Region:Asia

Author(s):Rebecca

Product Code:KRAA3355

Pages:97

Published On:September 2025

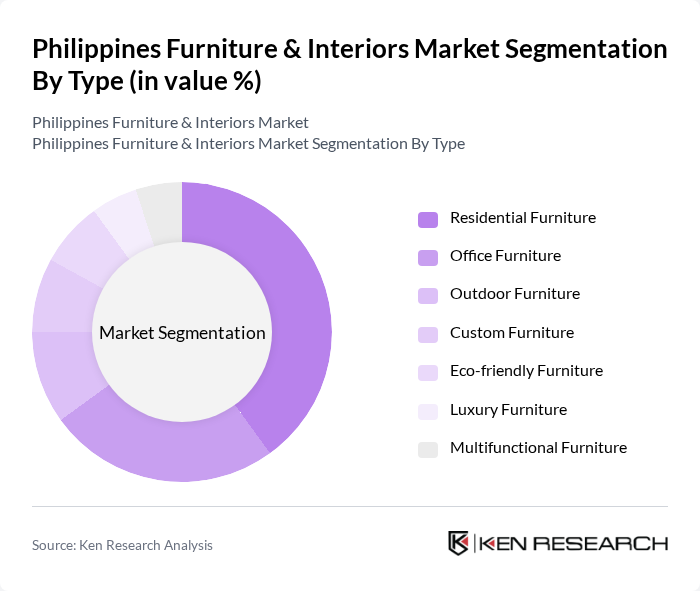

By Type:The market is segmented into various types of furniture, including residential, office, outdoor, custom, eco-friendly, luxury, and multifunctional furniture. Among these, residential furniture is the most dominant segment, driven by the increasing number of households and the trend towards home improvement. Consumers are increasingly investing in stylish and functional pieces that enhance their living spaces, with growing preference for minimalist designs, tech-integrated furniture, and customization options. Office furniture is also significant, reflecting the growth of the corporate sector and the demand for ergonomic solutions, particularly driven by the shift to remote work arrangements.

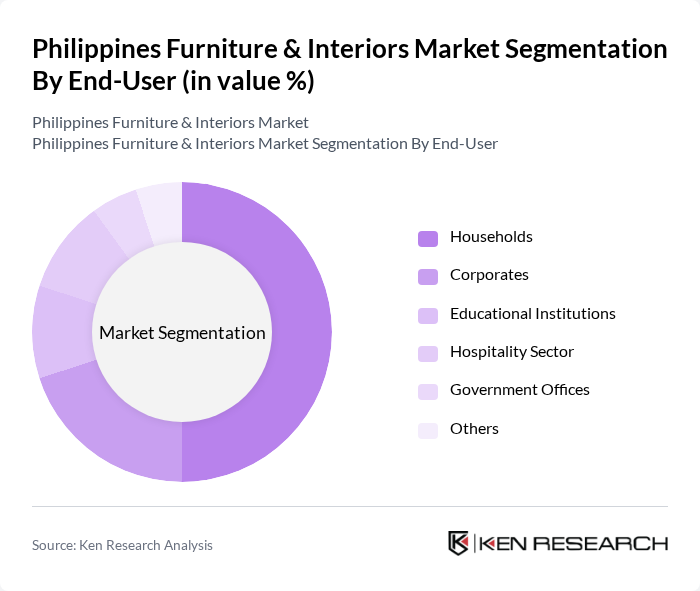

By End-User:The end-user segmentation includes households, corporates, educational institutions, the hospitality sector, government offices, and others. Households represent the largest segment, driven by the increasing number of residential properties and the trend of home renovations. Corporates follow closely, as businesses invest in modern office spaces to enhance employee productivity and comfort, with particular emphasis on ergonomic products suitable for hybrid work environments. The hospitality sector is also a significant contributor, with hotels and restaurants seeking stylish and durable furniture to attract customers, supported by the expansion of the tourism sector.

The Philippines Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Philippines, Mandaue Foam Industrial Corporation, Scanteak, Homeworks, Our Home, Furniture Republic, Blims Fine Furniture, Dimensione, CWC Furniture, Vito Selma, Kultura, Cielo Home, Crafters, A. D. M. Furniture, A. M. Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines furniture market is poised for dynamic growth, driven by urbanization and rising incomes. As consumers increasingly prioritize sustainability, manufacturers are likely to innovate with eco-friendly materials and designs. Additionally, the integration of technology in furniture, such as smart home features, is expected to gain traction. The market will also see a shift towards online sales channels, enhancing accessibility and convenience for consumers, thereby reshaping the retail landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-friendly Furniture Luxury Furniture Multifunctional Furniture |

| By End-User | Households Corporates Educational Institutions Hospitality Sector Government Offices Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Supermarkets and Hypermarkets Specialty Stores |

| By Material | Wood Metal Plastic Glass Fabric Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Design Style | Modern Traditional Contemporary Rustic Others |

| By Functionality | Multi-functional Space-saving Ergonomic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 80 | Office Managers, Facility Coordinators |

| Custom Furniture Orders | 60 | Architects, Custom Furniture Designers |

| Online Furniture Shopping Trends | 100 | eCommerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Interior Design | 70 | Home Decor Enthusiasts, Trend Analysts |

The Philippines Furniture & Interiors Market is valued at approximately USD 4.3 billion, driven by urbanization, rising disposable incomes, and a growing demand for home improvement and interior design services.