Region:Asia

Author(s):Shubham

Product Code:KRAA3604

Pages:88

Published On:September 2025

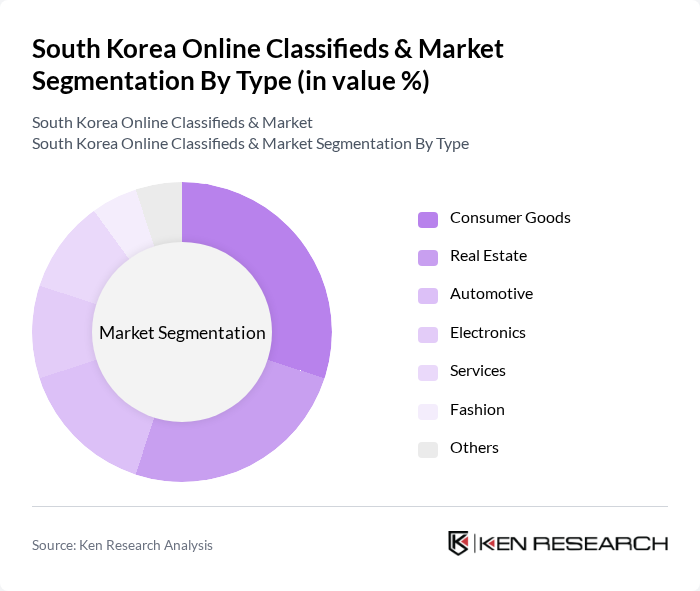

By Type:The market is segmented into various types, including Consumer Goods, Real Estate, Automotive, Electronics, Services, Fashion, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of demand and market dynamics.

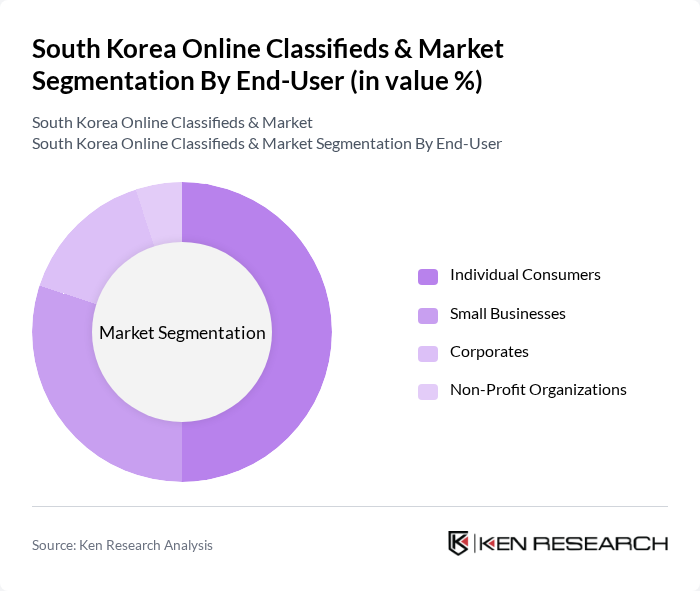

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Non-Profit Organizations. Each segment has distinct purchasing behaviors and requirements, influencing the overall market dynamics.

The South Korea Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naver Corporation, Kakao Corp, 11st Co., Ltd., Gmarket, Auction.co.kr, Interpark, Daangn Market (Karrot), Carrot Market (Karrot), TMON, WeMakePrice, Coupang, Zigzag, Musinsa, Baedal Minjok (Baemin), Toss contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean online classifieds market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As platforms increasingly integrate AI and machine learning, user experiences will become more personalized, enhancing engagement. Additionally, the rise of social commerce is expected to reshape how users interact with classifieds, creating new avenues for sales. With a focus on sustainability and niche markets, the industry is likely to witness innovative solutions that cater to diverse consumer needs, ensuring continued relevance and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Goods Real Estate Automotive Electronics Services Fashion Others |

| By End-User | Individual Consumers Small Businesses Corporates Non-Profit Organizations |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Events |

| By Product Condition | New Used Refurbished |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | Age Groups Income Levels Education Levels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General User Experience with Online Classifieds | 120 | Regular Users, Occasional Buyers |

| Small Business Utilization of Classifieds | 60 | Small Business Owners, Marketing Managers |

| Consumer Preferences in Product Categories | 80 | Frequent Buyers, Niche Market Shoppers |

| Impact of Mobile Platforms on Classifieds | 40 | Mobile Users, Tech-Savvy Consumers |

| Trends in User Engagement and Retention | 50 | Marketing Analysts, User Experience Researchers |

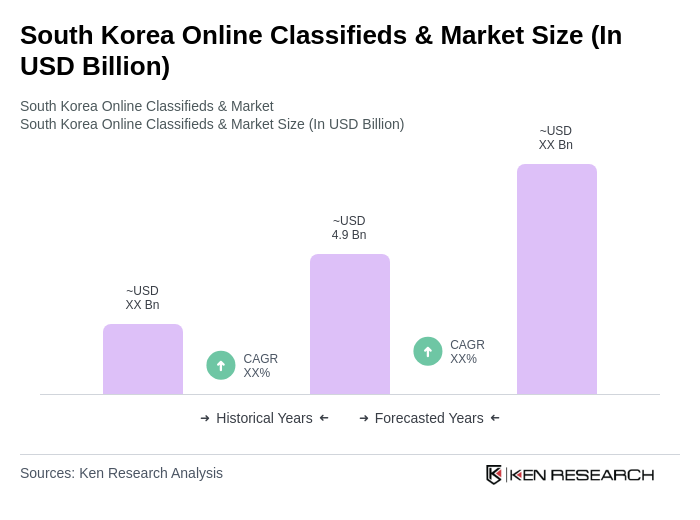

The South Korea Online Classifieds Market is valued at approximately USD 4.9 billion, driven by increased smartphone penetration, internet access, and a shift towards online shopping and second-hand goods.