Region:Asia

Author(s):Geetanshi

Product Code:KRAA3314

Pages:90

Published On:September 2025

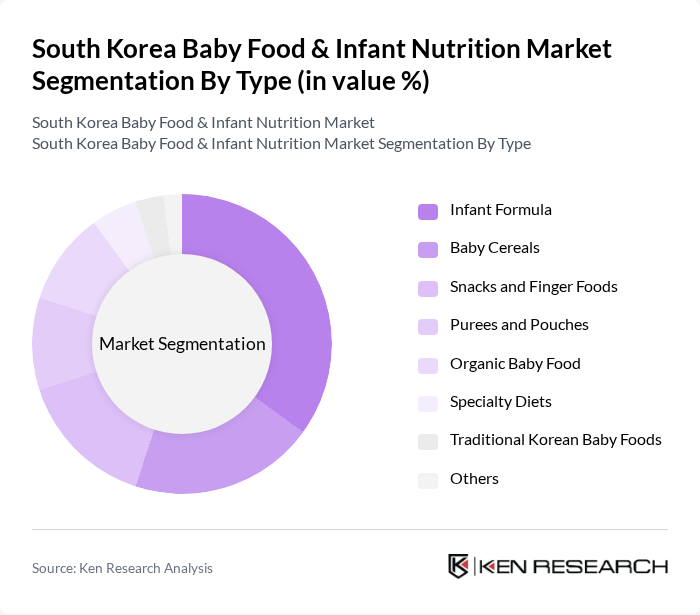

By Type:The market is segmented into various types of baby food products, including Infant Formula, Baby Cereals, Snacks and Finger Foods, Purees and Pouches, Organic Baby Food, Specialty Diets, Traditional Korean Baby Foods, and Others. Among these,Infant Formularemains the leading sub-segment, driven by the increasing number of working mothers and heightened awareness of infant nutrition. The demand for organic and specialty diets is also on the rise, reflecting a trend toward healthier and more tailored nutrition options for infants. The market is further influenced by the introduction of allergen-free and gluten-free baby food products, as well as the popularity of clean-label and minimally processed offerings .

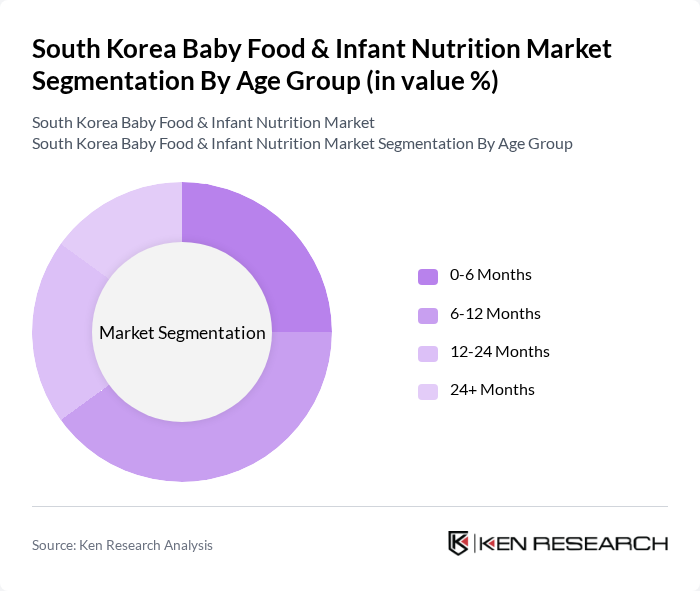

By Age Group:The market is segmented by age groups, including 0-6 Months, 6-12 Months, 12-24 Months, and 24+ Months. The6-12 Monthsage group dominates the market, as this is a critical period for introducing solid foods to infants. Parents are increasingly seeking nutritious and convenient options for their babies during this stage, leading to a higher demand for baby food products tailored to this age group. The trend is reinforced by pediatric recommendations and the growing availability of age-specific formulations .

The South Korea Baby Food & Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maeil Dairies Co., Ltd., Namyang Dairy Products Co., Ltd., Seoul Milk Cooperative (Seoul Dairy Cooperative), Ildong Foodis Co., Ltd., Lotte Foods Co., Ltd., Binggrae Co., Ltd., Maeil Health Nutrition Co., Ltd., Nestlé Korea Ltd., Danone Korea Co., Ltd., Abbott Korea Ltd., Mead Johnson Nutrition Korea Ltd., Hero Group (Hero Baby), Bellamy's Organic, Plum Organics, Happy Family Organics contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean baby food market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As parents increasingly seek transparency in product sourcing and sustainability, brands that prioritize eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of digital platforms for marketing and sales will enhance accessibility, allowing companies to reach a broader audience. The focus on personalized nutrition solutions will also shape product development, catering to the unique dietary needs of infants and toddlers.

| Segment | Sub-Segments |

|---|---|

| By Type | Infant Formula Baby Cereals Snacks and Finger Foods Purees and Pouches Organic Baby Food Specialty Diets (e.g., lactose-free, hypoallergenic, soy-based, gluten-free) Traditional Korean Baby Foods (e.g., juk/porridge, rice-based meals) Others |

| By Age Group | 6 Months 12 Months 24 Months + Months |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Pharmacies/Drugstores Baby Specialty Stores Convenience Stores Direct Sales Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans/Tins Boxes/Cartons Others |

| By Brand Type | Domestic Brands International Brands Organic Brands Premium Brands Private Labels |

| By Nutritional Content | High Protein Fortified with Vitamins & Minerals Low Sugar/No Added Sugar Probiotic/Prebiotic Enriched DHA/ARA Enriched Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parents of Infants (0-12 months) | 120 | New Parents, Expecting Parents |

| Pediatric Nutritionists | 40 | Healthcare Professionals, Dietitians |

| Retail Buyers from Supermarkets | 60 | Category Managers, Purchasing Agents |

| Online Retailers of Baby Food | 50 | E-commerce Managers, Product Managers |

| Focus Group Participants (Caregivers) | 40 | Caregivers, Childcare Providers |

The South Korea Baby Food & Infant Nutrition Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increased awareness of infant nutrition and rising disposable incomes among families.