Region:Middle East

Author(s):Shubham

Product Code:KRAA3607

Pages:96

Published On:September 2025

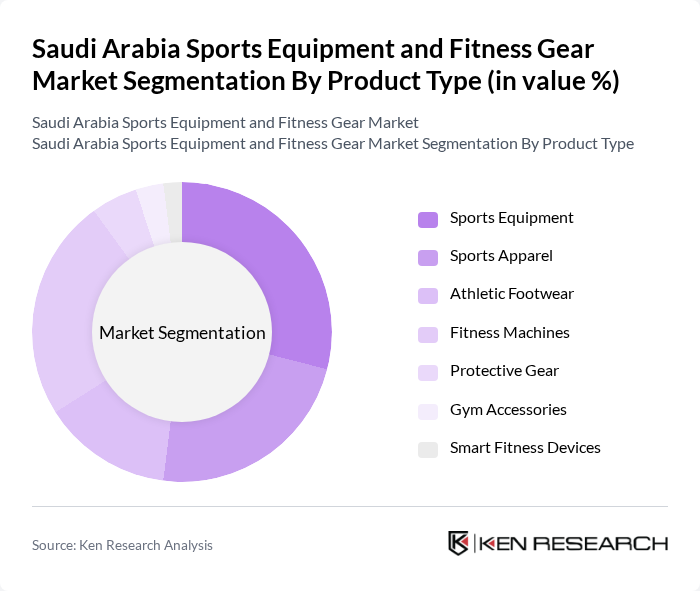

By Product Type:The market is segmented into various product types, including sports equipment, sports apparel, athletic footwear, fitness machines, protective gear, gym accessories, and smart fitness devices. Among these, sports apparel is the leading segment, driven by athleisure trends, the influence of global brands, and increased participation of women in sports. Fitness machines and sports equipment are also popular due to the growing number of fitness centers and home gym setups. The demand for smart fitness devices is rising as consumers seek technology-driven solutions to enhance their fitness experiences, with digital integration and personalized tracking becoming key purchase drivers .

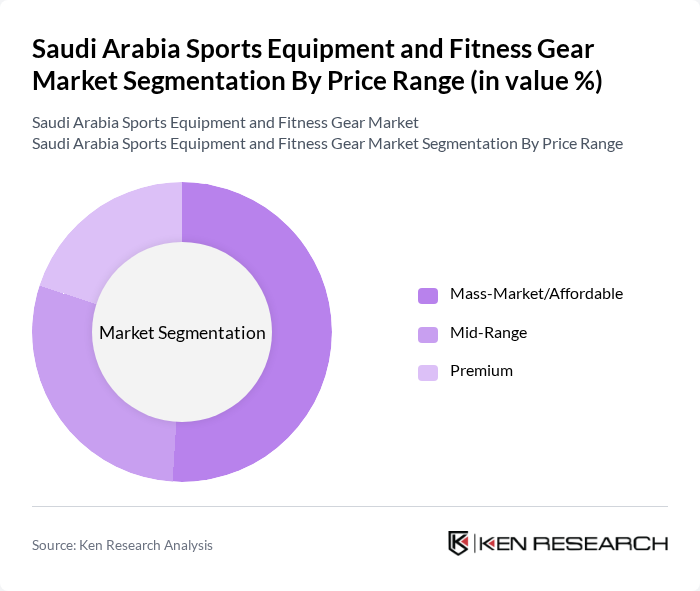

By Price Range:The market is categorized into mass-market/affordable, mid-range, and premium segments. The mass-market segment dominates due to the increasing number of budget-conscious consumers seeking affordable fitness solutions. However, the premium segment is also witnessing growth as affluent consumers invest in high-quality and branded fitness gear. The rise of e-commerce and access to international brands have further diversified price offerings and consumer choices .

The Saudi Arabia Sports Equipment and Fitness Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Inc., Adidas AG, Puma SE, Under Armour Inc., Decathlon S.A., ASICS Corporation, New Balance Athletics Inc., Reebok International Ltd., Wilson Sporting Goods, Mizuno Corporation, The North Face Inc., Columbia Sportswear Company, Skechers USA Inc., Fitness First Middle East, Sun & Sand Sports contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia sports equipment and fitness gear market is poised for significant growth, driven by increasing health awareness and government support for sports initiatives. As the population becomes more engaged in fitness activities, the demand for innovative and sustainable products will rise. Additionally, the integration of technology in fitness gear will enhance user experience, while the expansion of e-commerce platforms will facilitate easier access to a wider range of products, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports Equipment Sports Apparel Athletic Footwear Fitness Machines Protective Gear Gym Accessories Smart Fitness Devices |

| By Price Range | Mass-Market/Affordable Mid-Range Premium |

| By Distribution Channel | Online Retail Offline Retail Specialty Sports Stores Department Stores |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Sports Clubs |

| By Region | Western Region Central Region Eastern Region Northern Region Southern Region |

| By Gender | Men's Sports Equipment Women's Sports Equipment Unisex Sports Equipment |

| By Sports Type | Football Basketball Running/Athletics Swimming Fitness/Gym Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 120 | Store Managers, Sales Executives |

| Fitness Center Equipment Usage | 85 | Gym Owners, Fitness Instructors |

| Consumer Fitness Gear Purchases | 150 | Fitness Enthusiasts, Casual Gym Users |

| Online Fitness Equipment Market | 95 | E-commerce Managers, Digital Marketing Specialists |

| Trends in Home Fitness Equipment | 75 | Home Gym Users, Personal Trainers |

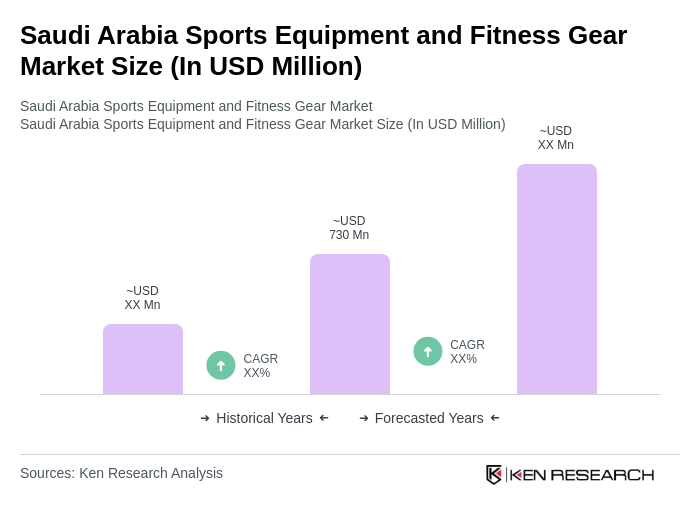

The Saudi Arabia Sports Equipment and Fitness Gear Market is valued at approximately USD 730 million, reflecting a significant growth trend driven by increased health awareness and government initiatives promoting fitness among the population.