Region:Central and South America

Author(s):Dev

Product Code:KRAA3520

Pages:81

Published On:September 2025

By Type:The mattress market is segmented into various types, including innerspring, memory foam, latex, hybrid, adjustable, organic, and others. Among these, innerspring mattresses currently hold the largest revenue share, favored for their durability and affordability, while memory foam mattresses are rapidly gaining popularity due to their superior comfort and support features. Hybrid mattresses are increasingly sought after for their combination of materials and advanced features. The demand for organic and eco-friendly mattresses is rising as consumers become more health-conscious and environmentally aware. Technological advancements have also introduced smart mattresses with integrated sensors for sleep tracking and temperature regulation .

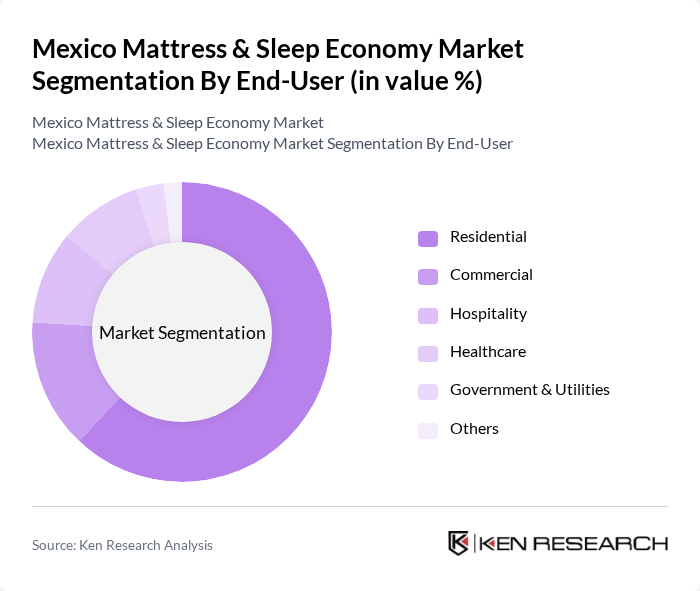

By End-User:The end-user segmentation includes residential, commercial, hospitality, healthcare, government & utilities, and others. The residential segment dominates the market, driven by rising consumer spending on home furnishings, a growing focus on sleep quality, and increased real estate activity. The hospitality sector is also significant, as hotels and resorts invest in high-quality mattresses to enhance guest experiences and meet international standards. The healthcare segment is expanding, with increasing demand for specialized mattresses designed for patient care, pressure relief, and infection control in hospitals and clinics. Commercial and institutional buyers, including government and utilities, contribute to steady demand through bulk procurement for dormitories and staff housing .

The Mexico Mattress & Sleep Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colchones América, Spring Air México, Grupo Concord, Sealy México, Serta México, Restonic México, Tempur Sealy International, Inc., Dormimundo, Luuna, Emma Sleep, Zinus, Inc., IKEA México, América Suavestar, Dorme, Boxi Sleep contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico mattress market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As more consumers prioritize sleep quality, the demand for innovative sleep solutions, including smart mattresses, is expected to rise. Additionally, the integration of eco-friendly materials will likely become a key differentiator in product offerings. The expansion of e-commerce platforms will further facilitate access to diverse mattress options, enhancing consumer choice and convenience in the purchasing process.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Organic Mattresses Others |

| By End-User | Residential Commercial Hospitality Healthcare Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Foam Fabric Metal Wood Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Budget Brands Private Labels |

| By Customer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 120 | Homeowners, Renters aged 25-55 |

| Retail Mattress Sales Insights | 60 | Store Managers, Sales Associates |

| Health and Sleep Expert Opinions | 40 | Sleep Specialists, Chiropractors |

| Online Mattress Shopping Behavior | 50 | eCommerce Managers, Digital Marketing Specialists |

| Trends in Sleep Accessories | 45 | Product Designers, Retail Buyers |

The Mexico Mattress & Sleep Economy Market is valued at approximately USD 1.0 billion, driven by factors such as increasing consumer awareness of sleep health, rising disposable incomes, and a growing preference for premium sleep products.