Qatar Furniture and Interiors Market Overview

- The Qatar Furniture and Interiors Market is valued at USD 1.4 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, a robust real estate sector, a growing expatriate population, and rising disposable incomes among consumers. Additional growth drivers include the expansion of tourism offerings, such as cruise and sports tourism, and the development of new residential and commercial projects. The demand for both residential and commercial furniture has surged, reflecting a shift towards modern, multifunctional, and stylish interior designs, as well as a rising interest in sustainable and eco-friendly furniture options .

- Doha is the dominant city in the Qatar Furniture and Interiors Market, attributed to its rapid urban development, infrastructure investments, and a growing expatriate population. The city serves as a hub for luxury and contemporary furniture brands, catering to both local and international consumers. Other notable areas include Al Rayyan and Al Wakrah, which are also experiencing significant growth in the furniture sector due to ongoing construction and real estate projects .

- The “Qatar Construction Specifications (QCS) 2014” issued by the Ministry of Municipality and Environment, along with the National Green Building Certification System, establishes binding requirements for sustainable practices in the construction and interiors sector. These regulations mandate the use of eco-friendly materials, energy-efficient designs, and compliance with green building standards for all major projects, including furniture manufacturing and fit-outs. The regulatory framework is part of Qatar's broader strategy to enhance environmental sustainability and reduce carbon footprints across sectors .

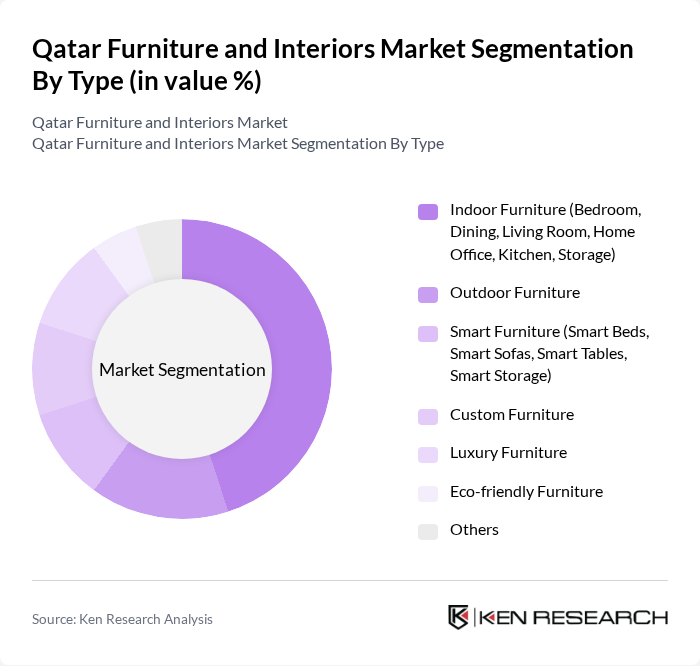

Qatar Furniture and Interiors Market Segmentation

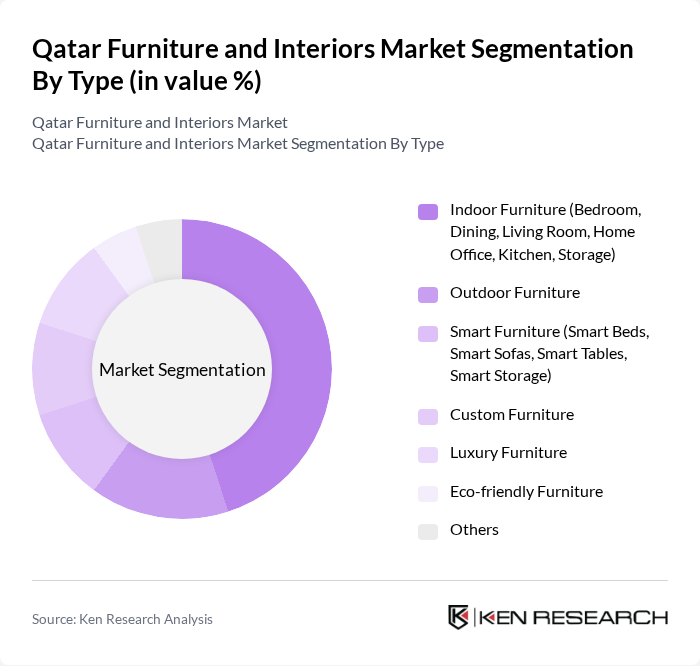

By Type:The furniture market is segmented into various types, including Indoor Furniture, Outdoor Furniture, Smart Furniture, Custom Furniture, Luxury Furniture, Eco-friendly Furniture, and Others. Among these, Indoor Furniture—which encompasses bedroom, dining, living room, home office, kitchen, and storage items—dominates the market due to the increasing demand for home improvement, interior design, and multifunctional living solutions. Consumers are increasingly investing in stylish, space-saving, and functional indoor furniture to enhance their living spaces and accommodate modern lifestyles .

