Turkey Crop Protection and Agrochemicals Market Overview

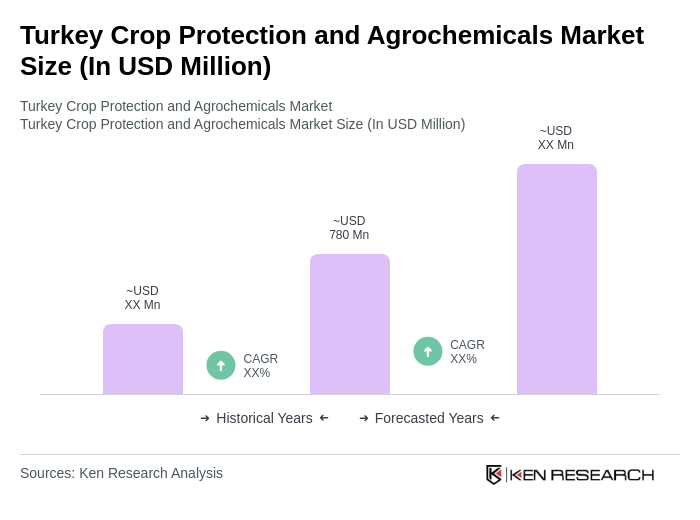

- The Turkey Crop Protection and Agrochemicals Market is valued at USD 780 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for food security, advancements in agricultural technology, and the rising adoption of sustainable farming practices. The market has seen a significant uptick in the use of agrochemicals to enhance crop yield and protect against pests and diseases. Recent trends highlight a shift toward eco-friendly and innovative crop protection solutions, with major players investing in research and partnerships to support sustainable agriculture and technology transfer initiatives .

- Key regions dominating the market include Marmara and Aegean, which are known for their extensive agricultural activities and favorable climatic conditions. The concentration of agricultural cooperatives and distributors in these areas further supports market growth, making them pivotal in the distribution and application of crop protection products. These regions are also the primary hubs for cereals, grains, fruits, and vegetables, which drive demand for crop protection inputs .

- The Regulation on the Placing of Plant Protection Products on the Market, issued by the Ministry of Agriculture and Forestry in 2020, governs the registration, distribution, and use of crop protection products in Turkey. This regulation includes provisions to promote the use of biopesticides and integrated pest management, requiring that plant protection products meet specific safety, efficacy, and environmental criteria. The regulation also mandates compliance with residue limits and encourages the adoption of sustainable practices in line with international standards .

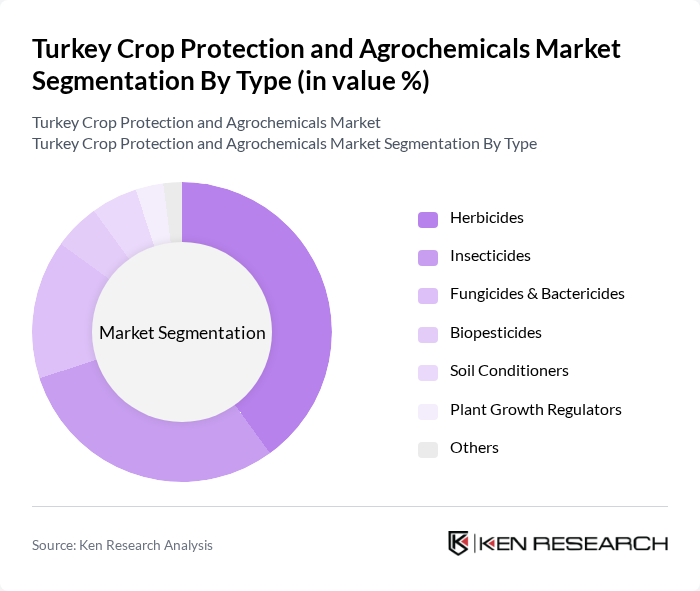

Turkey Crop Protection and Agrochemicals Market Segmentation

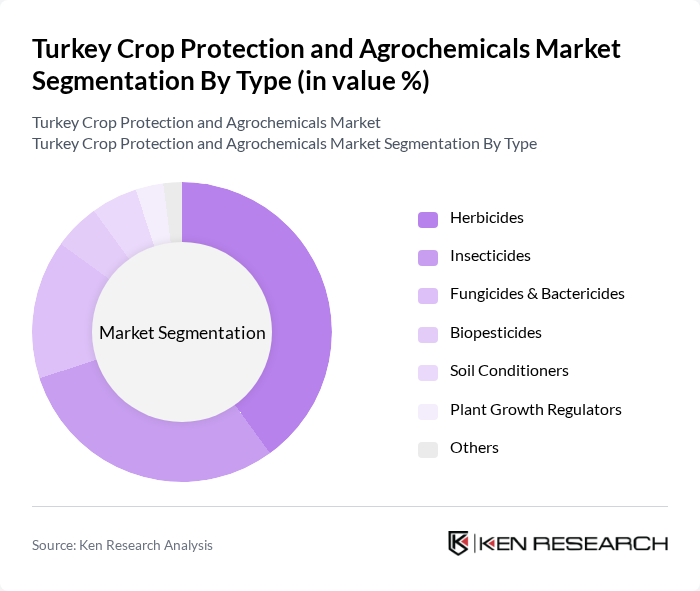

By Type:The market is segmented into various types of crop protection products, including herbicides, insecticides, fungicides & bactericides, biopesticides, soil conditioners, plant growth regulators, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yield. The increasing focus on sustainable agriculture is also driving the adoption of biopesticides, which are gaining popularity among environmentally conscious farmers. Recent data confirms that herbicides remain the largest product segment, with biopesticides showing the fastest growth rate due to regulatory support and rising demand for eco-friendly solutions .

