Region:Middle East

Author(s):Shubham

Product Code:KRAA3619

Pages:92

Published On:September 2025

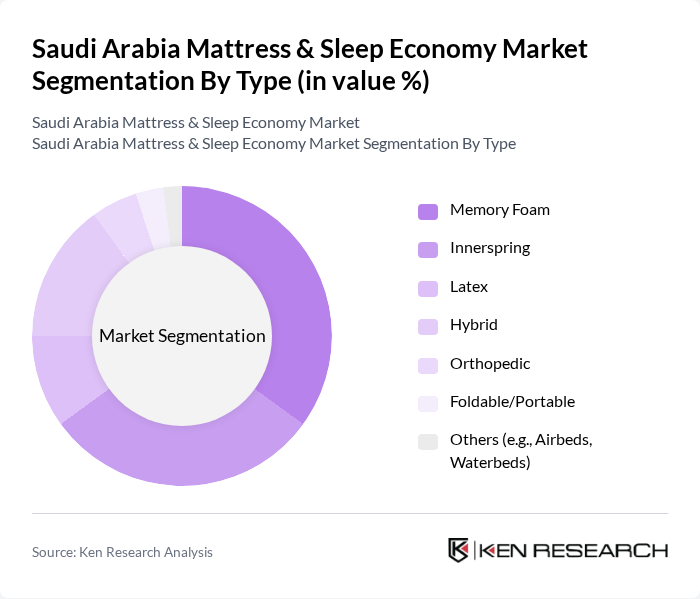

By Type:The mattress market is segmented into various types, including Memory Foam, Innerspring, Latex, Hybrid, Orthopedic, Foldable/Portable, and Others (e.g., Airbeds, Waterbeds). Among these, Memory Foam mattresses are gaining popularity due to their comfort and support, particularly among consumers seeking relief from back pain. Innerspring mattresses remain a traditional choice, favored for their affordability and availability. The Hybrid segment is also witnessing growth as it combines the benefits of both foam and innerspring technologies, appealing to a broader audience .

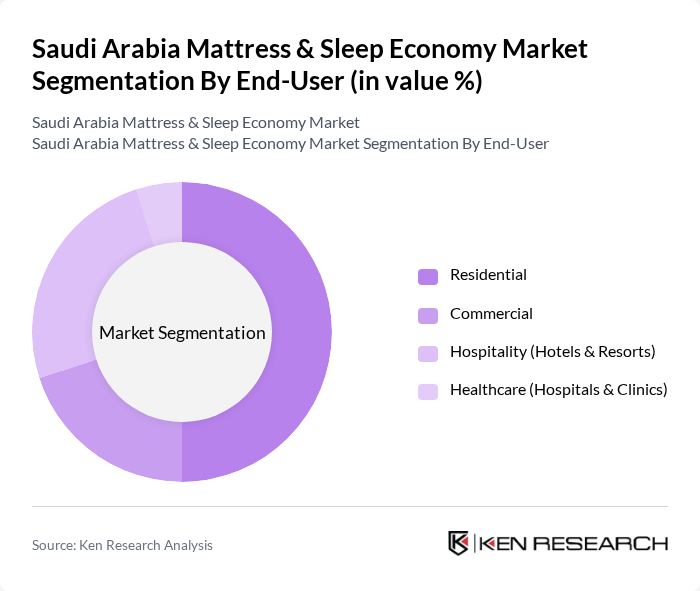

By End-User:The mattress market is segmented by end-user into Residential, Commercial, Hospitality (Hotels & Resorts), and Healthcare (Hospitals & Clinics). The Residential segment dominates the market, driven by increasing consumer spending on home furnishings and a growing focus on sleep quality. The Hospitality sector is also significant, as hotels and resorts invest in high-quality mattresses to enhance guest experiences. The Healthcare segment is emerging, with hospitals seeking specialized mattresses for patient comfort and support .

The Saudi Arabia Mattress & Sleep Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nahda International, Sleep High, IKEA Saudi Arabia, King Koil, Sealy, Tempur, Serta, Restonic, Dunlopillo, Zinus, Sleepnice, Al Rajhi Group, Simmons, Emma – The Sleep Company, Silentnight Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi mattress market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As awareness of sleep health continues to rise, manufacturers are likely to focus on innovative products that integrate sleep technology, enhancing comfort and support. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, catering to the growing demand for convenience and personalized shopping experiences in the mattress sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Memory Foam Innerspring Latex Hybrid Orthopedic Foldable/Portable Others (e.g., Airbeds, Waterbeds) |

| By End-User | Residential Commercial Hospitality (Hotels & Resorts) Healthcare (Hospitals & Clinics) |

| By Distribution Channel | Online Retail/E-commerce Offline Retail (Showrooms, Specialty Stores) Direct Sales (B2B, Institutional) Wholesale/Distributors |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Material | Natural Materials (Latex, Cotton, Wool) Synthetic Materials (PU Foam, Memory Foam, Polyester) |

| By Brand Positioning | Luxury Value-for-Money Economy |

| By Customer Demographics | Age Group Income Level Lifestyle Preferences |

| By Region | Western (Jeddah, Mecca, Medina) Central (Riyadh) Eastern (Dammam, Khobar) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 100 | Homeowners, Renters aged 25-55 |

| Retail Mattress Sales Insights | 60 | Store Managers, Sales Representatives |

| Health and Sleep Quality Perspectives | 40 | Sleep Specialists, Health Practitioners |

| Online Shopping Behavior | 80 | Frequent Online Shoppers, E-commerce Users |

| Market Trends and Innovations | 50 | Product Developers, Industry Analysts |

The Saudi Arabia Mattress & Sleep Economy Market is valued at approximately USD 720 million, reflecting a significant growth driven by increased consumer awareness of sleep health, rising disposable incomes, and a booming hospitality sector demanding quality bedding solutions.