Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3260

Pages:83

Published On:September 2025

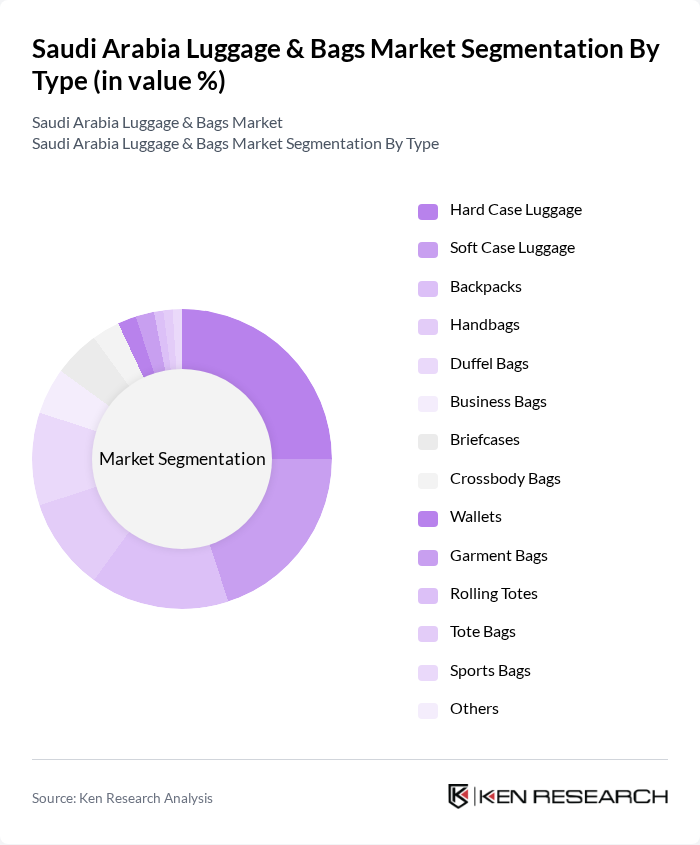

By Type:The luggage and bags market can be segmented into various types, including Hard Case Luggage, Soft Case Luggage, Backpacks, Handbags, Duffel Bags, Business Bags, Briefcases, Crossbody Bags, Wallets, Garment Bags, Rolling Totes, Tote Bags, Sports Bags, and Others. Among these, the Hard Case Luggage segment is gaining traction due to its durability and enhanced security features, appealing to frequent travelers and business professionals. The Soft Case Luggage segment is also popular for its lightweight and flexible nature, catering to a broader audience seeking convenience and versatility. Backpacks remain the largest revenue-generating type, driven by their widespread use among students, professionals, and travelers.

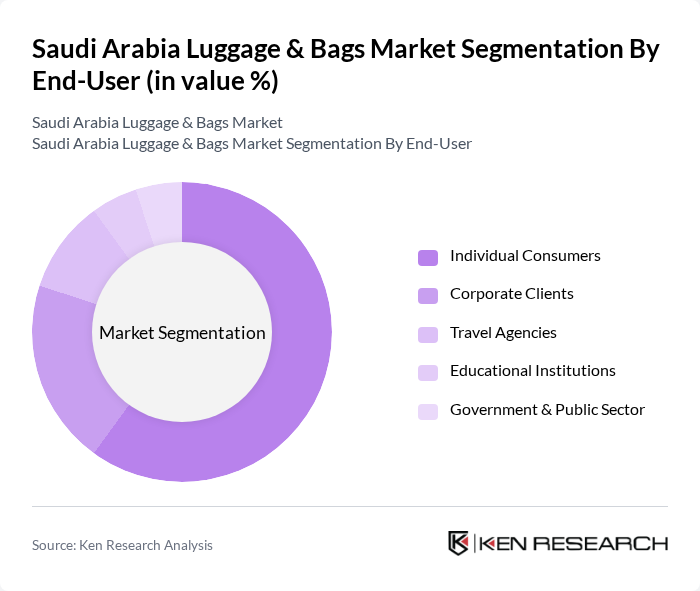

By End-User:The market can be segmented based on end-users, including Individual Consumers, Corporate Clients, Travel Agencies, Educational Institutions, and Government & Public Sector. Individual Consumers dominate the market, driven by the increasing trend of personal travel, leisure activities, and the adoption of smart and premium luggage. Corporate Clients also contribute significantly, as businesses require luggage for employee travel, conferences, and events.

