Japan Luggage & Bags Market Overview

- The Japan Luggage & Bags Market is valued at approximately USD 8.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of domestic and international travelers, coupled with a rising trend in fashion-conscious consumers seeking stylish and functional luggage options. The market has also benefited from the expansion of e-commerce platforms, making it easier for consumers to access a wide variety of products. Recent trends highlight a strong consumer preference for minimalist, multifunctional designs, with a growing emphasis on sustainability and the use of eco-friendly materials. Practicality, organization, and the integration of technology—such as smart features and lightweight, durable materials—are increasingly important to Japanese consumers, reflecting broader lifestyle shifts toward efficiency and environmental awareness.

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Luggage & Bags Market due to their status as major urban centers with high population density and significant tourist attractions. These cities serve as key hubs for both domestic and international travel, leading to increased demand for luggage and bags. Additionally, the presence of numerous retail outlets and e-commerce platforms in these areas further supports market growth.

- In recent years, the Japanese government has implemented regulations aimed at enhancing consumer safety and product quality in the luggage industry. The Consumer Product Safety Act (Act No. 31 of 1973), administered by the Consumer Affairs Agency, requires that luggage products meet specific safety standards, including durability and material quality, to ensure they can withstand the rigors of travel. Compliance with these standards is mandatory for market entry, and manufacturers must conduct rigorous testing to certify product safety. This initiative aims to protect consumers and promote the use of high-quality materials in luggage manufacturing.

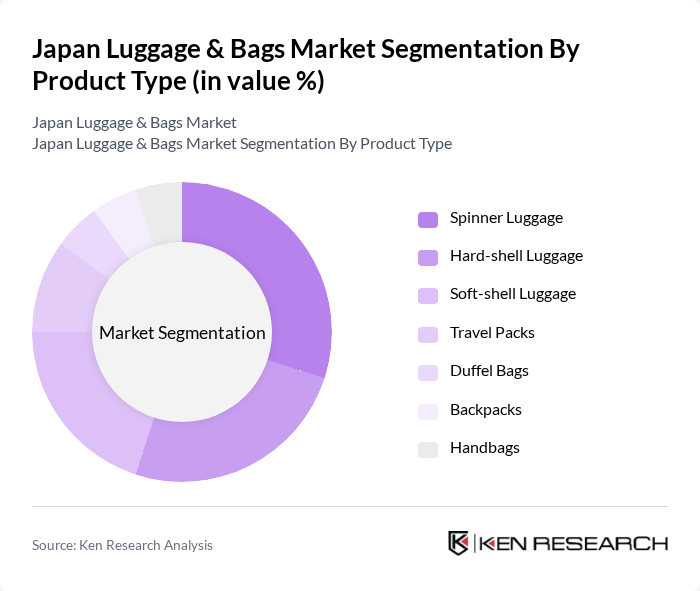

Japan Luggage & Bags Market Segmentation

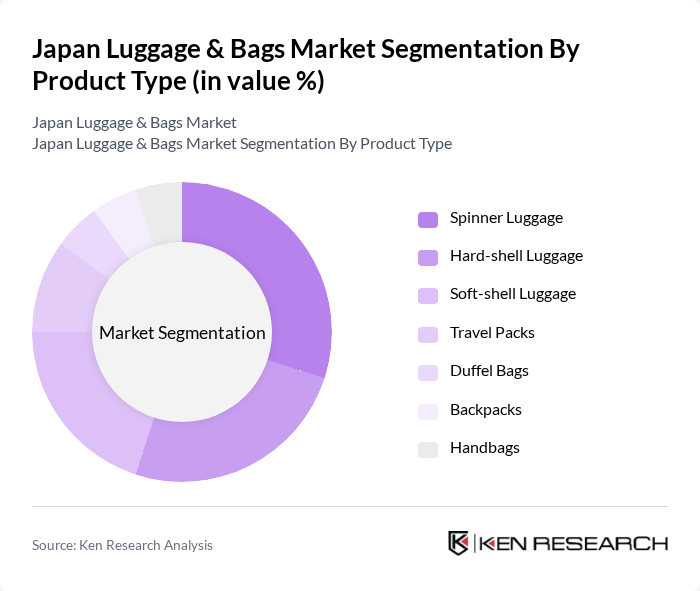

By Product Type:The product type segmentation includes various categories such as Spinner Luggage, Hard-shell Luggage, Soft-shell Luggage, Travel Packs, Duffel Bags, Backpacks, and Handbags. Among these, Spinner Luggage has gained significant popularity due to its ease of maneuverability and convenience for travelers. Hard-shell Luggage is also favored for its durability and security features, making it a preferred choice for frequent flyers. The demand for Soft-shell Luggage is rising as it offers flexibility and lightweight options for casual travelers. Backpacks and multifunctional bags are increasingly popular for daily use, reflecting a cultural preference for compact, organized systems that transition seamlessly between work, travel, and leisure.