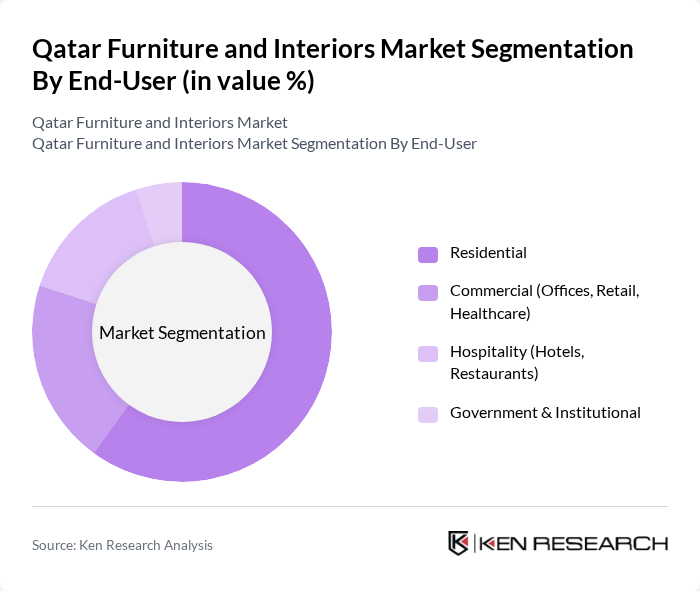

By End-User:The market is segmented by end-user into Residential, Commercial (Offices, Retail, Healthcare), Hospitality (Hotels, Restaurants), and Government & Institutional. The Residential segment leads the market, driven by a growing population, increasing home ownership rates, and a rising influx of expatriates. Consumers are investing in quality furniture to enhance their living environments, reflecting a trend towards personalized, comfortable, and multifunctional home spaces .

Qatar Furniture and Interiors Market Competitive Landscape

The Qatar Furniture and Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Qatar, Home Centre, Al Muftah Furniture, The One Qatar, Pan Emirates, Royal Furniture, Midas Furniture, Doha Furniture, Al Jazeera Furniture, Al Hattab Furniture, Al Fardan Furnishings, Landmark Group, Al Rayyan Furniture, Qatari Furniture Company, Al Sraiya Holding Group, Marina Home Interiors, Danube Home, Almana Maple, Decoration World, Depa Qatar contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Furniture and Interiors Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Qatar's urban population is projected to reach approximately 2.9 million in future, up from about 2.7 million in the most recent available data, according to the World Bank. This rapid urbanization drives demand for residential and commercial furniture as new housing and office spaces are developed. The urbanization rate is estimated at around 2.2% annually, indicating a growing need for modern interiors, which is expected to significantly boost the furniture market as consumers seek stylish and functional designs to accommodate their evolving lifestyles.

- Rising Disposable Incomes:The average disposable income in Qatar is estimated to be around QAR 11,000 per month in the most recent available data. This rise in disposable income allows consumers to invest more in home furnishings and interior design. As households prioritize comfort and aesthetics, the demand for high-quality furniture is expected to surge, particularly in the luxury segment, which is projected to grow as consumers seek premium products that enhance their living spaces.

- Growth in Real Estate Sector:The real estate sector in Qatar is anticipated to grow, supported by government initiatives and infrastructure projects. With over QAR 50 billion allocated for new developments, including residential and commercial properties, the demand for furniture is set to rise. This growth is further supported by major sporting events, which have accelerated construction and increased the need for quality furnishings in hotels and residential units, creating a robust market for furniture suppliers.

Market Challenges

- High Import Duties:Qatar imposes import duties of up to 5% on furniture, which can significantly increase costs for retailers and consumers. This high tariff structure limits the competitiveness of imported goods compared to locally produced items. As a result, many consumers may opt for lower-priced alternatives, impacting the overall market growth. The reliance on imports for quality materials further complicates pricing strategies, making it challenging for businesses to maintain profit margins while offering competitive prices.

- Intense Competition:The Qatar furniture market is characterized by intense competition, with over 200 registered furniture retailers in the most recent available data. This saturation leads to price wars and reduced profit margins, making it difficult for new entrants to establish a foothold. Established brands dominate the market, leveraging brand loyalty and extensive distribution networks. As a result, smaller companies may struggle to differentiate themselves, leading to potential market exits and reduced innovation in product offerings.

Qatar Furniture and Interiors Market Future Outlook

The Qatar furniture and interiors market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative and sustainable furniture solutions will rise. Additionally, the integration of smart technology into home furnishings is expected to enhance user experience. With government support for local manufacturing and sustainability initiatives, the market is likely to witness a shift towards eco-friendly products, creating new avenues for growth and investment in the coming years.

Market Opportunities

- Expansion of E-commerce Platforms:The e-commerce sector in Qatar is estimated to be growing rapidly, providing furniture retailers with an opportunity to reach a broader audience. Online shopping trends are reshaping consumer behavior, allowing businesses to offer a diverse range of products and services. This shift can enhance customer engagement and streamline purchasing processes, ultimately driving sales and market penetration for furniture brands.

- Customization Trends:The demand for customized furniture solutions is on the rise, with consumers increasingly seeking unique designs that reflect their personal style. This trend is expected to grow as more consumers prioritize individuality in their home decor. Companies that offer tailored solutions can capitalize on this opportunity, enhancing customer satisfaction and loyalty while differentiating themselves in a competitive market landscape.