Region:Middle East

Author(s):Shubham

Product Code:KRAA3594

Pages:87

Published On:September 2025

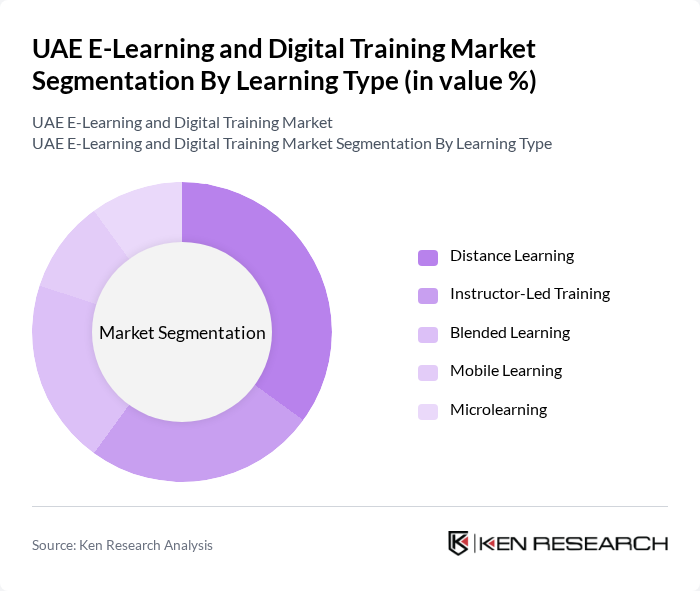

By Learning Type:The learning type segmentation includes various methods of delivering educational content. The subsegments are Distance Learning, Instructor-Led Training, Blended Learning, Mobile Learning, and Microlearning. Distance Learning has gained significant traction due to its flexibility and accessibility, allowing learners to engage with content from anywhere. Instructor-Led Training remains popular in corporate settings, where direct interaction enhances learning outcomes. Blended Learning combines traditional and digital methods, catering to diverse learning preferences. Mobile Learning is increasingly favored for its convenience, while Microlearning addresses the need for bite-sized content that fits into busy schedules .

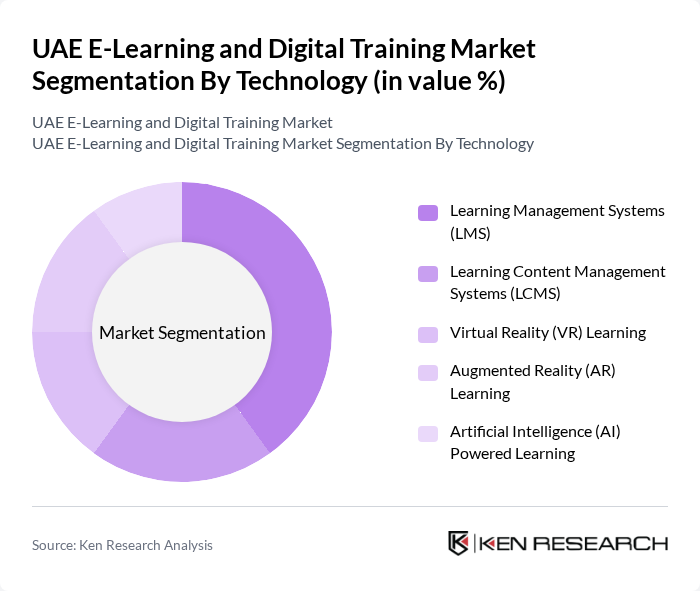

By Technology:The technology segmentation encompasses various tools and platforms used in e-learning. This includes Learning Management Systems (LMS), Learning Content Management Systems (LCMS), Virtual Reality (VR) Learning, Augmented Reality (AR) Learning, and Artificial Intelligence (AI) Powered Learning. LMS platforms dominate the market due to their comprehensive features for managing and delivering educational content. LCMS is gaining traction for its ability to create and manage learning content efficiently. VR and AR Learning are emerging technologies that provide immersive experiences, while AI-Powered Learning is revolutionizing personalized education through adaptive learning paths .

The UAE E-Learning and Digital Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udemy, LinkedIn Learning, Blackboard Inc., Moodle, Adobe Captivate Prime, SAP Litmos, Cornerstone OnDemand, Skillsoft, Pluralsight, Khan Academy, edX, FutureLearn, Udacity, Alison contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE e-learning and digital training market appears promising, driven by technological advancements and evolving educational needs. The integration of artificial intelligence and virtual reality into learning experiences is expected to enhance engagement and effectiveness. Additionally, the shift towards hybrid learning models will likely become more prevalent, accommodating diverse learning preferences. As the demand for personalized learning solutions grows, providers will need to innovate continuously to meet the expectations of learners and organizations alike.

| Segment | Sub-Segments |

|---|---|

| By Learning Type | Distance Learning Instructor-Led Training Blended Learning Mobile Learning Microlearning |

| By Technology | Learning Management Systems (LMS) Learning Content Management Systems (LCMS) Virtual Reality (VR) Learning Augmented Reality (AR) Learning Artificial Intelligence (AI) Powered Learning |

| By End-User | K-12 Education Higher Education Corporate Training Government Sector Healthcare Training |

| By Content Type | Video-Based Content Interactive Simulations Gamified Learning Assessment and Certification Virtual Labs |

| By Deployment Mode | Cloud-Based On-Premise Hybrid Deployment |

| By Device Type | Desktop/Laptop Mobile Devices Tablets Smart TVs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Adoption | 100 | School Administrators, Teachers |

| Higher Education Digital Training | 70 | University Faculty, IT Directors |

| Corporate E-Learning Solutions | 110 | HR Managers, Training Coordinators |

| Government E-Learning Initiatives | 60 | Policy Makers, Educational Planners |

| EdTech Startups and Innovations | 80 | Founders, Product Managers |

The UAE E-Learning and Digital Training Market is valued at approximately USD 3.6 billion, reflecting significant growth driven by the adoption of digital technologies, remote learning solutions, and the demand for workforce upskilling and reskilling.