Region:Asia

Author(s):Shubham

Product Code:KRAA3625

Pages:100

Published On:September 2025

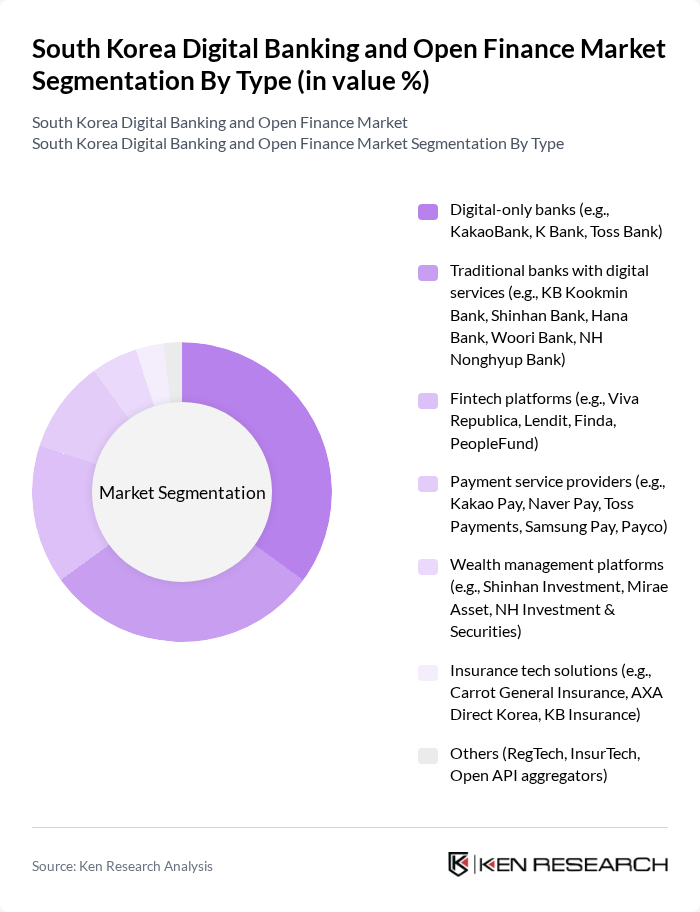

By Type:The market is segmented into digital-only banks, traditional banks with digital services, fintech platforms, payment service providers, wealth management platforms, insurance tech solutions, and others. Digital-only banks are expanding rapidly due to their intuitive mobile interfaces and lower operational costs, while traditional banks are accelerating digital transformation to retain and attract customers. Fintech platforms are increasingly significant, offering specialized solutions such as peer-to-peer lending, robo-advisory, and alternative credit scoring .

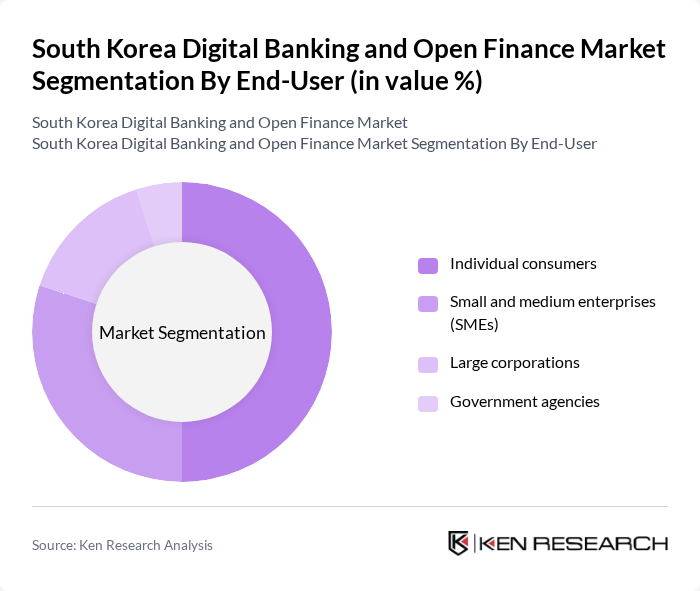

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies. Individual consumers constitute the largest segment, propelled by high smartphone penetration and widespread use of mobile banking and payment apps. SMEs are increasingly utilizing digital banking to streamline cash flow and access credit, while large corporations leverage advanced digital solutions for operational efficiency .