The Saudi Arabia Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Tumi Holdings, Inc., American Tourister, Delsey S.A., Rimowa GmbH, Travelpro Products, Inc., Briggs & Riley Travelware, Victorinox AG, Eastpak, Herschel Supply Co., Osprey Packs, Inc., The North Face, Inc., Fjällräven, Kipling, Piquadro S.p.A., VIP Industries Ltd., Antler Ltd., BRIC'S S.p.A., Valigeria Roncato S.p.A., Ralph Lauren Corporation, Tommy Hilfiger (PVH Corp.), Adidas AG, Nike, Inc., Aldo Group, Burberry Group plc, Capri Holdings Limited, Christian Dior SE, Kering S.A., Prada S.p.A., LVMH Moët Hennessy Louis Vuitton SE contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia luggage and bags market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As smart luggage gains traction, brands are likely to invest in innovative features such as GPS tracking and built-in charging ports. Additionally, the increasing focus on sustainability will push manufacturers to adopt eco-friendly materials and practices, aligning with global trends. This dynamic environment presents opportunities for growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Case Luggage Soft Case Luggage Backpacks Handbags Duffel Bags Business Bags Briefcases Crossbody Bags Wallets Garment Bags Rolling Totes Tote Bags Sports Bags Others |

| By End-User | Individual Consumers Corporate Clients Travel Agencies Educational Institutions Government & Public Sector |

| By Sales Channel | Online Retail Offline Retail Wholesale Distributors Direct Sales Exclusive Brand Outlets (EBOs) Multi-Brand Outlets (MBOs) Local Retailers |

| By Price Range | Budget/Economy Mid-range Premium Luxury |

| By Brand Positioning | Luxury Brands Mid-tier Brands Value Brands |

| By Material | Polyester Nylon Leather Polycarbonate Other Materials |

| By Usage Occasion | Business Travel Leisure Travel Adventure Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 100 | Store Managers, Sales Associates |

| Consumer Preferences in Travel Bags | 80 | Frequent Travelers, Tourists |

| Online Shopping Behavior for Luggage | 60 | eCommerce Shoppers, Digital Marketing Analysts |

| Market Trends in Luxury Luggage | 50 | Luxury Retail Managers, Brand Representatives |

| Impact of Tourism on Luggage Sales | 40 | Travel Agency Owners, Tour Operators |

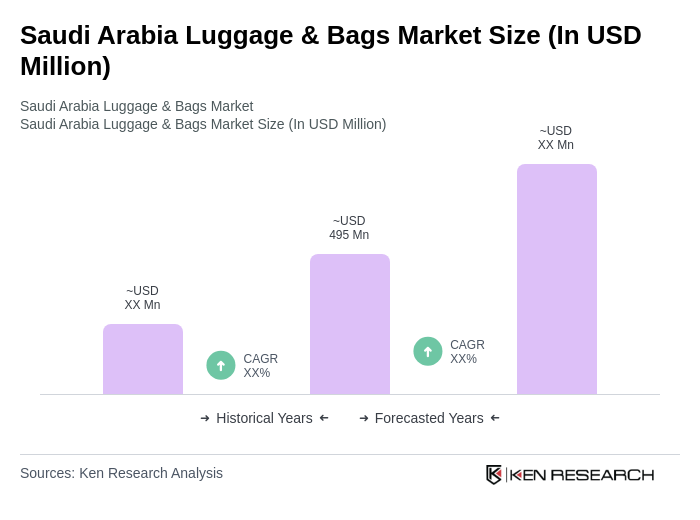

The Saudi Arabia Luggage & Bags Market is valued at approximately USD 495 million, reflecting a significant growth driven by increasing travel activities and a rising middle class with disposable income.