Region:Middle East

Author(s):Dev

Product Code:KRAA3578

Pages:80

Published On:September 2025

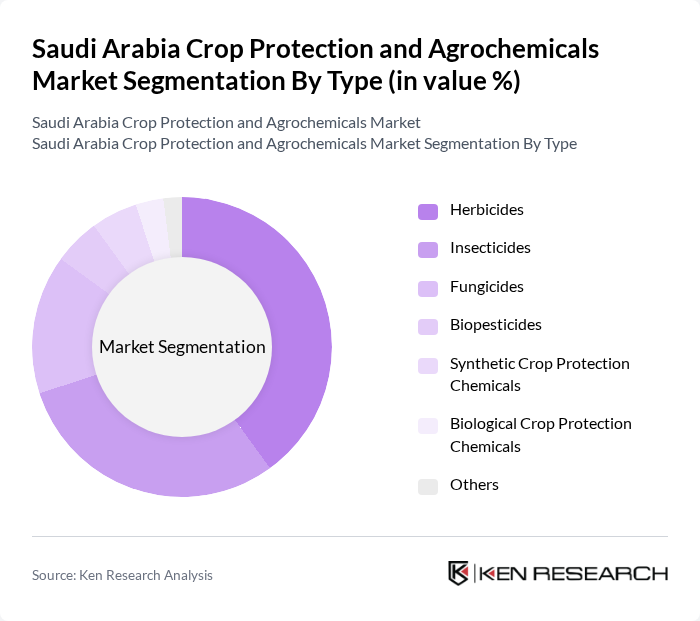

By Type:The crop protection and agrochemicals market is segmented into herbicides, insecticides, fungicides, biopesticides, synthetic crop protection chemicals, biological crop protection chemicals, and others. Herbicides and insecticides remain the most dominant segments, reflecting their essential role in controlling weeds and pests to maximize crop yields. The growing adoption of integrated pest management and heightened awareness of sustainable agriculture further drive demand for these products.

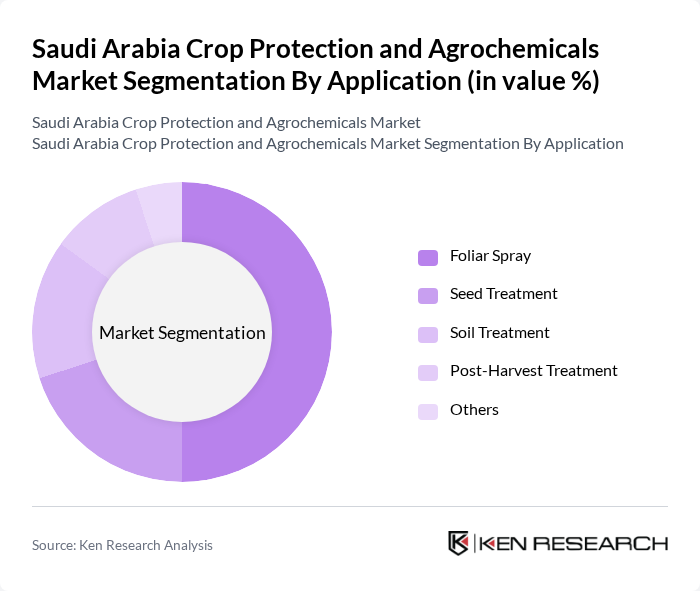

By Application:The market is also segmented by application, including foliar spray, seed treatment, soil treatment, post-harvest treatment, and others. Foliar spray is the leading application method, enabling targeted crop treatment and effective pest and disease control. The focus on improving crop quality and yield through efficient application methods continues to drive growth in this segment.

The Saudi Arabia Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Delta Saudi Chemical Industries Company, Saudi United Fertilizer Company (Al-Asmida), Saudi Agricultural and Livestock Investment Company (SALIC), Al-Jubail Fertilizer Company (AlBayroni), Saudi Basic Industries Corporation (SABIC) – Agri-Nutrients, Al Rowad Chemicals Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia crop protection and agrochemicals market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As the government continues to invest in agricultural innovation, the adoption of precision agriculture and integrated pest management is expected to rise significantly. Furthermore, the increasing demand for organic and eco-friendly products will likely reshape product offerings, encouraging companies to innovate and adapt to changing consumer preferences while ensuring compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Synthetic Crop Protection Chemicals Biological Crop Protection Chemicals Others |

| By Application | Foliar Spray Seed Treatment Soil Treatment Post-Harvest Treatment Others |

| By Crop Type | Cereals & Grains Fruits & Vegetables Oilseeds & Pulses Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Product Formulation | Liquid Granular Powder Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Product Usage | 120 | Farmers, Agronomists |

| Agrochemical Distribution Channels | 60 | Distributors, Retailers |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Managers, Compliance Officers |

| Market Trends and Innovations | 50 | Research Scientists, Product Development Managers |

| Consumer Preferences in Agrochemicals | 70 | End-users, Agricultural Consultants |

The Saudi Arabia Crop Protection and Agrochemicals Market is valued at approximately USD 890 million, reflecting a significant growth driven by increased food security demands and the adoption of advanced agricultural technologies.