The South Korea Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as KB Kookmin Bank, Shinhan Bank, Woori Bank, Hana Bank, KEB Hana Bank, Toss Bank, KakaoBank, NH Nonghyup Bank, Samsung Card, Lendit, Viva Republica, Payco, Naver Financial, DGB Financial Group, BNK Financial Group, K Bank, Kakao Pay, Naver Pay, Finda, PeopleFund, Carrot General Insurance, Mirae Asset, NH Investment & Securities, AXA Direct Korea, KB Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean digital banking and open finance market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning technologies become more integrated into banking services, institutions will enhance personalization and efficiency. Additionally, the increasing focus on sustainability will shape product offerings, aligning with global trends. The collaboration between banks and fintechs will further innovate service delivery, ensuring that the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks (e.g., KakaoBank, K Bank, Toss Bank) Traditional banks with digital services (e.g., KB Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank, NH Nonghyup Bank) Fintech platforms (e.g., Viva Republica, Lendit, Finda, PeopleFund) Payment service providers (e.g., Kakao Pay, Naver Pay, Toss Payments, Samsung Pay, Payco) Wealth management platforms (e.g., Shinhan Investment, Mirae Asset, NH Investment & Securities) Insurance tech solutions (e.g., Carrot General Insurance, AXA Direct Korea, KB Insurance) Others (RegTech, InsurTech, Open API aggregators) |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Large corporations Government agencies |

| By Application | Personal banking Business banking Investment services Payment processing |

| By Distribution Channel | Mobile applications Web platforms Third-party integrations Direct sales |

| By Customer Segment | Retail customers Corporate clients High-net-worth individuals |

| By Service Type | Savings accounts Loans and credit Investment products Insurance products |

| By Policy Support | Government subsidies for fintech innovation Tax incentives for digital banking Regulatory support for open finance initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking Users | 120 | Retail Banking Customers, Mobile Banking Users |

| Fintech Service Providers | 60 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Analysts | 50 | Market Researchers, Financial Analysts |

| Small Business Owners | 45 | Entrepreneurs, Financial Decision Makers |

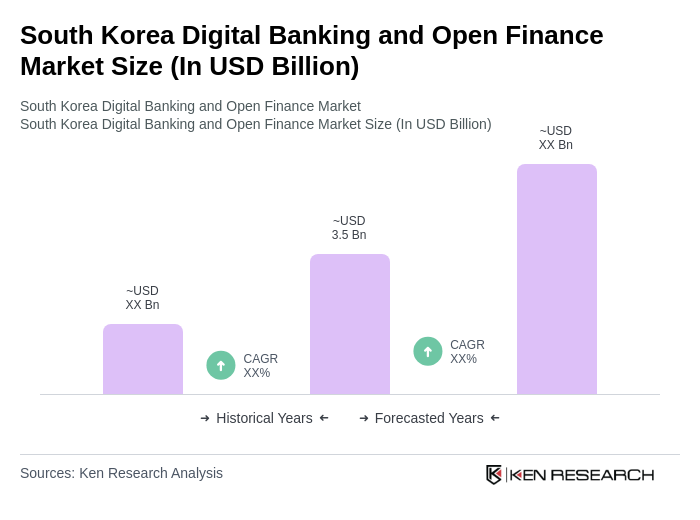

The South Korea Digital Banking and Open Finance Market is valued at approximately USD 3.5 billion, driven by the rapid adoption of digital payment solutions and a strong consumer demand for mobile-first financial services.