Region:Global

Author(s):Dev

Product Code:KRAA3506

Pages:86

Published On:September 2025

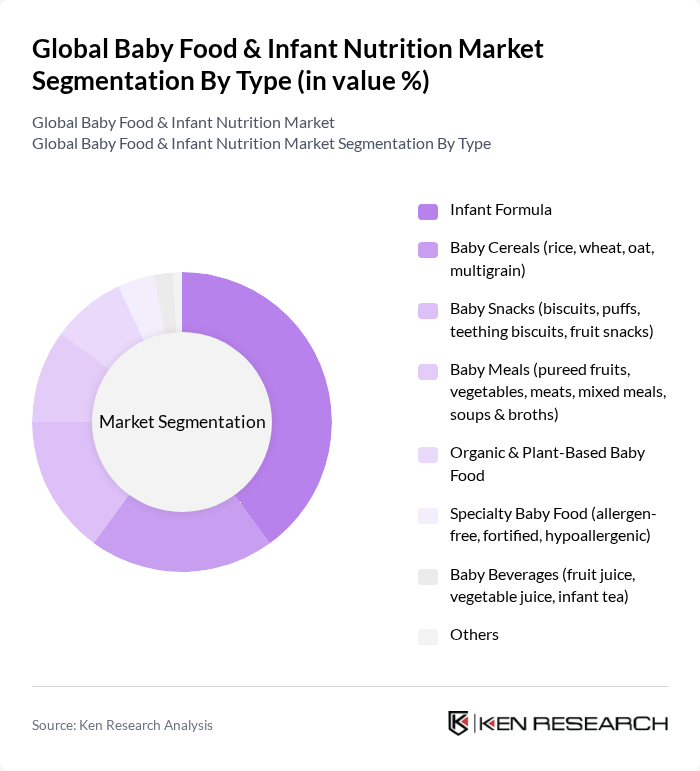

By Type:The market is segmented into Infant Formula, Baby Cereals, Baby Snacks, Baby Meals, Organic & Plant-Based Baby Food, Specialty Baby Food, Baby Beverages, and Others. Infant Formula remains the leading sub-segment, propelled by the increasing number of working mothers and heightened awareness of infant nutrition. Baby Cereals and Organic & Plant-Based Baby Food are gaining traction as parents prioritize healthier, allergen-conscious, and sustainable options for their children .

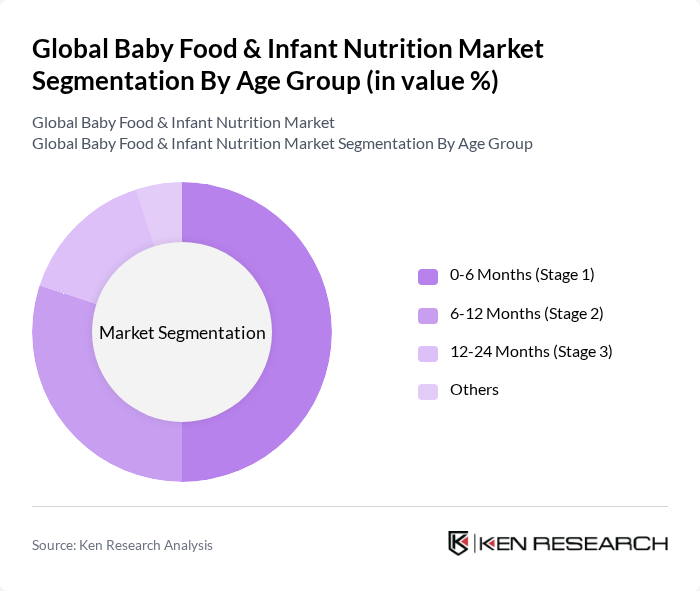

By Age Group:The market is also segmented by age group, including 0-6 Months (Stage 1), 6-12 Months (Stage 2), 12-24 Months (Stage 3), and Others. The 0-6 Months age group is the most significant segment, as infants in this stage rely heavily on formula and specialized baby food. Increased awareness of the importance of nutrition during early infancy continues to drive demand in this category .

The Global Baby Food & Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company (Reckitt Benckiser Group plc), Hero Group, The Hain Celestial Group, Inc., Plum Organics (Campbell Soup Company), Beech-Nut Nutrition Company, Earth's Best Organic (The Hain Celestial Group, Inc.), Happy Family Organics (Danone S.A.), Gerber Products Company (Nestlé S.A.), Sprout Organic Foods, Inc., Yumi, Little Spoon, Bellamy’s Organic, Feihe International Inc., FrieslandCampina, HiPP GmbH & Co. Vertrieb KG, Perrigo Company plc, Arla Foods amba, Kraft Heinz Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby food and infant nutrition market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek convenience and quality, the market is likely to see a rise in innovative product offerings, including plant-based and personalized nutrition options. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse products, enabling brands to reach a broader audience and adapt to changing consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Infant Formula Baby Cereals (rice, wheat, oat, multigrain) Baby Snacks (biscuits, puffs, teething biscuits, fruit snacks) Baby Meals (pureed fruits, vegetables, meats, mixed meals, soups & broths) Organic & Plant-Based Baby Food Specialty Baby Food (allergen-free, fortified, hypoallergenic) Baby Beverages (fruit juice, vegetable juice, infant tea) Others |

| By Age Group | 6 Months (Stage 1) 12 Months (Stage 2) 24 Months (Stage 3) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Specialty Stores Pharmacies/Drugstores Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans Boxes/Cartons Others |

| By Nutritional Content | High Protein Low Sugar Fortified (with vitamins, minerals, DHA, etc.) Allergen-Free Others |

| By Brand Type | National Brands Private Labels Store Brands Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infant Formula Purchasers | 120 | Parents of infants aged 0-12 months |

| Organic Baby Food Consumers | 90 | Health-conscious parents and caregivers |

| Retail Buyers of Baby Food | 60 | Category Managers and Buyers from supermarkets |

| Pediatric Healthcare Professionals | 50 | Pediatricians and Nutritionists |

| Market Analysts in Infant Nutrition | 40 | Industry Analysts and Researchers |

The Global Baby Food & Infant Nutrition Market is valued at approximately USD 71 billion, driven by increasing parental awareness of infant nutrition, a rise in working mothers, and higher disposable incomes allowing for greater spending on premium baby food products.