Region:Middle East

Author(s):Shubham

Product Code:KRAA3624

Pages:100

Published On:September 2025

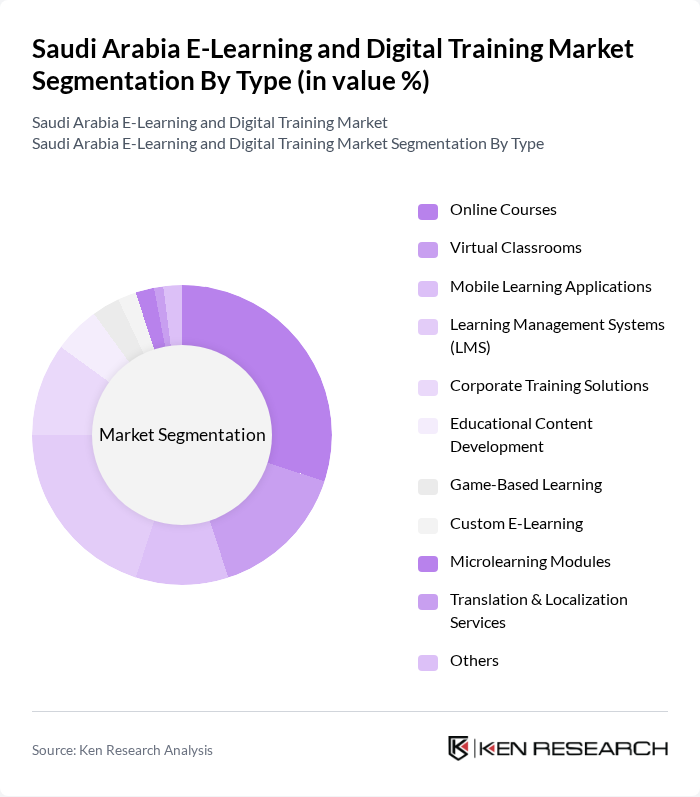

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Applications, Learning Management Systems (LMS), Corporate Training Solutions, Educational Content Development, Game-Based Learning, Custom E-Learning, Microlearning Modules, Translation & Localization Services, and Others. Among these,Online CoursesandLearning Management Systems (LMS)are particularly prominent due to their flexibility, scalability, and ability to serve diverse learner populations, including both academic and corporate users .

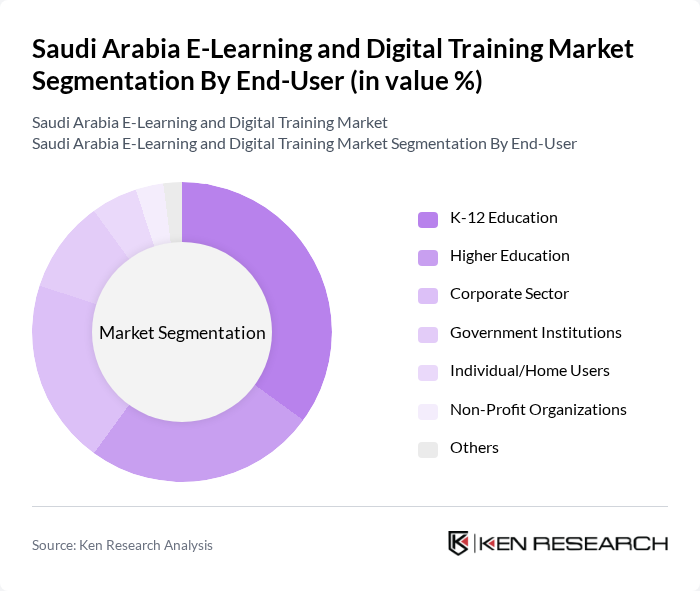

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Sector, Government Institutions, Individual/Home Users, Non-Profit Organizations, and Others. TheK-12 Educationsegment leads the market, driven by the widespread integration of digital tools in schools, government mandates for online learning, and the growing demand for personalized, adaptive learning experiences among students .

The Saudi Arabia E-Learning and Digital Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Falak Electronic Equipment & Supplies Co., Edraak, Rwaq, Nafham, Classera, Noon Academy, Future Institute of Higher Education & Training, National eLearning Center (NELC), Smart Learning Solutions (SLS), Madrasati Platform (Ministry of Education, KSA), Blackboard, Moodle, Coursera, Udacity, LinkedIn Learning contribute to innovation, geographic expansion, and service delivery in this space .

The future of the e-learning and digital training market in Saudi Arabia appears promising, driven by technological advancements and changing educational preferences. The integration of artificial intelligence and machine learning into learning platforms is expected to enhance personalized learning experiences, catering to individual student needs. Additionally, the increasing collaboration between e-learning providers and educational institutions will likely foster innovative solutions, making education more accessible and engaging for a diverse audience across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Mobile Learning Applications Learning Management Systems (LMS) Corporate Training Solutions Educational Content Development Game-Based Learning Custom E-Learning Microlearning Modules Translation & Localization Services Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Individual/Home Users Non-Profit Organizations Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Instructor-Led Training (ILT) Others |

| By Content Type | Video-Based Learning Text-Based Learning Interactive Learning Modules Assessment and Certification Simulation-Based Learning Others |

| By Subscription Model | Freemium Model Monthly Subscription Annual Subscription Pay-Per-Course Enterprise Licensing Others |

| By Geographic Reach | Local Market Regional Market International Market Others |

| By Pricing Tier | Budget-Friendly Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Adoption | 100 | School Administrators, Teachers |

| Higher Education Digital Training | 70 | University Professors, IT Directors |

| Corporate E-Learning Programs | 90 | HR Managers, Training Coordinators |

| Government E-Learning Initiatives | 60 | Policy Makers, Educational Consultants |

| EdTech Startups and Innovations | 50 | Founders, Product Managers |

The Saudi Arabia E-Learning and Digital Training Market is valued at approximately USD 2.4 billion, driven by the increasing adoption of digital technologies in education and government initiatives like Vision 2030, which promote digital transformation in the education sector.