Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3324

Pages:92

Published On:September 2025

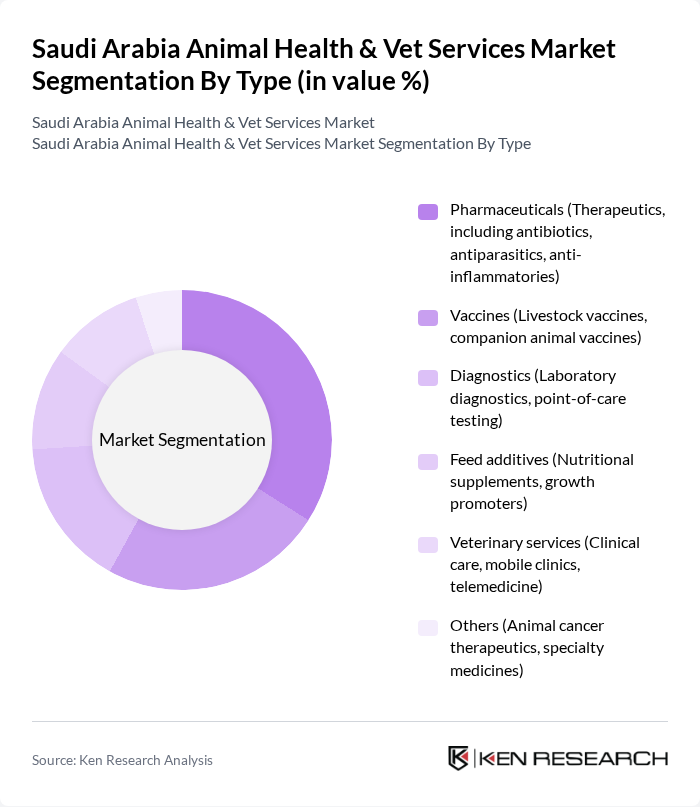

By Type:The market can be segmented into pharmaceuticals, vaccines, diagnostics, feed additives, veterinary services, and others. Each of these segments plays a crucial role in ensuring the health and well-being of animals. Pharmaceuticals remain the largest segment, while diagnostics is the fastest-growing due to increased adoption of digital and point-of-care technologies .

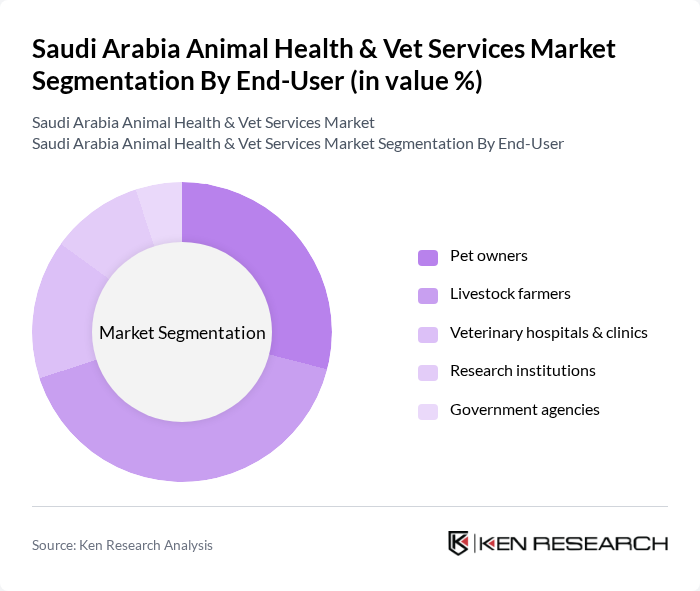

By End-User:The end-users of the market include pet owners, livestock farmers, veterinary hospitals and clinics, research institutions, and government agencies. Each of these segments has unique needs and contributes to the overall demand for animal health products and services. Livestock farmers constitute the largest share, reflecting the country’s focus on food security and livestock productivity .

The Saudi Arabia Animal Health & Vet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Vetoquinol S.A., Virbac S.A., IDEXX Laboratories, Inc., Neogen Corporation, Phibro Animal Health Corporation, Alltech, Inc., Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Al-Watania Veterinary, Almarai Company, National Veterinary Care Company (NVCC), Al Hokair Group (Vet Division), Al-Dawaa Pharmacies (Veterinary Division), Al Safwa Veterinary Clinic, Riyadh Veterinary Hospital, PetCare Veterinary Clinic, and Jeddah Veterinary Clinic contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia animal health and veterinary services market appears promising, driven by increasing pet ownership and livestock production. The integration of technology in veterinary practices, such as telemedicine and e-commerce, is expected to enhance service delivery and accessibility. Additionally, the growing focus on preventive healthcare will likely lead to increased spending on veterinary services, fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals (Therapeutics, including antibiotics, antiparasitics, anti-inflammatories) Vaccines (Livestock vaccines, companion animal vaccines) Diagnostics (Laboratory diagnostics, point-of-care testing) Feed additives (Nutritional supplements, growth promoters) Veterinary services (Clinical care, mobile clinics, telemedicine) Others (Animal cancer therapeutics, specialty medicines) |

| By End-User | Pet owners Livestock farmers Veterinary hospitals & clinics Research institutions Government agencies |

| By Animal Type | Companion animals (dogs, cats, horses) Production animals (cattle, sheep, goats, poultry, camels) Aquatic animals (fish, shrimp) |

| By Distribution Channel | Online retail Veterinary hospitals & clinics Pharmacies Direct sales Retail stores |

| By Service Type | Preventive care (vaccination, wellness checks) Surgical services Emergency care Specialty services (oncology, dermatology, orthopedics) |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Al Khobar) Western Region (Jeddah, Makkah, Madinah) Southern Region (Abha, Jizan) |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 90 | Veterinarians, Clinic Managers |

| Livestock Farmers | 60 | Farm Owners, Animal Husbandry Specialists |

| Pet Owners | 100 | Pet Owners, Animal Caretakers |

| Animal Health Product Distributors | 50 | Sales Managers, Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Officers |

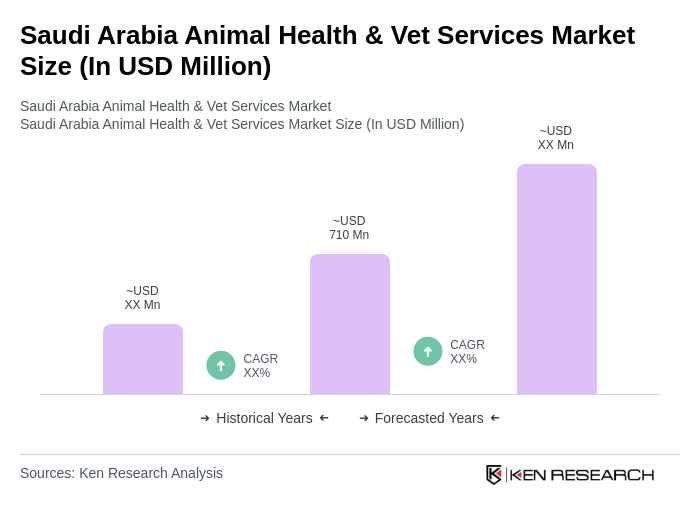

The Saudi Arabia Animal Health & Vet Services Market is valued at approximately USD 710 million, reflecting a significant growth driven by increasing pet ownership, livestock production, and advancements in veterinary technology.