Region:Middle East

Author(s):Shubham

Product Code:KRAA3602

Pages:100

Published On:September 2025

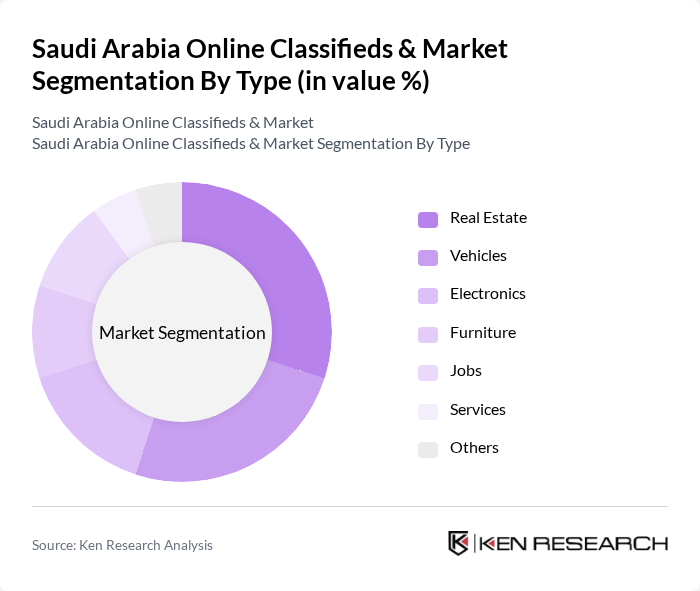

By Type:The market is segmented into Real Estate, Vehicles, Electronics, Furniture, Jobs, Services, and Others. Each segment addresses specific consumer needs, with Real Estate and Vehicles experiencing particularly high demand due to ongoing urbanization and increased mobility requirements .

The Real Estate segment leads the market, driven by surging demand for residential and commercial properties in major urban centers. Rapid urbanization and population growth in cities like Riyadh and Jeddah have resulted in a significant increase in property listings and transactions. The trend of expatriates seeking housing options also supports this segment. The Vehicles segment is robust, reflecting rising vehicle ownership and the growing need for efficient online buying and selling solutions .

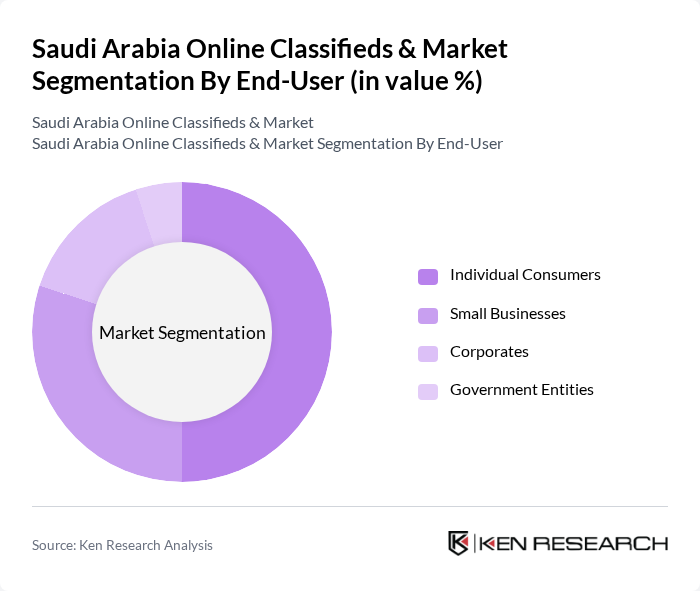

By End-User:The market is segmented into Individual Consumers, Small Businesses, Corporates, and Government Entities. Each segment has unique requirements, shaping their interaction with online classifieds. Individual Consumers and Small Businesses are the most active, leveraging these platforms for convenience, reach, and cost-effectiveness .

The Individual Consumers segment is the largest, propelled by the widespread adoption of online shopping and the ease of accessing a diverse range of products and services. This group includes young professionals and families who value convenience and digital engagement. Small Businesses also comprise a significant share, utilizing online classifieds to expand their customer base and promote offerings efficiently .

The Saudi Arabia Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Saudi Arabia, Haraj, Expatriates.com, Noon, Dubizzle Saudi Arabia, OpenSooq, Syarah, Mawdoo3, Qaym, Bazar, Aqar, Mudarib, Taqeem, Al-Muqayda, Al-Bawaba contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online classifieds market in Saudi Arabia appears promising, driven by technological advancements and changing consumer behaviors. As mobile-first platforms gain traction, businesses will need to adapt to meet the demands of a tech-savvy population. Additionally, the integration of AI and machine learning will enhance user experiences, making transactions more efficient. However, companies must remain vigilant regarding regulatory changes and consumer trust issues to sustain growth and capitalize on emerging opportunities in the evolving digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Vehicles Electronics Furniture Jobs Services Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Sales Channel | Online Platforms Mobile Applications Social Media |

| By Region | Central Region Western Region Eastern Region Southern Region |

| By Price Range | Low-End Mid-Range High-End |

| By Payment Method | Credit/Debit Cards Cash on Delivery Digital Wallets |

| By Product Condition | New Used Refurbished |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Users of Online Classifieds | 120 | Frequent Buyers, Casual Users |

| Small Business Advertisers | 60 | Business Owners, Marketing Managers |

| Real Estate Listings | 50 | Real Estate Agents, Property Managers |

| Automotive Sellers | 40 | Car Dealers, Private Sellers |

| Consumer Electronics Listings | 45 | Electronics Retailers, Individual Sellers |

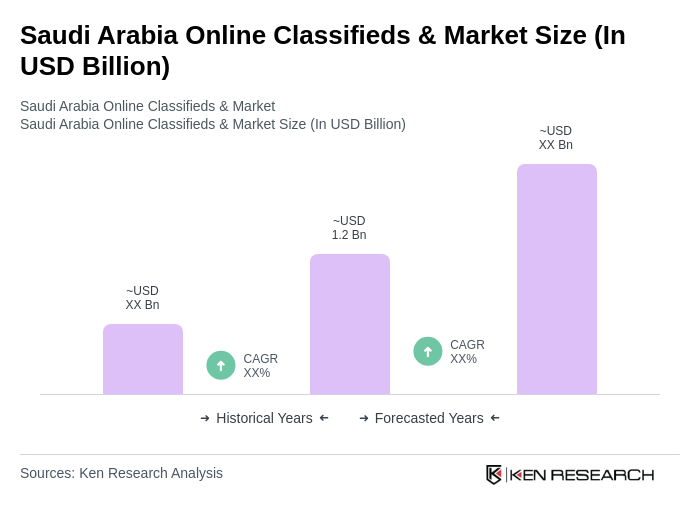

The Saudi Arabia Online Classifieds & Market is valued at approximately USD 1.2 billion, driven by increased internet penetration, smartphone usage, and a shift towards online shopping and digital platforms.