexity, and regulatory requirements. Small and medium enterprises are increasingly adopting cyber insurance as targeted attacks and ransomware incidents rise, while large corporations and government entities require broader, more complex coverage due to higher exposure and compliance obligations.

The South Korea Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Fire & Marine Insurance Co., Ltd., Hanwha General Insurance Co., Ltd., DB Insurance Co., Ltd., Meritz Fire & Marine Insurance Co., Ltd., Hyundai Marine & Fire Insurance Co., Ltd., KB Insurance Co., Ltd., Lotte Insurance Co., Ltd., AIG Korea Insurance Co., Ltd., Allianz Global Corporate & Specialty SE, Chubb Limited, AXA Korea, QBE Insurance Group, Tokio Marine & Nichido Fire Insurance Co., Ltd., Zurich Insurance Group, and Generali Group contribute to innovation, geographic expansion, and service delivery in this space. These companies are expanding their cyber insurance portfolios, investing in digital claims management, and collaborating with cybersecurity firms to offer value-added services such as incident response and risk assessment.

The South Korean cyber insurance market is poised for significant evolution as businesses increasingly recognize the importance of comprehensive coverage. With the government enhancing regulatory frameworks and promoting cybersecurity awareness, the market is expected to see a surge in policy adoption. Additionally, the integration of advanced technologies, such as AI for risk assessment, will likely reshape product offerings, making them more accessible and tailored to specific business needs. This dynamic environment will foster innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Cyber Liability Insurance Data Breach Insurance Business Interruption Insurance Network Security Insurance Others |

| By End-User | Small and Medium Enterprises Large Corporations Government Entities Non-Profit Organizations |

| By Industry | Financial Services (BFSI) Healthcare Retail Technology Manufacturing Education Others |

| By Coverage Type | Incident Response Coverage Legal Expenses Coverage Regulatory Fines Coverage Crisis Management Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Pricing Model | Fixed Premium Variable Premium Pay-As-You-Go Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 80 | IT Security Directors, Insurance Underwriters |

| Retail Industry Cyber Insurance Adoption | 70 | Operations Managers, IT Managers |

| Manufacturing Sector Cybersecurity Policies | 50 | Chief Information Officers, Risk Assessment Analysts |

| SME Cyber Insurance Awareness | 60 | Business Owners, Financial Advisors |

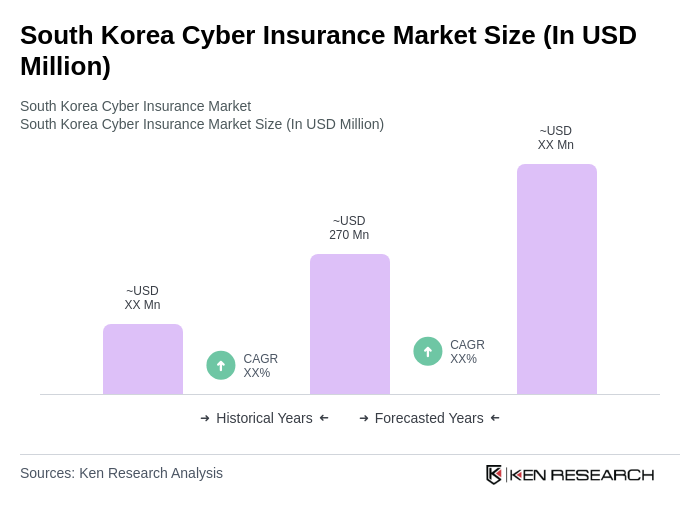

The South Korea Cyber Insurance Market is valued at approximately USD 270 million, reflecting a significant increase driven by the rising frequency of cyberattacks and the growing need for businesses to mitigate financial risks associated with cyber incidents.