Region:Central and South America

Author(s):Rebecca

Product Code:KRAA3334

Pages:91

Published On:September 2025

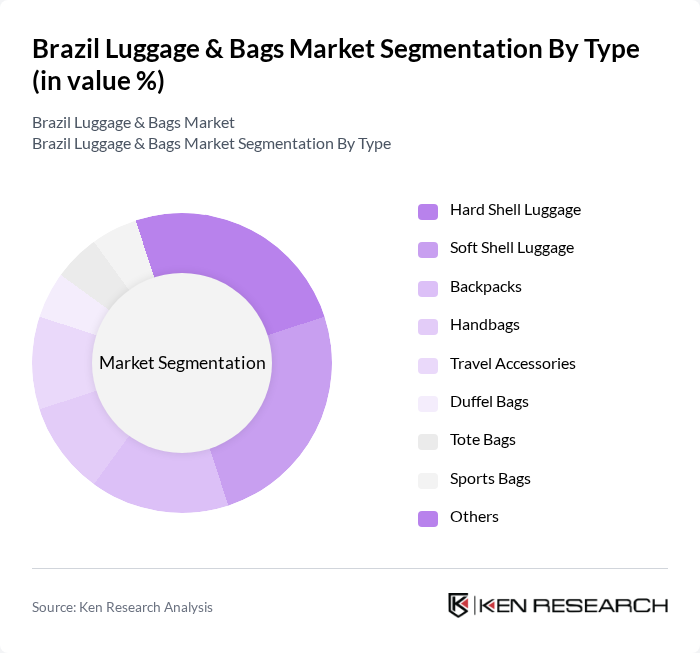

By Type:The luggage and bags market can be segmented into various types, including Hard Shell Luggage, Soft Shell Luggage, Backpacks, Handbags, Travel Accessories, Duffel Bags, Tote Bags, Sports Bags, and Others. Each of these subsegments caters to different consumer needs and preferences, with specific features and designs appealing to various demographics.

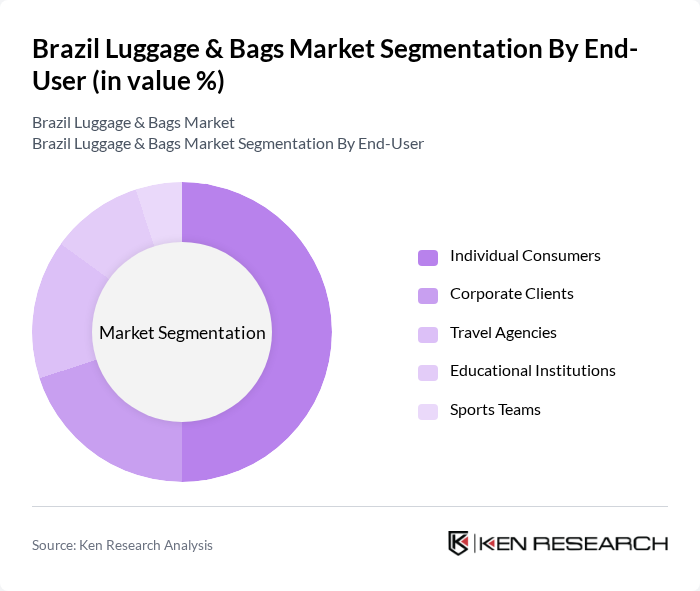

By End-User:The market can also be segmented by end-user categories, which include Individual Consumers, Corporate Clients, Travel Agencies, Educational Institutions, and Sports Teams. Each segment has unique requirements and purchasing behaviors, influencing the types of products that are in demand.

The Brazil Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite Brasil Ltda., Delsey Brasil, Victorinox Brasil, Kipling Brasil, American Tourister Brasil, Sestini, Le Postiche, Bagaggio, Adidas Brasil, Nike do Brasil, The North Face Brasil, Targus Brasil, Eastpak Brasil, Victor Hugo, Chenson Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil luggage and bags market is poised for transformation, driven by technological advancements and evolving consumer preferences. The integration of smart luggage technology, such as GPS tracking and built-in charging ports, is expected to attract tech-savvy consumers. Additionally, the growing trend towards minimalist designs and sustainable materials will likely shape product offerings, catering to environmentally conscious buyers. As the market adapts to these trends, it will create new avenues for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Shell Luggage Soft Shell Luggage Backpacks Handbags Travel Accessories Duffel Bags Tote Bags Sports Bags Others |

| By End-User | Individual Consumers Corporate Clients Travel Agencies Educational Institutions Sports Teams |

| By Sales Channel | Online Retail Offline Retail (Specialty Stores, Department Stores, Hypermarkets/Supermarkets) Direct Sales Wholesale Distribution |

| By Price Range | Budget Mid-Range Premium |

| By Material | Polyester Nylon Leather Canvas Polycarbonate ABS (Acrylonitrile Butadiene Styrene) |

| By Brand | Local Brands International Brands Private Labels |

| By Usage Occasion | Business Travel Leisure Travel Adventure Travel Daily Commute Sports & Fitness |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 120 | Store Managers, Sales Representatives |

| Consumer Preferences in Travel Bags | 150 | Frequent Travelers, Casual Consumers |

| Online Shopping Behavior for Bags | 100 | E-commerce Shoppers, Digital Marketing Specialists |

| Market Trends in Luxury Luggage | 60 | Luxury Brand Managers, Fashion Retailers |

| Impact of Sustainability on Purchasing Decisions | 80 | Eco-conscious Consumers, Sustainability Advocates |

The Brazil Luggage & Bags Market is valued at approximately USD 1.36 billion, reflecting a five-year historical analysis. This growth is attributed to increasing domestic travel, rising disposable income, and a shift towards online shopping among consumers.