Philippines Digital Banking and Open Finance Market Overview

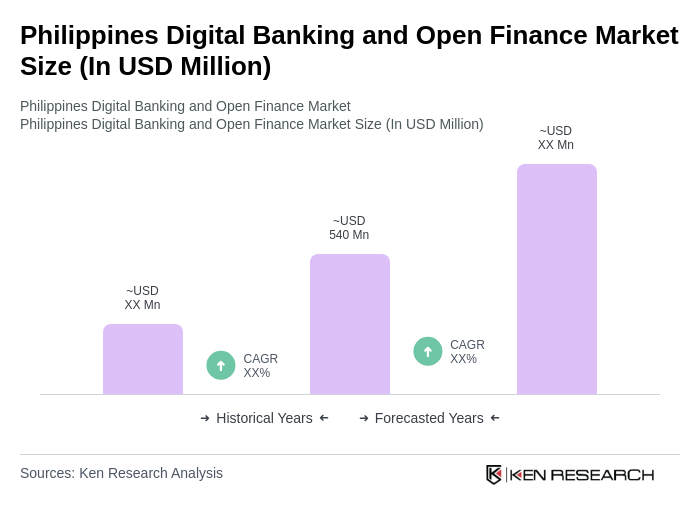

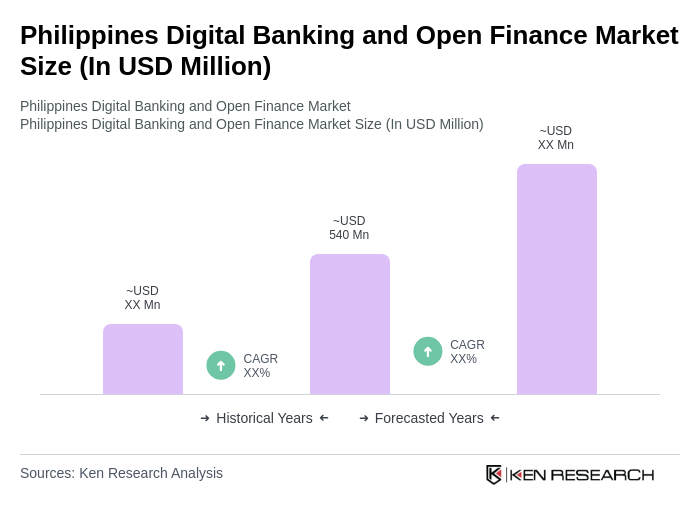

- The Philippines Digital Banking and Open Finance Market is valued at USD 540 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, fueled by a surge in smartphone penetration, improved internet connectivity, and favorable government fintech policies. The rise of fintech companies, the proliferation of digital wallets, and the shift towards cashless transactions have significantly contributed to the market's expansion, alongside strong investments in artificial intelligence and cloud-native platforms .

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Digital Banking and Open Finance Market. Metro Manila, as the capital, serves as the financial hub with a high concentration of banks and fintech startups. Cebu and Davao are emerging as key players due to their growing urbanization, rising local business activity, and increasing digital literacy among the population, making them attractive markets for digital banking services .

- In 2023, the Bangko Sentral ng Pilipinas (BSP) implemented the Digital Payments Transformation Roadmap 2020–2023, aiming to increase digital payments to 50% of total transactions by 2023. This regulatory framework, issued by the Bangko Sentral ng Pilipinas, mandates financial institutions to adopt robust digital payment systems, enhance cybersecurity, and promote interoperability among digital platforms, thereby fostering a more inclusive and resilient financial ecosystem in the Philippines .

