Region:Asia

Author(s):Shubham

Product Code:KRAA3615

Pages:98

Published On:September 2025

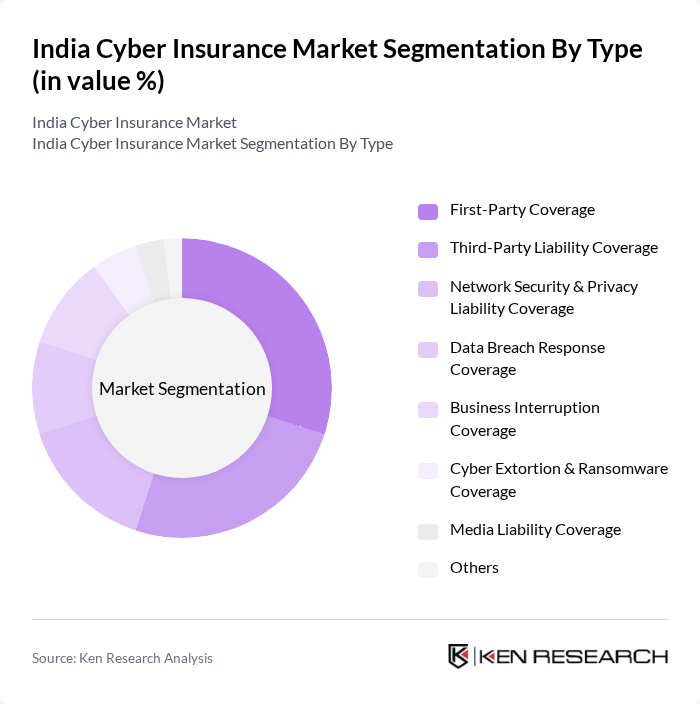

By Type:The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Liability Coverage, Network Security & Privacy Liability Coverage, Data Breach Response Coverage, Business Interruption Coverage, Cyber Extortion & Ransomware Coverage, Media Liability Coverage, and Others. Among these, First-Party Coverage is gaining traction as businesses seek to protect their own assets and data from cyber threats. This segment is particularly popular among small and medium enterprises (SMEs) that are increasingly vulnerable to cyberattacks.

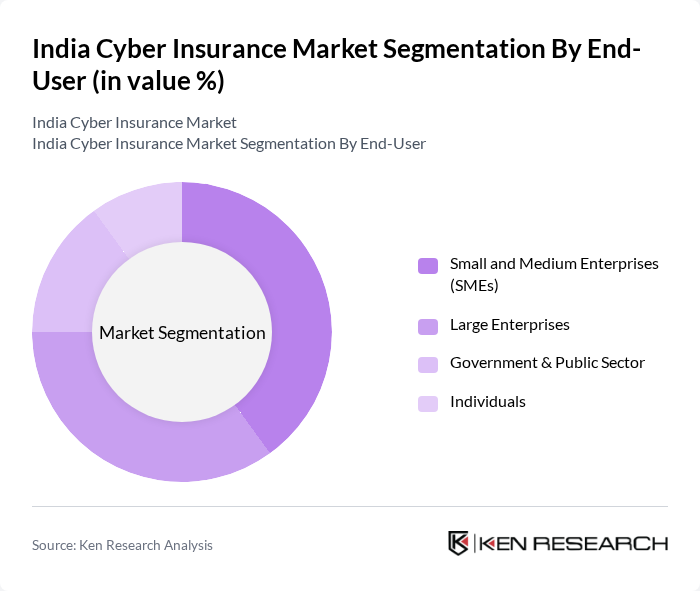

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, and Individuals. SMEs are increasingly adopting cyber insurance as they face significant risks from cyber threats but often lack the resources to manage these risks effectively. The growing awareness of the importance of cybersecurity among SMEs is driving the demand for tailored insurance solutions.

The India cyber insurance market is characterized by a dynamic mix of regional and international players. Leading participants such as ICICI Lombard General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, The New India Assurance Company Limited, Reliance General Insurance Company Limited, SBI General Insurance Company Limited, Aditya Birla General Insurance Company Limited, Kotak Mahindra General Insurance Company Limited, Future Generali India Insurance Company Limited, The Oriental Insurance Company Limited, United India Insurance Company Limited, Tata AIG General Insurance Company Limited, Bharti AXA General Insurance Company Limited, Niva Bupa Health Insurance Company Limited, and Go Digit General Insurance Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cyber insurance market in India appears promising, driven by increasing digitalization and regulatory pressures. As businesses continue to embrace digital transformation, the demand for comprehensive cyber insurance solutions is expected to rise. Additionally, the growing collaboration between insurers and technology firms will likely lead to innovative products tailored to specific industry needs, enhancing market accessibility and coverage options for businesses of all sizes.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Liability Coverage Network Security & Privacy Liability Coverage Data Breach Response Coverage Business Interruption Coverage Cyber Extortion & Ransomware Coverage Media Liability Coverage Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Individuals |

| By Industry | BFSI (Banking, Financial Services & Insurance) Healthcare IT & Telecom Retail & E-commerce Manufacturing Education Others |

| By Coverage Type | Packaged (Bundled) Policies Stand-alone Policies Customized Coverage |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium (Below INR 1 Lakh) Medium Premium (INR 1 Lakh - INR 10 Lakh) High Premium (Above INR 10 Lakh) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 80 | IT Security Managers, Insurance Underwriters |

| E-commerce Cyber Liability | 90 | Operations Managers, Digital Security Experts |

| Manufacturing Sector Cyber Insurance | 70 | Supply Chain Managers, IT Directors |

| SME Cyber Insurance Adoption | 50 | Business Owners, Financial Advisors |

The India cyber insurance market is valued at approximately USD 580 million, driven by increasing cyber threats, digitalization, and heightened awareness among businesses regarding data protection and risk management solutions.