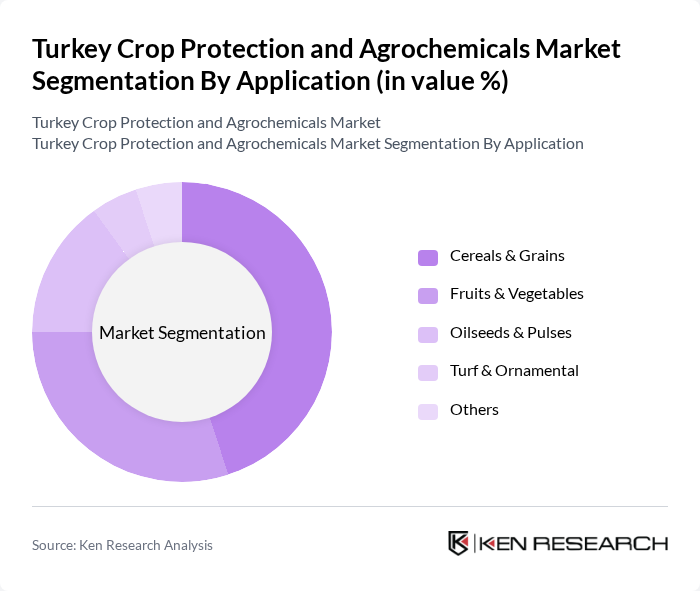

By Application:The application segment includes cereals & grains, fruits & vegetables, oilseeds & pulses, turf & ornamental, and others. The cereals & grains segment holds a significant share due to the high demand for staple foods in Turkey. Additionally, the increasing cultivation of fruits and vegetables for both domestic consumption and export is driving growth in that segment. The rising trend of urban gardening and landscaping is also contributing to the turf & ornamental segment. Recent industry insights confirm cereals & grains as the dominant application, with fruits & vegetables also representing a substantial portion of the market .

Turkey Crop Protection and Agrochemicals Market Competitive Landscape

The Turkey Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Cheminova A/S, Isagro S.p.A., Albaugh LLC, Hekta? Ticaret T.A.?., Toros Tar?m Sanayi ve Ticaret A.?., Doktor Tarsa Tar?m Sanayi ve Ticaret A.?., Agrofarm Tar?m Ürünleri Sanayi ve Ticaret Ltd. ?ti., Agrobest Grup Tar?m Sanayi ve Ticaret A.?., Bioteknik Kimya Sanayi ve Ticaret A.?. contribute to innovation, geographic expansion, and service delivery in this space.

Turkey Crop Protection and Agrochemicals Market Industry Analysis

Growth Drivers

- Increasing Agricultural Productivity:Turkey's agricultural sector is projected to contribute approximatelyUSD 50 billionto the national GDP in future, driven by a focus on enhancing crop yields. The government aims to increase productivity by10–15%through the adoption of advanced agrochemicals and farming techniques. This growth is supported by a rise in cultivated land area, which reached23 million hectares, indicating a strong demand for crop protection solutions to maximize output and ensure food security.

- Rising Demand for Organic Farming:The organic farming sector in Turkey is expected to grow toUSD 800 millionin future, reflecting a15%annual increase. This trend is fueled by consumer preferences shifting towards organic produce, with over500,000 hectarescurrently under organic cultivation. The government has introduced incentives, including subsidies for organic inputs, which are expected to further stimulate the demand for organic agrochemicals, thereby enhancing market growth.

- Technological Advancements in Agrochemicals:The Turkish agrochemical market is witnessing significant technological innovations, with investments in R&D projected to reachUSD 100 millionin future. These advancements include the development of more effective and environmentally friendly pesticides, which are crucial for meeting the increasing agricultural demands. The integration of precision agriculture technologies is also expected to enhance the efficiency of agrochemical applications, leading to improved crop yields and reduced environmental impact.

Market Challenges

- Stringent Regulatory Requirements:The Turkish agrochemical market faces challenges due to stringent regulatory frameworks, with over100–150new pesticide registrations required annually. Compliance with these regulations can be costly and time-consuming for manufacturers, potentially hindering market entry for new products. Additionally, the need to align with EU standards adds complexity, as Turkey aims to harmonize its regulations with those of the European Union, impacting market dynamics significantly.

- Environmental Concerns and Sustainability Issues:Increasing environmental awareness among consumers and regulatory bodies poses a challenge for the agrochemical industry. In future, it is estimated that a significant proportion of farmers will face pressure to adopt sustainable practices, leading to a potential decline in traditional agrochemical usage. This shift necessitates the development of eco-friendly alternatives, which may not yet be widely available, creating a gap in the market that could affect profitability.

Turkey Crop Protection and Agrochemicals Market Future Outlook

The Turkey Crop Protection and Agrochemicals Market is poised for significant transformation as it adapts to evolving consumer preferences and regulatory landscapes. The shift towards sustainable practices will drive innovation in biopesticides and organic solutions, while the integration of digital agriculture technologies will enhance operational efficiencies. As the market navigates these changes, collaboration with research institutions will be crucial for developing cutting-edge products that meet both consumer demands and environmental standards, ensuring long-term growth and sustainability.

Market Opportunities

- Expansion of Export Markets:Turkey's agrochemical exports are projected to reachUSD 500 millionin future, driven by increasing demand from neighboring countries. This expansion presents a significant opportunity for local manufacturers to diversify their markets and enhance revenue streams, particularly in regions where agricultural productivity is on the rise.

- Development of Biopesticides:The biopesticide market in Turkey is expected to grow toUSD 100 millionin future, reflecting a growing trend towards sustainable agriculture. This presents an opportunity for companies to invest in research and development of biopesticides, catering to the increasing demand for environmentally friendly pest control solutions among farmers and consumers alike.