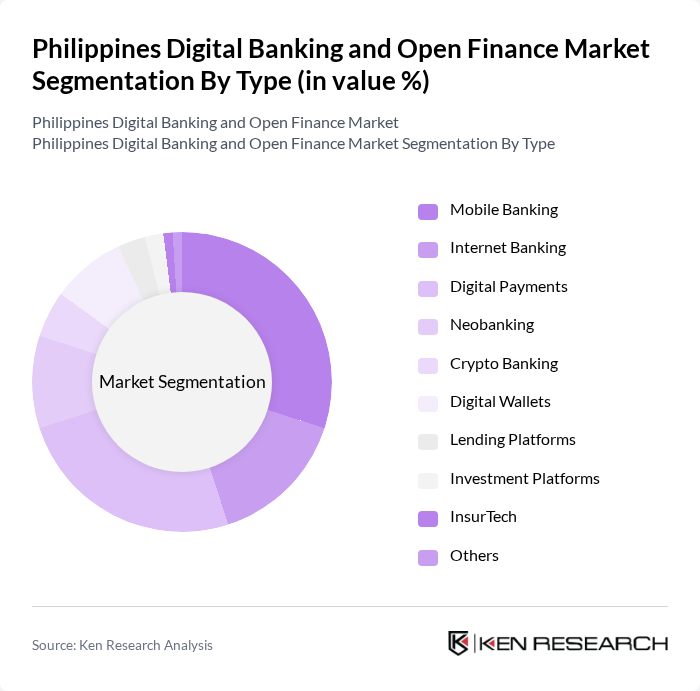

Philippines Digital Banking and Open Finance Market Segmentation

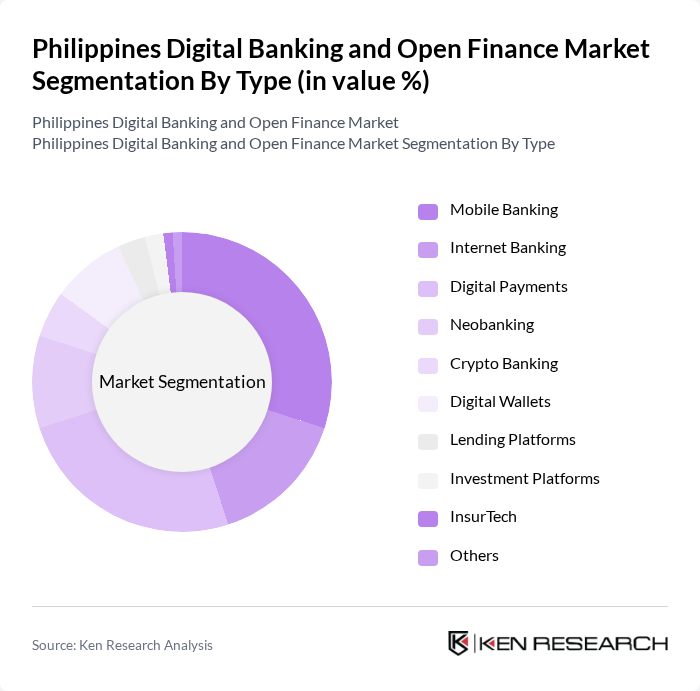

By Type:The market is segmented into various types, including Mobile Banking, Internet Banking, Digital Payments, Neobanking, Crypto Banking, Digital Wallets, Lending Platforms, Investment Platforms, InsurTech, and Others. Each of these segments caters to different consumer needs and preferences, with Mobile Banking and Digital Payments being particularly dominant due to their convenience, accessibility, and the widespread use of smartphones and e-wallets for everyday transactions .

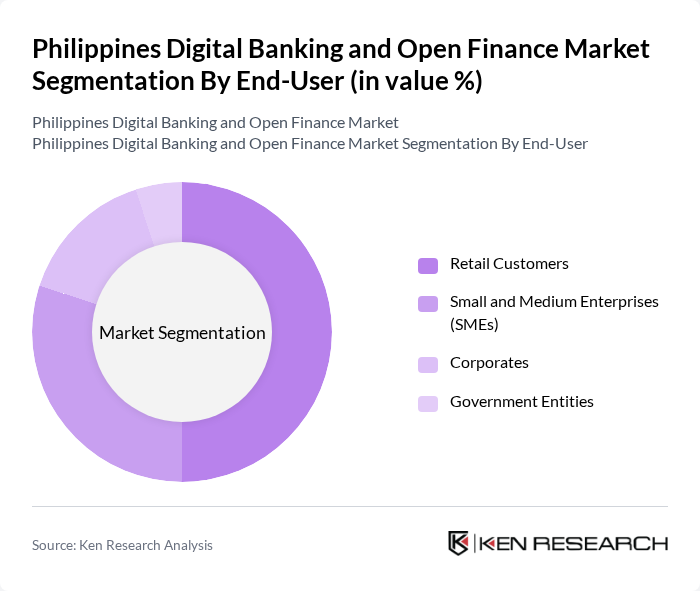

By End-User:The market is segmented by end-users, including Retail Customers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Retail Customers dominate the market due to the increasing adoption of digital banking solutions for personal finance management, while SMEs are rapidly embracing digital platforms for operational efficiency and access to financial services. The introduction of user-friendly apps and the ease of managing finances through mobile platforms have accelerated digital adoption among these groups .

