Region:Asia

Author(s):Rebecca

Product Code:KRAA3350

Pages:100

Published On:September 2025

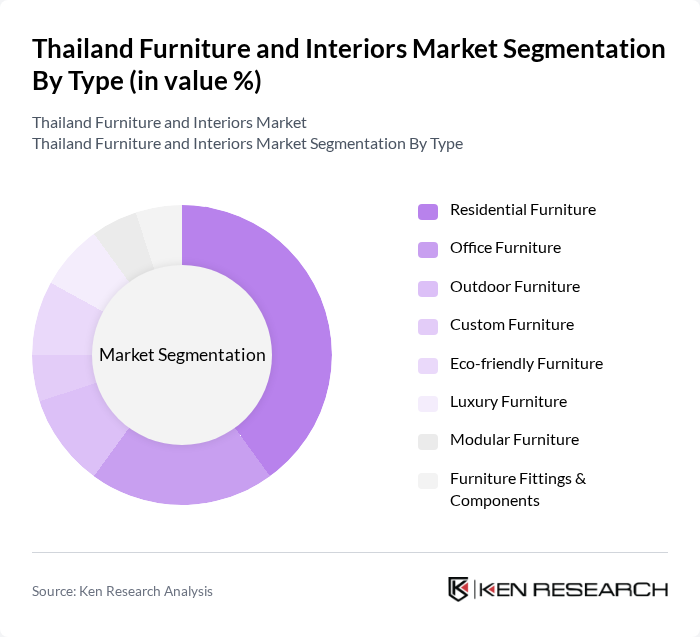

By Type:The furniture market in Thailand is diverse, encompassing various types that cater to different consumer needs. The primary subsegments include Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-friendly Furniture, Luxury Furniture, Modular Furniture, and Furniture Fittings & Components. Among these, Residential Furniture is the most dominant segment, driven by the increasing trend of home renovations, urban living, and the growing middle-class population seeking stylish, functional, and space-efficient home furnishings. The market also reflects a rising preference for eco-friendly and modular designs, aligning with sustainability and urbanization trends .

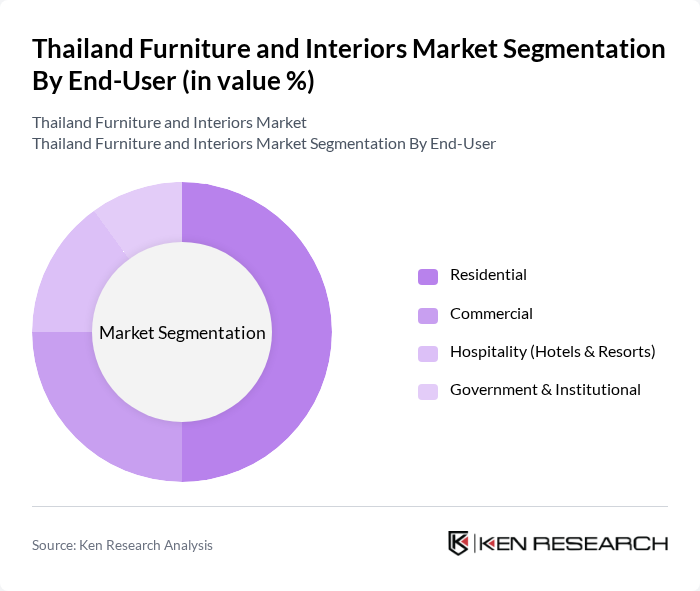

By End-User:The end-user segmentation of the furniture market includes Residential, Commercial, Hospitality (Hotels & Resorts), and Government & Institutional. The Residential segment is the largest, driven by the increasing number of households, urban apartment living, and the trend of home improvement. The Commercial segment is also significant, fueled by the growth of businesses, office expansions, and the need for modern office furnishings. The hospitality sector continues to expand, particularly in tourist destinations, increasing demand for hotel and resort furniture .

The Thailand Furniture and Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Thailand, SB Furniture, Index Living Mall, Modernform Group Public Company Limited, TPI Polene Public Company Limited, Thai Furniture Industry Co., Ltd., Home Product Center Public Company Limited (HomePro), Koncept Furniture (by SB Furniture Group), NocNoc, Poonphol Furniture Co., Ltd., Thai Watsadu (Central Retail Corporation), Kittichai Furniture, T.A. Furniture Industry Co., Ltd., P&P Furniture Co., Ltd., S.P. Furniture Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand furniture market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the increasing focus on sustainability will push manufacturers to innovate eco-friendly products. The integration of smart technology into furniture design will also create new market segments, enhancing user experience and functionality. Overall, the market is expected to adapt dynamically to these trends, fostering growth and diversification.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-friendly Furniture Luxury Furniture Modular Furniture Furniture Fittings & Components |

| By End-User | Residential Commercial Hospitality (Hotels & Resorts) Government & Institutional |

| By Sales Channel | Online Retail Offline Retail (Specialist Stores, Non-specialist Stores) Direct Sales Distributors |

| By Material | Wood Metal Plastic & Fiber Glass Fabric/Upholstery Others (e.g., Bamboo, Rattan) |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist |

| By Functionality | Multi-functional Space-saving Ergonomic Smart/Connected Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Retail | 120 | Store Managers, Sales Executives |

| Commercial Furniture Solutions | 100 | Business Owners, Procurement Managers |

| Interior Design Trends | 80 | Interior Designers, Architects |

| Online Furniture Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Practices | 70 | Sustainability Officers, Product Designers |

The Thailand Furniture and Interiors Market is valued at approximately USD 10 billion, driven by urbanization, rising disposable incomes, and a growing trend towards home improvement and contemporary interior design.