Region:Middle East

Author(s):Rebecca

Product Code:KRAA3338

Pages:88

Published On:September 2025

By Product Type:The furniture market is segmented into various product types, including beds, tables and desks, sofa and couches, chairs and stools, cabinets and shelves, and other furniture categories. Each of these segments caters to different consumer needs and preferences, with beds being anticipated to account for a significant market share owing to increasing awareness about the importance of purchasing the correct bed for improving sleep cycles and wellbeing.

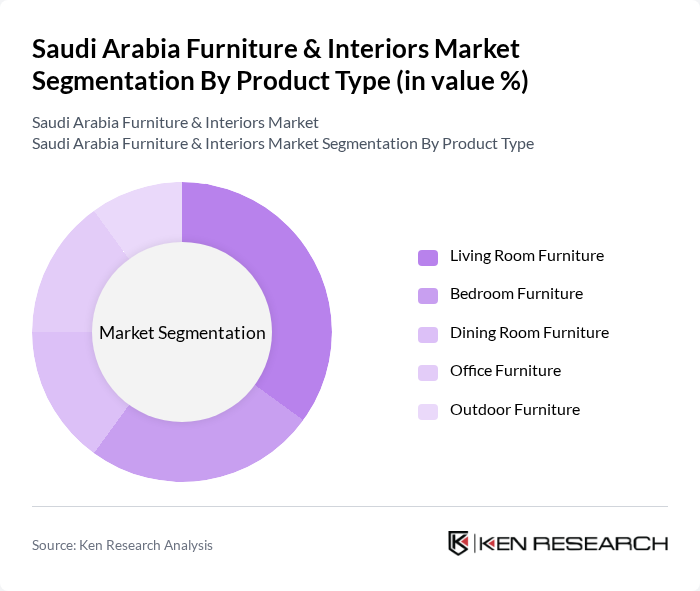

The living room furniture segment leads the market, driven by consumer preferences for stylish and functional designs that enhance home aesthetics. Increasing renovation and remodeling activities due to rising disposable incomes are aiding market growth, with reports indicating that 52% of homeowners made changes to their interiors. Bedroom furniture follows closely, as consumers prioritize comfort and personalization in their private spaces, with rising disposable incomes leading consumers to heavily spend on decorative beds to elevate their bedroom design schemes.

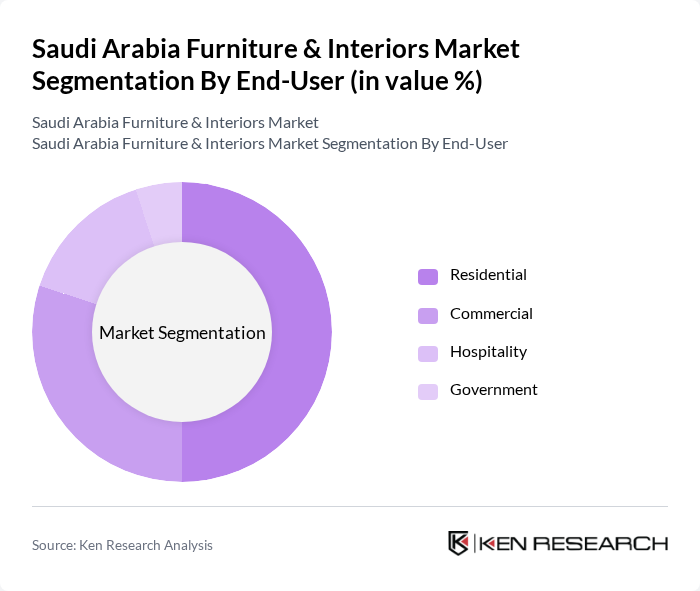

By End-User:The market is segmented by end-user into residential, commercial, hospitality, and government sectors. Each segment has distinct requirements and purchasing behaviors, with residential and commercial sectors being the largest contributors to market growth.

The residential segment dominates the market, driven by a growing population and increasing home ownership rates. Consumers are investing in quality furniture to enhance their living spaces, reflecting a shift towards more personalized home environments with emphasis on contemporary designs and multifunctional furniture. The commercial segment is also significant, as businesses seek modern and functional furniture solutions to improve workplace productivity and employee satisfaction. The hospitality sector is expanding, with the emphasis on boosting tourism through the development of luxury hotels, resorts, and other accommodations necessitating high-quality furniture to meet international standards.

The Saudi Arabia Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia, Almutlaq Furniture, Home Centre (Landmark Group), Pan Emirates, Al Rugaib Furniture, Al Jedaie Furniture, Al-Hokair Group, United Furniture, Al-Nahda International, Al-Jazira Furniture, Al-Mansour Furniture, Al-Suwaidi Group, Al-Rajhi Group, Al-Faisaliah Group, Al-Muhaidib Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart furniture solutions is expected to gain traction, catering to tech-savvy consumers seeking convenience and functionality. Additionally, the growing emphasis on sustainability will likely influence purchasing decisions, with consumers increasingly favoring eco-friendly materials. As the hospitality sector expands, opportunities for customized and high-quality furniture will emerge, further enhancing market dynamics and encouraging innovation among manufacturers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Office Furniture Outdoor Furniture |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Material Type | Wood Metal Upholstered Glass |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Contemporary Traditional Industrial Scandinavian |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Value Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Design Enthusiasts |

| Office Furniture Procurement | 90 | Office Managers, Facility Managers |

| Decorative Items Market | 60 | Retail Buyers, Home Decor Specialists |

| Consumer Preferences in Furniture Design | 100 | Interior Designers, Architects |

| Trends in Sustainable Furniture | 70 | Eco-conscious Consumers, Sustainability Advocates |

The Saudi Arabia Furniture & Interiors Market is valued at approximately USD 6.8 billion, driven by urbanization, a growing real estate sector, and increasing disposable incomes among consumers, reflecting a shift towards modern living spaces and enhanced interior aesthetics.