Philippines Digital Banking and Open Finance Market Competitive Landscape

The Philippines Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Unibank, Inc., Bank of the Philippine Islands (BPI), Metrobank, Union Bank of the Philippines, RCBC (Rizal Commercial Banking Corporation), Security Bank Corporation, EastWest Banking Corporation, Maya Bank, GCash, GrabPay, Coins.ph, Tonik Digital Bank, Philippine National Bank (PNB), UnionDigital Bank, ING Bank N.V., GoTyme Bank, Overseas Filipino Bank, Land Bank of the Philippines, UNO Digital Bank contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Digital Banking and Open Finance Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:The Philippines has seen smartphone penetration reach approximately76%in future, with over83 million users. This surge in mobile device usage facilitates access to digital banking services, enabling consumers to perform transactions conveniently. The World Bank reports that mobile internet subscriptions have increased by15% annually, indicating a strong trend towards mobile banking adoption. This growth is crucial for digital banking, as it allows financial institutions to reach previously underserved populations effectively.

- Rising Demand for Financial Inclusion:As of in future, around44% of Filipino adults remain unbanked, highlighting a significant opportunity for digital banking solutions. The government aims to increase financial inclusion, with the Bangko Sentral ng Pilipinas (BSP) reporting that digital finance can potentially addUSD 12 billionto the economy by improving access to financial services, thus driving growth in the digital banking sector.

- Government Initiatives Promoting Digital Finance:The Philippine government has implemented the Digital Payments Transformation Roadmap, aiming for50% of all transactions to be digital in future. This initiative is supported by the BSP, which has allocated approximatelyUSD 200 millionfor infrastructure development. Additionally, the government is fostering partnerships with fintech companies to enhance service delivery. These efforts are expected to significantly boost the digital banking landscape, encouraging innovation and competition in the sector.

Market Challenges

- Cybersecurity Threats:The rise of digital banking in the Philippines has led to increased cybersecurity threats, with reported incidents rising byup to 50% in recent years. The Philippine National Police Cybercrime Group noted that financial institutions are prime targets for cybercriminals, leading to potential losses exceedingUSD 1 billion annually. This challenge necessitates robust security measures and consumer education to mitigate risks and build trust in digital banking platforms.

- Regulatory Compliance Complexities:Navigating the regulatory landscape poses significant challenges for digital banks in the Philippines. Compliance with the Anti-Money Laundering Act and data privacy regulations requires substantial investment in legal and operational frameworks. The BSP has issuedover 50 regulatory guidelines in recent years, creating a complex environment for new entrants. This complexity can hinder innovation and slow down the growth of digital banking services in the region.

Philippines Digital Banking and Open Finance Market Future Outlook

The future of digital banking in the Philippines appears promising, driven by technological advancements and a growing consumer base eager for financial services. As smartphone penetration continues to rise, more Filipinos will access banking services digitally. Additionally, the government's commitment to enhancing financial inclusion will likely lead to increased investment in fintech solutions. The focus on improving customer experience and security will be paramount, ensuring that digital banking becomes a trusted and integral part of everyday financial transactions for Filipinos.

Market Opportunities

- Expansion of Digital Payment Solutions:With the government targeting a50% digital transaction rate in future, there is a significant opportunity for digital payment solutions. The market for e-wallets and mobile payment platforms is projected to grow, driven by consumer demand for convenience and security. This expansion can enhance financial accessibility for millions of Filipinos, fostering economic growth.

- Partnerships with Fintech Companies:Collaborations between traditional banks and fintech firms can lead to innovative financial products tailored to local needs. By leveraging technology, banks can enhance service delivery and customer engagement. The BSP's supportive regulatory framework encourages such partnerships, creating a fertile ground for innovation and improved financial services in the digital banking sector.