Region:Europe

Author(s):Shubham

Product Code:KRAA3609

Pages:82

Published On:September 2025

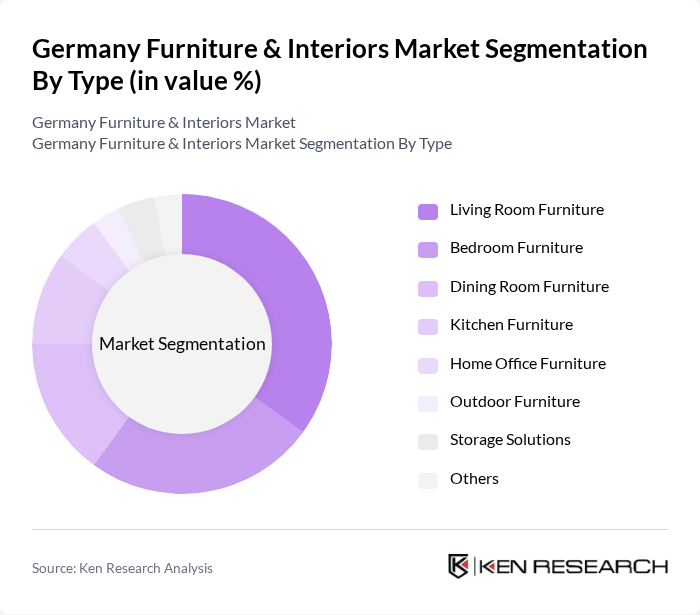

By Type:The market is segmented into various types of furniture, including living room furniture, bedroom furniture, dining room furniture, kitchen furniture, home office furniture, outdoor furniture, storage solutions, and others. Among these, home furniture holds the largest share at approximately 55 percent of the market, with living room furniture as a key sub-segment driven by consumer preferences for stylish, functional designs that enhance the aesthetic appeal of homes. The increasing trend of open-plan living spaces has also contributed to demand for versatile living room furniture. Kitchen and home office furniture are experiencing growth due to changing lifestyles and the rise of remote work, while healthcare furniture is the fastest-growing segment, supported by demographic shifts and institutional investments.

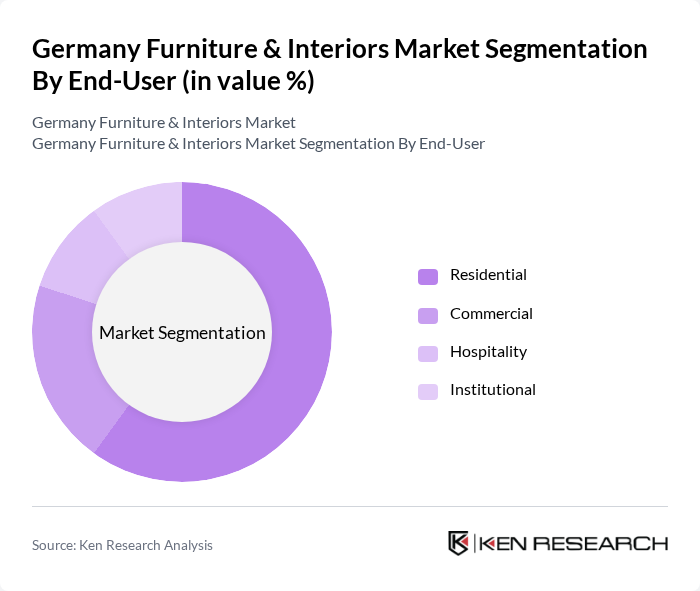

By End-User:The market is segmented by end-user into residential, commercial, hospitality, and institutional sectors. The residential segment holds the largest share, driven by increasing home ownership and a growing trend of home renovations. Consumers are increasingly investing in quality furniture that reflects their personal style and enhances their living spaces, leading to robust demand in this segment. The commercial and institutional segments are also significant, with office and healthcare furniture seeing accelerated growth due to workplace modernization and aging population needs.

The Germany Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Höffner, XXXLutz, Roller, Home24, Otto Group (including Otto, Otto Office, and other brands), Möbel Martin, Kika/Leiner, Baur Versand, BoConcept, Vitra, Muji, Westwing, Tchibo, Häcker Küchen, Wilkhahn, Sedus Stoll, Interio, Segmüller, Poco contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany furniture and interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-saving furniture solutions will grow. Additionally, the integration of smart technology into furniture design is expected to enhance functionality and appeal. Companies that prioritize sustainability and customization will likely capture a larger market share, aligning with consumer values and preferences for eco-friendly and personalized products.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture (sofas, coffee tables, TV stands, entertainment units) Bedroom Furniture (beds, mattresses, wardrobes, bedside tables) Dining Room Furniture (dining tables, chairs, sideboards, buffets) Kitchen Furniture (kitchen cabinets, islands, pantry storage) Home Office Furniture (desks, office chairs, bookshelves, file cabinets) Outdoor Furniture (garden, patio, balcony) Storage Solutions (wardrobes, shelving, modular storage) Others (bathroom, children’s, specialty furniture) |

| By End-User | Residential (homeowners, renters) Commercial (offices, coworking spaces) Hospitality (hotels, restaurants, cafes) Institutional (healthcare, education, government) |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (furniture stores, department stores, specialty shops) Direct Sales (manufacturer showrooms, B2B sales) Wholesale (bulk sales to retailers, institutions) |

| By Material | Wood (solid wood, veneer, engineered wood) Metal (steel, aluminum, alloys) Plastic (recycled, bio-based polymers) Fabric (upholstery, textiles) |

| By Price Range | Budget (entry-level, value-focused) Mid-range (mainstream, quality-focused) Premium (luxury, designer, bespoke) |

| By Style | Modern (minimalist, clean lines) Traditional (classic, heritage designs) Contemporary (current trends, eclectic) Rustic (natural, country-inspired) |

| By Functionality | Multi-functional (convertible, space-saving) Specialized (ergonomic, medical, acoustic) Customizable (modular, made-to-order) Standard (mass-produced, fixed design) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 90 | Office Managers, Facility Managers |

| Online Furniture Shopping Trends | 100 | eCommerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Preferences | 60 | Eco-conscious Consumers, Sustainability Advocates |

| Custom Furniture Design Insights | 50 | Custom Furniture Makers, Interior Architects |

The Germany Furniture & Interiors Market is valued at approximately USD 21 billion, reflecting a significant growth trend driven by increased consumer spending on home improvement and a shift towards sustainable furniture options.