Region:Europe

Author(s):Rebecca

Product Code:KRAA3345

Pages:91

Published On:September 2025

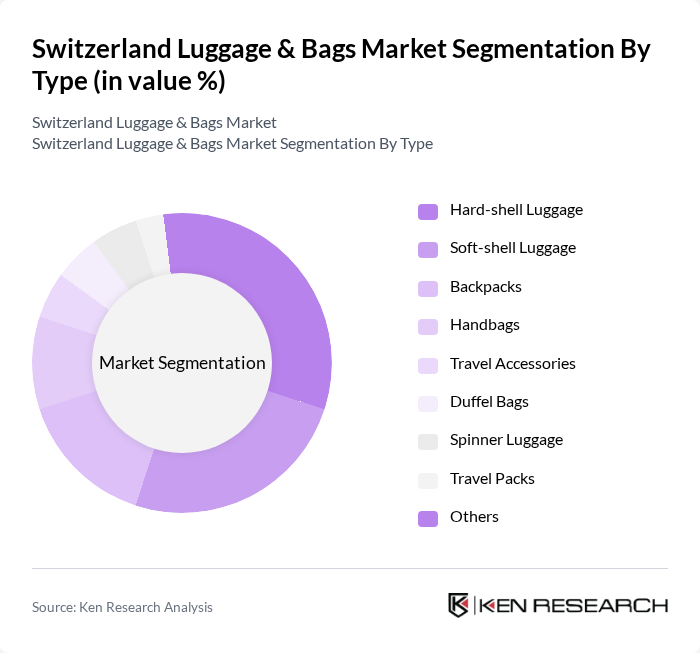

By Type:The luggage and bags market can be segmented into various types, including hard-shell luggage, soft-shell luggage, backpacks, handbags, travel accessories, duffel bags, spinner luggage, travel packs, and others. Among these, hard-shell luggage has gained significant popularity due to its durability, security features, and resistance to impact, making it appealing to frequent travelers. Soft-shell luggage offers flexibility, expandability, and lightweight options, making it a preferred choice for casual travelers and those seeking convenience. The increasing trend of outdoor activities and urban commuting has also boosted the demand for backpacks and travel packs, especially among younger consumers and professionals .

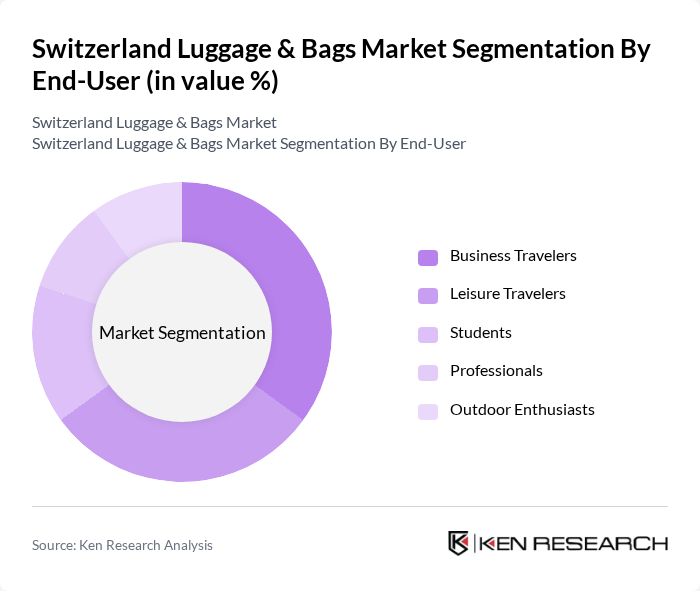

By End-User:The market can also be segmented based on end-users, including business travelers, leisure travelers, students, professionals, and outdoor enthusiasts. Business travelers represent a significant portion of the market, as they often require durable and functional luggage for frequent trips, with a preference for smart and secure features. Leisure travelers are increasingly looking for stylish, versatile, and lightweight options that cater to their travel needs. The rise in outdoor activities, urban commuting, and student mobility has also led to a growing demand for specialized bags among outdoor enthusiasts and students .

The Switzerland Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Tumi Holdings, Inc., Rimowa GmbH, American Tourister, Eastpak, The North Face, Herschel Supply Co., Osprey Europe Ltd., Delsey S.A., Travelpro International, Inc., Briggs & Riley Travelware, Victorinox AG, Crumpler, Thule Group AB, Piquadro S.p.A., Wenger SA, Freitag Lab AG, Mammut Sports Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The Switzerland luggage and bags market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of smart luggage technology, such as GPS tracking and built-in charging ports, is expected to gain traction among tech-savvy travelers. Additionally, the demand for eco-friendly products will likely increase, as consumers become more environmentally conscious, prompting brands to innovate and adapt their offerings to meet these emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-shell Luggage Soft-shell Luggage Backpacks Handbags Travel Accessories Duffel Bags Spinner Luggage Travel Packs Others |

| By End-User | Business Travelers Leisure Travelers Students Professionals Outdoor Enthusiasts |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Specialty Stores Hypermarkets & Supermarkets Airport Retailers |

| By Price Range | Budget Mid-range Premium |

| By Material | Polyester Nylon Leather Canvas Polycarbonate/ABS |

| By Brand | Luxury Brands Mid-tier Brands Budget Brands |

| By Usage Occasion | Business Trips Weekend Getaways Long Vacations Daily Commute Outdoor Activities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Luggage | 120 | Frequent Travelers, Casual Vacationers |

| Retail Insights on Bags | 60 | Store Managers, Sales Staff |

| Online Shopping Behavior | 80 | E-commerce Shoppers, Digital Marketing Specialists |

| Brand Loyalty and Awareness | 50 | Brand Managers, Marketing Analysts |

| Travel Trends and Preferences | 40 | Travel Agents, Tour Operators |

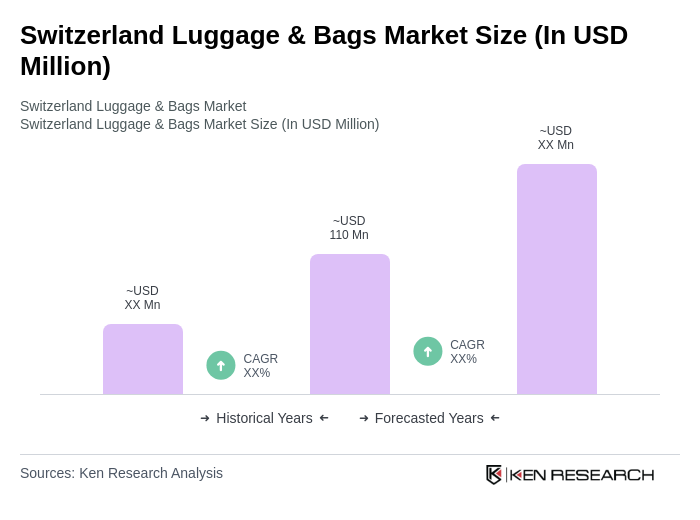

The Switzerland Luggage & Bags Market is valued at approximately USD 110 million, reflecting a five-year historical analysis. This growth is driven by increasing travel and a trend towards stylish, functional luggage options among consumers.