Region:Asia

Author(s):Rebecca

Product Code:KRAA3332

Pages:95

Published On:September 2025

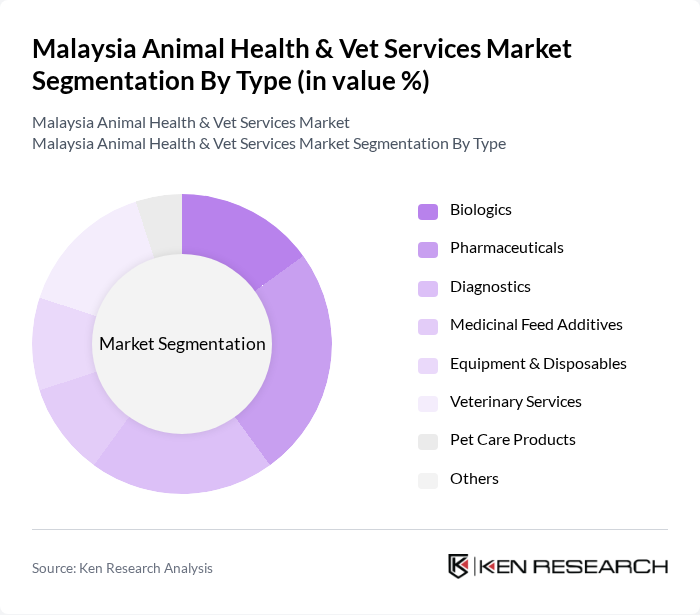

By Type:The market is segmented into various types, including Biologics, Pharmaceuticals, Diagnostics, Medicinal Feed Additives, Equipment & Disposables, Veterinary Services, Pet Care Products, and Others. Each of these subsegments plays a crucial role in addressing the diverse needs of animal health and welfare.

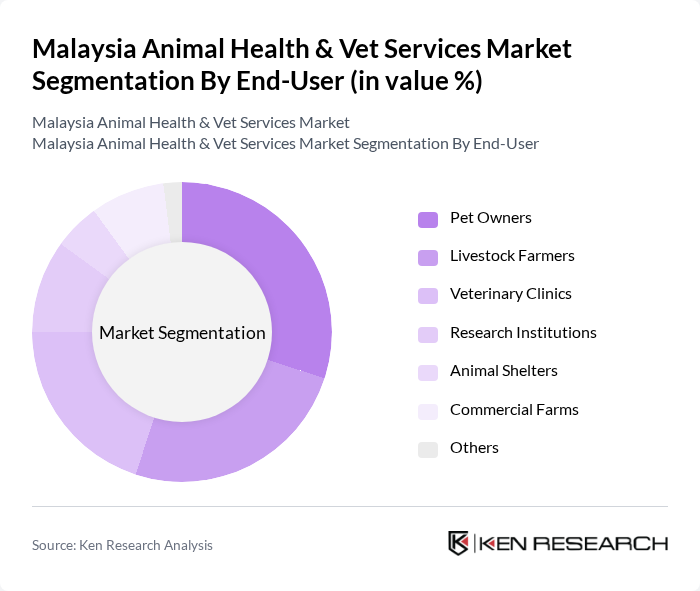

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Research Institutions, Animal Shelters, Commercial Farms, and Others. Each segment reflects the diverse consumer base and their specific requirements for animal health services and products.

The Malaysia Animal Health & Vet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Malaysia Sdn Bhd, Merck Animal Health (MSD Animal Health Malaysia), Elanco Animal Health Malaysia, Boehringer Ingelheim Malaysia, Vetoquinol Malaysia Sdn Bhd, Ceva Animal Health Malaysia, Virbac Malaysia Sdn Bhd, IDEXX Laboratories Malaysia, Alltech Malaysia, Neogen Corporation Malaysia, Bayer Animal Health (now part of Elanco), Pharmaniaga Animal Health Sdn Bhd, Agrovet Market Animal Health, Vetopia Sdn Bhd, Pet World Nutritions Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia Animal Health & Vet Services market appears promising, driven by increasing pet ownership and a growing emphasis on preventive care. The integration of technology, such as telemedicine, is expected to enhance service delivery, making veterinary care more accessible. Additionally, the rising demand for organic pet food and wellness products will likely shape market dynamics, encouraging innovation and specialization within the veterinary sector, ultimately benefiting both pets and their owners.

| Segment | Sub-Segments |

|---|---|

| By Type | Biologics Pharmaceuticals Diagnostics Medicinal Feed Additives Equipment & Disposables Veterinary Services Pet Care Products Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Animal Shelters Commercial Farms Others |

| By Service Type | Preventive Care Surgical Services Emergency Care Diagnostic Services Rehabilitation Services Telemedicine Services Others |

| By Distribution Channel | Online Retail Veterinary Clinics Pharmacies Direct Sales Agricultural Cooperatives Others |

| By Product Category | Prescription Products Over-the-Counter Products Nutraceuticals Vaccines Supplements Others |

| By Animal Type | Companion Animals (Dogs, Cats, Small Mammals, Birds) Livestock (Cattle, Poultry, Swine, Goats, Sheep) Aquatic Animals (Fish, Shrimp) Horses Exotic Animals Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Livestock Farmers | 50 | Farm Owners, Animal Husbandry Specialists |

| Pet Owners | 100 | Pet Owners, Animal Welfare Advocates |

| Animal Health Product Distributors | 40 | Sales Managers, Distribution Coordinators |

| Veterinary Pharmaceutical Companies | 40 | Product Managers, Regulatory Affairs Specialists |

The Malaysia Animal Health & Vet Services Market is valued at approximately USD 450 million, reflecting significant growth driven by increasing pet ownership, heightened awareness of animal health, and an expanding livestock sector.