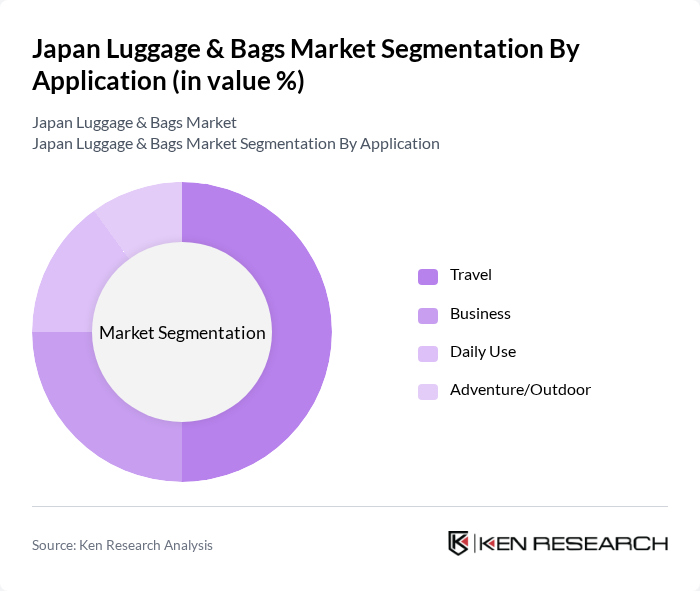

By Application:The application segmentation encompasses Travel, Business, Daily Use, and Adventure/Outdoor. The Travel segment dominates the market, driven by the increasing number of tourists and business travelers. The Business segment is also significant, as professionals seek stylish and functional luggage for work-related travel. Daily Use applications are gaining traction as consumers look for versatile bags for everyday activities, while Adventure/Outdoor applications cater to a niche market of outdoor enthusiasts. The shift toward urban living and the need for bags that serve multiple purposes—such as commuting, shopping, and short trips—are key drivers in the daily use segment.

Japan Luggage & Bags Market Competitive Landscape

The Japan Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite Japan K.K., Ace Co., Ltd., RIMOWA Japan K.K., TUMI Japan, Inc., VF Corporation Japan (The North Face), Yoshida & Co., Ltd. (Porter), Ryohin Keikaku Co., Ltd. (Muji), American Tourister Japan, Delsey Japan K.K., Travelpro International Japan, Victorinox Japan K.K., Briggs & Riley Japan, Herschel Supply Co. Japan, Eastpak Japan K.K., Thule Japan K.K. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Luggage & Bags Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism:In future, Japan is projected to welcome approximately 40 million international tourists, a significant increase from 31.9 million in the past. This surge in travel is driven by events like the upcoming Summer Olympics in Paris, which boosts outbound travel. The Japan National Tourism Organization reports that tourism contributes around ¥4.8 trillion to the economy, creating a robust demand for luggage and bags as travelers seek quality and durable products for their journeys.

- Rising Disposable Income:Japan's average disposable income is expected to reach ¥3.2 million per household in future, up from ¥3.3 million in the past. This increase allows consumers to spend more on travel-related products, including luggage and bags. As disposable income rises, consumers are more inclined to invest in high-quality, branded luggage, which enhances their travel experience. This trend is particularly evident among younger demographics, who prioritize both functionality and style in their travel gear.

- Growing E-commerce Sales:E-commerce sales in Japan are projected to exceed ¥20 trillion in future, reflecting a growth rate of 10% from the past. This shift towards online shopping is reshaping consumer purchasing behavior, particularly for luggage and bags. Major retailers are enhancing their online presence, offering a wider range of products and competitive pricing. The convenience of online shopping, coupled with targeted marketing strategies, is expected to drive significant sales growth in the luggage sector, catering to tech-savvy consumers.

Market Challenges

- Intense Competition:The Japanese luggage market is characterized by fierce competition, with over 200 brands vying for market share. Major players like Samsonite and Tumi dominate, but numerous local brands also compete aggressively. This saturation leads to price wars, which can erode profit margins. In future, the average price of luggage is expected to decline by 5% due to competitive pressures, making it challenging for smaller brands to maintain profitability while trying to differentiate their products.

- Fluctuating Raw Material Prices:The luggage industry is heavily reliant on materials such as nylon and polycarbonate, whose prices are subject to volatility. In future, the cost of nylon is projected to rise by 8% due to supply chain disruptions and increased demand from other industries. This fluctuation can significantly impact production costs for manufacturers, forcing them to either absorb the costs or pass them on to consumers, which may affect sales and market stability.

Japan Luggage & Bags Market Future Outlook

The Japan luggage and bags market is poised for dynamic growth, driven by increasing travel activity and evolving consumer preferences. As disposable incomes rise, consumers are expected to prioritize quality and sustainability in their purchases. Additionally, the integration of smart technology in luggage design is anticipated to attract tech-savvy travelers. Companies that adapt to these trends and invest in innovative solutions will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

Market Opportunities

- Expansion of Online Retail:With e-commerce sales projected to surpass ¥20 trillion, brands have a significant opportunity to enhance their online retail strategies. By optimizing their digital platforms and utilizing data analytics, companies can better target consumers, leading to increased sales and brand loyalty. This shift allows for a broader reach, especially among younger consumers who prefer online shopping.

- Customization and Personalization Trends:The demand for personalized products is on the rise, with consumers willing to pay a premium for customized luggage. In future, approximately 30% of consumers are expected to seek personalized options, presenting a lucrative opportunity for brands to differentiate themselves. Offering customization can enhance customer satisfaction and foster brand loyalty, driving repeat purchases in a competitive market.